Comerica Bank trimmed its position in shares of Cboe Global Markets, Inc. (NASDAQ:CBOE - Free Report) by 7.5% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 25,702 shares of the company's stock after selling 2,090 shares during the quarter. Comerica Bank's holdings in Cboe Global Markets were worth $5,816,000 as of its most recent SEC filing.

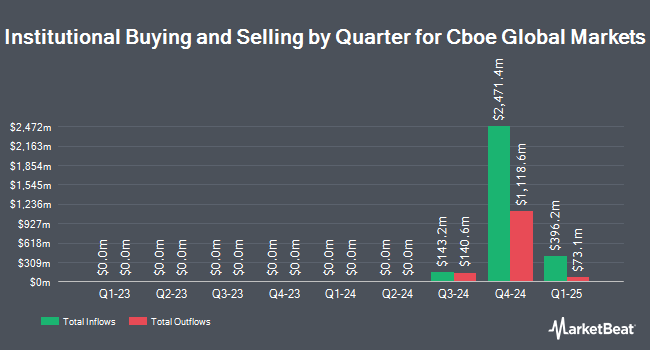

Several other institutional investors have also recently made changes to their positions in CBOE. Brighton Jones LLC increased its holdings in shares of Cboe Global Markets by 10.1% during the 4th quarter. Brighton Jones LLC now owns 1,092 shares of the company's stock valued at $213,000 after purchasing an additional 100 shares in the last quarter. Coldstream Capital Management Inc. grew its stake in Cboe Global Markets by 40.5% in the 4th quarter. Coldstream Capital Management Inc. now owns 1,852 shares of the company's stock valued at $362,000 after acquiring an additional 534 shares during the period. Susquehanna Fundamental Investments LLC acquired a new position in Cboe Global Markets during the fourth quarter worth $723,000. Northern Trust Corp raised its position in Cboe Global Markets by 9.2% during the fourth quarter. Northern Trust Corp now owns 1,242,890 shares of the company's stock worth $242,861,000 after acquiring an additional 104,257 shares during the period. Finally, Rehmann Capital Advisory Group raised its position in Cboe Global Markets by 40.9% during the fourth quarter. Rehmann Capital Advisory Group now owns 1,765 shares of the company's stock worth $345,000 after acquiring an additional 512 shares during the period. 82.67% of the stock is owned by hedge funds and other institutional investors.

Cboe Global Markets Price Performance

Shares of Cboe Global Markets stock traded down $2.76 during trading hours on Tuesday, reaching $233.19. 598,492 shares of the company's stock were exchanged, compared to its average volume of 879,450. Cboe Global Markets, Inc. has a 1 year low of $187.30 and a 1 year high of $255.27. The company has a market capitalization of $24.39 billion, a P/E ratio of 32.30, a price-to-earnings-growth ratio of 1.75 and a beta of 0.46. The business has a fifty day moving average of $240.28 and a two-hundred day moving average of $226.40. The company has a quick ratio of 1.39, a current ratio of 1.78 and a debt-to-equity ratio of 0.34.

Cboe Global Markets (NASDAQ:CBOE - Get Free Report) last released its earnings results on Friday, August 1st. The company reported $2.46 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.43 by $0.03. Cboe Global Markets had a net margin of 18.64% and a return on equity of 22.02%. During the same quarter last year, the business earned $2.15 earnings per share. Cboe Global Markets's revenue was up 14.3% compared to the same quarter last year. As a group, research analysts predict that Cboe Global Markets, Inc. will post 8.96 earnings per share for the current fiscal year.

Cboe Global Markets Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, September 15th. Investors of record on Friday, August 29th will be issued a $0.72 dividend. This is an increase from Cboe Global Markets's previous quarterly dividend of $0.63. This represents a $2.88 dividend on an annualized basis and a dividend yield of 1.2%. The ex-dividend date of this dividend is Friday, August 29th. Cboe Global Markets's payout ratio is currently 33.76%.

Wall Street Analyst Weigh In

A number of research firms have weighed in on CBOE. Royal Bank Of Canada restated a "sector perform" rating and set a $254.00 price objective on shares of Cboe Global Markets in a research report on Monday, August 4th. Morgan Stanley set a $218.00 price objective on shares of Cboe Global Markets and gave the stock an "underweight" rating in a research report on Tuesday, July 15th. Keefe, Bruyette & Woods upped their price objective on shares of Cboe Global Markets from $243.00 to $248.00 and gave the stock a "market perform" rating in a research report on Monday, August 4th. Oppenheimer set a $265.00 price objective on shares of Cboe Global Markets and gave the stock an "outperform" rating in a research report on Monday, August 4th. Finally, Barclays upped their price objective on shares of Cboe Global Markets from $243.00 to $256.00 and gave the stock an "equal weight" rating in a research report on Monday, August 4th. Two analysts have rated the stock with a Buy rating, nine have assigned a Hold rating and three have given a Sell rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Reduce" and an average target price of $231.38.

View Our Latest Analysis on CBOE

Cboe Global Markets Company Profile

(

Free Report)

Cboe Global Markets, Inc is one of the largest stock exchange operators by volume in the United States and a leading market globally for ETP trading. Cboe offers trading across a diverse range of products in multiple asset classes and geographies, including options, futures, U.S. and European equities, exchange-traded products (ETPs), global foreign exchange (FX) and multi-asset volatility products based on the VIX Index.

Further Reading

Before you consider Cboe Global Markets, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cboe Global Markets wasn't on the list.

While Cboe Global Markets currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.