Cohen Investment Advisors LLC acquired a new position in shares of CrowdStrike (NASDAQ:CRWD - Free Report) in the 2nd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 1,155 shares of the company's stock, valued at approximately $588,000.

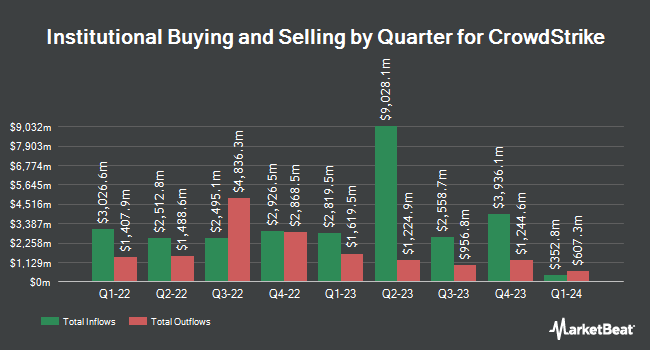

Several other institutional investors and hedge funds also recently modified their holdings of CRWD. Brighton Jones LLC boosted its position in shares of CrowdStrike by 44.9% during the fourth quarter. Brighton Jones LLC now owns 7,803 shares of the company's stock worth $2,670,000 after buying an additional 2,417 shares during the period. Miracle Mile Advisors LLC boosted its position in shares of CrowdStrike by 1.8% during the first quarter. Miracle Mile Advisors LLC now owns 1,704 shares of the company's stock worth $601,000 after buying an additional 30 shares during the period. OLD National Bancorp IN acquired a new position in shares of CrowdStrike during the first quarter worth about $248,000. Wesbanco Bank Inc. acquired a new position in shares of CrowdStrike during the first quarter worth about $341,000. Finally, Farther Finance Advisors LLC raised its holdings in CrowdStrike by 34.3% during the first quarter. Farther Finance Advisors LLC now owns 5,668 shares of the company's stock worth $2,054,000 after acquiring an additional 1,449 shares in the last quarter. 71.16% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several analysts recently issued reports on CRWD shares. Morgan Stanley upped their target price on CrowdStrike from $460.00 to $475.00 and gave the stock an "equal weight" rating in a report on Thursday, September 18th. UBS Group dropped their target price on CrowdStrike from $545.00 to $500.00 and set a "buy" rating on the stock in a report on Thursday, August 28th. Mizuho upped their target price on CrowdStrike from $430.00 to $450.00 and gave the stock a "neutral" rating in a report on Wednesday, September 17th. Needham & Company LLC upped their target price on CrowdStrike from $475.00 to $535.00 and gave the stock a "buy" rating in a report on Thursday, September 18th. Finally, Wells Fargo & Company upped their target price on CrowdStrike from $550.00 to $600.00 and gave the stock an "overweight" rating in a report on Wednesday, October 1st. One investment analyst has rated the stock with a Strong Buy rating, twenty-eight have issued a Buy rating, seventeen have issued a Hold rating and two have assigned a Sell rating to the company's stock. Based on data from MarketBeat.com, CrowdStrike currently has a consensus rating of "Moderate Buy" and an average target price of $491.81.

Read Our Latest Report on CrowdStrike

CrowdStrike Price Performance

NASDAQ:CRWD opened at $509.95 on Thursday. The company has a quick ratio of 1.88, a current ratio of 1.88 and a debt-to-equity ratio of 0.20. The stock's 50 day moving average price is $448.01 and its two-hundred day moving average price is $442.21. The firm has a market capitalization of $127.98 billion, a price-to-earnings ratio of -428.53, a P/E/G ratio of 113.88 and a beta of 1.19. CrowdStrike has a 12-month low of $292.50 and a 12-month high of $517.98.

CrowdStrike (NASDAQ:CRWD - Get Free Report) last released its quarterly earnings data on Wednesday, August 27th. The company reported $0.93 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.83 by $0.10. The firm had revenue of $1.17 billion for the quarter, compared to analyst estimates of $1.15 billion. CrowdStrike had a negative return on equity of 1.53% and a negative net margin of 6.84%.The business's revenue for the quarter was up 21.4% compared to the same quarter last year. During the same quarter in the prior year, the company earned $1.04 earnings per share. CrowdStrike has set its FY 2026 guidance at 3.600-3.72 EPS. Q3 2026 guidance at 0.930-0.95 EPS. On average, analysts anticipate that CrowdStrike will post 0.55 earnings per share for the current year.

Insider Activity at CrowdStrike

In other news, CEO George Kurtz sold 42,267 shares of the stock in a transaction that occurred on Tuesday, August 5th. The stock was sold at an average price of $450.47, for a total transaction of $19,040,015.49. Following the transaction, the chief executive officer owned 2,132,887 shares in the company, valued at approximately $960,801,606.89. This trade represents a 1.94% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, President Michael Sentonas sold 20,000 shares of the stock in a transaction that occurred on Wednesday, October 1st. The stock was sold at an average price of $500.00, for a total value of $10,000,000.00. Following the transaction, the president owned 379,116 shares in the company, valued at approximately $189,558,000. This trade represents a 5.01% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 132,816 shares of company stock valued at $62,606,356 in the last 90 days. Corporate insiders own 3.32% of the company's stock.

CrowdStrike Company Profile

(

Free Report)

CrowdStrike Holdings, Inc provides cybersecurity solutions in the United States and internationally. Its unified platform offers cloud-delivered protection of endpoints, cloud workloads, identity, and data. The company offers corporate endpoint and cloud workload security, managed security, security and vulnerability management, IT operations management, identity protection, SIEM and log management, threat intelligence, data protection, security orchestration, automation and response and AI powered workflow automation, and securing generative AI workload services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CrowdStrike, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CrowdStrike wasn't on the list.

While CrowdStrike currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.