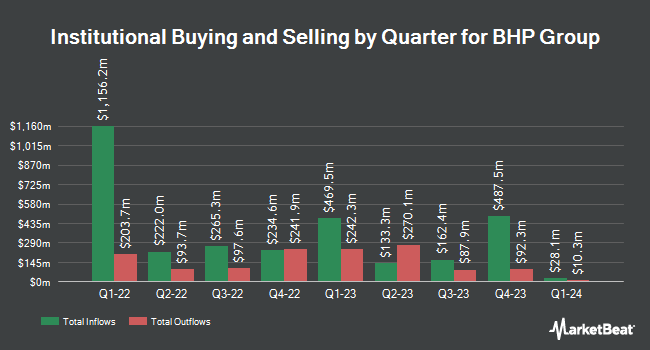

Compound Planning Inc. boosted its holdings in BHP Group Limited Sponsored ADR (NYSE:BHP - Free Report) by 44.4% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 22,380 shares of the mining company's stock after buying an additional 6,884 shares during the period. Compound Planning Inc.'s holdings in BHP Group were worth $1,086,000 as of its most recent SEC filing.

A number of other institutional investors have also bought and sold shares of BHP. WFA Asset Management Corp purchased a new stake in BHP Group in the 1st quarter worth $26,000. Costello Asset Management INC purchased a new stake in BHP Group in the 1st quarter worth $26,000. Alpine Bank Wealth Management purchased a new stake in BHP Group in the 1st quarter worth $27,000. Compagnie Lombard Odier SCmA purchased a new stake in BHP Group in the 1st quarter worth $32,000. Finally, Vermillion Wealth Management Inc. purchased a new stake in BHP Group in the 4th quarter worth $74,000. Hedge funds and other institutional investors own 3.79% of the company's stock.

BHP Group Stock Up 2.6%

Shares of NYSE BHP opened at $55.9250 on Friday. The firm's 50-day moving average price is $51.23 and its 200-day moving average price is $49.67. The company has a current ratio of 1.46, a quick ratio of 1.25 and a debt-to-equity ratio of 0.43. The stock has a market capitalization of $141.81 billion, a price-to-earnings ratio of 12.71 and a beta of 0.80. BHP Group Limited Sponsored ADR has a 12-month low of $39.73 and a 12-month high of $63.21.

BHP Group Increases Dividend

The firm also recently announced a semi-annual dividend, which will be paid on Thursday, September 25th. Stockholders of record on Friday, September 5th will be given a dividend of $1.185 per share. The ex-dividend date is Friday, September 5th. This represents a dividend yield of 410.0%. This is a positive change from BHP Group's previous semi-annual dividend of $1.00. BHP Group's dividend payout ratio is currently 44.77%.

Analysts Set New Price Targets

Several research analysts have commented on the stock. BMO Capital Markets downgraded shares of BHP Group from an "outperform" rating to a "market perform" rating in a report on Sunday, July 27th. Citigroup reissued a "neutral" rating on shares of BHP Group in a report on Wednesday. Argus downgraded shares of BHP Group from a "buy" rating to a "hold" rating in a report on Friday, June 13th. Berenberg Bank reissued a "sell" rating and set a $44.00 price objective on shares of BHP Group in a report on Thursday, July 24th. Finally, Macquarie downgraded shares of BHP Group from an "outperform" rating to a "neutral" rating in a report on Friday, July 18th. One research analyst has rated the stock with a Strong Buy rating, six have given a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat, BHP Group has a consensus rating of "Hold" and an average price target of $48.50.

Read Our Latest Stock Analysis on BHP

BHP Group Company Profile

(

Free Report)

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally. The company operates through Copper, Iron Ore, and Coal segments. It engages in the mining of copper, uranium, gold, zinc, lead, molybdenum, silver, iron ore, cobalt, and metallurgical and energy coal.

See Also

Want to see what other hedge funds are holding BHP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for BHP Group Limited Sponsored ADR (NYSE:BHP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BHP Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BHP Group wasn't on the list.

While BHP Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.