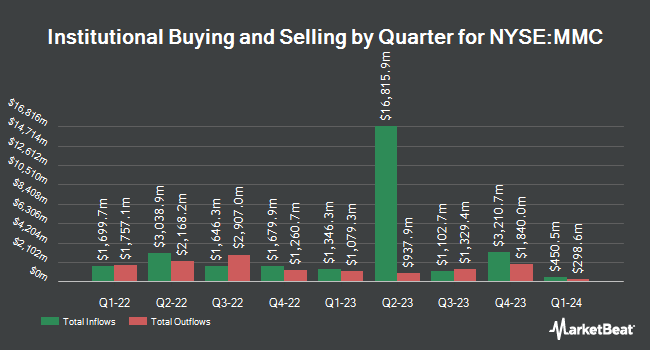

Coho Partners Ltd. cut its stake in shares of Marsh & McLennan Companies, Inc. (NYSE:MMC - Free Report) by 29.0% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 273,841 shares of the financial services provider's stock after selling 111,829 shares during the quarter. Marsh & McLennan Companies accounts for 4.0% of Coho Partners Ltd.'s portfolio, making the stock its 4th largest holding. Coho Partners Ltd. owned 0.06% of Marsh & McLennan Companies worth $66,825,000 as of its most recent filing with the Securities & Exchange Commission.

Other large investors have also modified their holdings of the company. City Holding Co. purchased a new stake in shares of Marsh & McLennan Companies in the first quarter valued at $37,000. Ameriflex Group Inc. purchased a new stake in shares of Marsh & McLennan Companies in the fourth quarter valued at $37,000. Garde Capital Inc. purchased a new stake in shares of Marsh & McLennan Companies in the first quarter valued at $42,000. Transce3nd LLC purchased a new stake in shares of Marsh & McLennan Companies in the fourth quarter valued at $39,000. Finally, Halbert Hargrove Global Advisors LLC purchased a new stake in shares of Marsh & McLennan Companies during the fourth quarter worth $45,000. 87.99% of the stock is owned by institutional investors.

Insider Activity

In related news, CEO Dean Michael Klisura sold 9,569 shares of Marsh & McLennan Companies stock in a transaction dated Monday, March 31st. The stock was sold at an average price of $245.00, for a total transaction of $2,344,405.00. Following the sale, the chief executive officer now directly owns 20,935 shares of the company's stock, valued at $5,129,075. This trade represents a 31.37% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, SVP Paul Beswick sold 2,237 shares of Marsh & McLennan Companies stock in a transaction dated Thursday, April 3rd. The stock was sold at an average price of $246.00, for a total value of $550,302.00. Following the sale, the senior vice president now directly owns 13,522 shares in the company, valued at approximately $3,326,412. This trade represents a 14.20% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.35% of the stock is currently owned by company insiders.

Analyst Upgrades and Downgrades

Several analysts recently issued reports on MMC shares. Wells Fargo & Company increased their price objective on Marsh & McLennan Companies from $223.00 to $232.00 and gave the stock an "equal weight" rating in a report on Thursday, April 10th. Barclays increased their price objective on Marsh & McLennan Companies from $246.00 to $249.00 and gave the stock an "equal weight" rating in a report on Friday, April 11th. Jefferies Financial Group increased their price objective on Marsh & McLennan Companies from $237.00 to $244.00 and gave the stock a "hold" rating in a report on Friday, April 11th. UBS Group increased their price objective on Marsh & McLennan Companies from $259.00 to $261.00 and gave the stock a "buy" rating in a report on Wednesday, April 9th. Finally, Redburn Atlantic assumed coverage on Marsh & McLennan Companies in a report on Tuesday, March 25th. They set a "buy" rating and a $281.00 price objective for the company. Two investment analysts have rated the stock with a sell rating, seven have given a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and a consensus target price of $241.93.

View Our Latest Research Report on MMC

Marsh & McLennan Companies Trading Up 1.0%

Shares of NYSE:MMC opened at $216.41 on Friday. The company has a market cap of $106.63 billion, a P/E ratio of 26.52, a P/E/G ratio of 2.65 and a beta of 0.83. The stock's 50-day moving average is $225.13 and its 200-day moving average is $224.77. Marsh & McLennan Companies, Inc. has a 52-week low of $207.21 and a 52-week high of $248.00. The company has a debt-to-equity ratio of 1.32, a quick ratio of 1.14 and a current ratio of 1.14.

Marsh & McLennan Companies (NYSE:MMC - Get Free Report) last issued its quarterly earnings results on Thursday, April 17th. The financial services provider reported $3.06 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.02 by $0.04. The company had revenue of $6.70 billion for the quarter, compared to the consensus estimate of $7.08 billion. Marsh & McLennan Companies had a return on equity of 32.19% and a net margin of 16.13%. During the same period last year, the business posted $2.89 earnings per share. Equities research analysts predict that Marsh & McLennan Companies, Inc. will post 9.61 earnings per share for the current year.

About Marsh & McLennan Companies

(

Free Report)

Marsh & McLennan Cos., Inc is a professional services firm, which engages in offering clients advice and solutions in risk, strategy, and people. It operates through the Risk and Insurance Services, and Consulting segments. The Risk and Insurance Services segment is involved in risk management activities, as well as insurance and reinsurance broking and services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Marsh & McLennan Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marsh & McLennan Companies wasn't on the list.

While Marsh & McLennan Companies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.