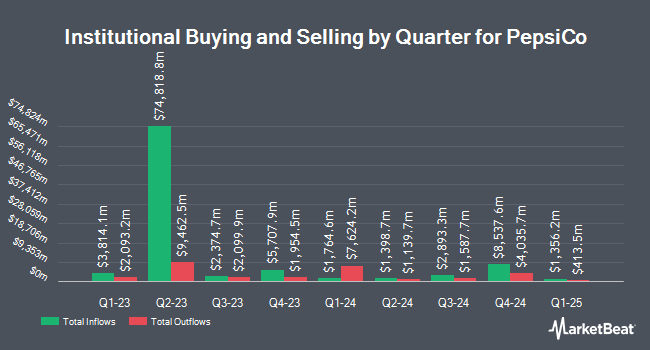

Comerica Bank lowered its holdings in shares of PepsiCo, Inc. (NASDAQ:PEP - Free Report) by 4.2% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 514,752 shares of the company's stock after selling 22,626 shares during the quarter. Comerica Bank's holdings in PepsiCo were worth $77,182,000 at the end of the most recent reporting period.

Other institutional investors have also recently made changes to their positions in the company. Elite Financial Inc. bought a new position in PepsiCo during the first quarter valued at approximately $28,000. Measured Risk Portfolios Inc. bought a new position in PepsiCo during the fourth quarter valued at approximately $31,000. Sunbeam Capital Management LLC bought a new position in PepsiCo during the fourth quarter valued at approximately $47,000. MorganRosel Wealth Management LLC bought a new stake in shares of PepsiCo in the 1st quarter valued at approximately $55,000. Finally, Migdal Insurance & Financial Holdings Ltd. bought a new stake in shares of PepsiCo in the 1st quarter valued at approximately $58,000. Hedge funds and other institutional investors own 73.07% of the company's stock.

PepsiCo Price Performance

NASDAQ PEP traded down $1.20 during trading hours on Tuesday, reaching $147.00. The company's stock had a trading volume of 11,207,315 shares, compared to its average volume of 7,658,064. The firm has a market capitalization of $201.25 billion, a price-to-earnings ratio of 26.78, a P/E/G ratio of 3.95 and a beta of 0.45. PepsiCo, Inc. has a 1-year low of $127.60 and a 1-year high of $179.73. The company has a debt-to-equity ratio of 2.12, a current ratio of 0.78 and a quick ratio of 0.60. The company's 50-day moving average is $140.01 and its two-hundred day moving average is $140.66.

PepsiCo (NASDAQ:PEP - Get Free Report) last issued its quarterly earnings data on Thursday, July 17th. The company reported $2.12 earnings per share for the quarter, topping the consensus estimate of $2.03 by $0.09. PepsiCo had a return on equity of 57.81% and a net margin of 8.23%.The company had revenue of $22.73 billion during the quarter, compared to analyst estimates of $22.28 billion. During the same period in the prior year, the business posted $2.28 earnings per share. The firm's revenue for the quarter was up 1.0% compared to the same quarter last year. PepsiCo has set its FY 2025 guidance at 8.038-8.038 EPS. On average, equities analysts predict that PepsiCo, Inc. will post 8.3 EPS for the current year.

PepsiCo Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Friday, September 5th will be issued a $1.4225 dividend. The ex-dividend date is Friday, September 5th. This represents a $5.69 annualized dividend and a yield of 3.9%. PepsiCo's payout ratio is 103.64%.

Analysts Set New Price Targets

PEP has been the subject of several analyst reports. Dbs Bank lowered PepsiCo from a "strong-buy" rating to a "hold" rating in a research note on Friday, May 9th. Bank of America decreased their price target on PepsiCo from $150.00 to $145.00 and set a "neutral" rating for the company in a research note on Friday, July 11th. Deutsche Bank Aktiengesellschaft reissued a "buy" rating on shares of PepsiCo in a research note on Thursday, July 17th. Cowen restated a "hold" rating on shares of PepsiCo in a report on Thursday, July 17th. Finally, Royal Bank Of Canada restated a "sector perform" rating and set a $148.00 price objective on shares of PepsiCo in a report on Tuesday, June 24th. Four research analysts have rated the stock with a Buy rating, fourteen have assigned a Hold rating and one has given a Sell rating to the company. According to MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $158.73.

Check Out Our Latest Analysis on PepsiCo

PepsiCo Profile

(

Free Report)

PepsiCo, Inc engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide. The company operates through seven segments: Frito-Lay North America; Quaker Foods North America; PepsiCo Beverages North America; Latin America; Europe; Africa, Middle East and South Asia; and Asia Pacific, Australia and New Zealand and China Region.

Recommended Stories

Before you consider PepsiCo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PepsiCo wasn't on the list.

While PepsiCo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.