Concentric Capital Strategies LP acquired a new position in Rayonier Inc. (NYSE:RYN - Free Report) in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 47,735 shares of the real estate investment trust's stock, valued at approximately $1,331,000.

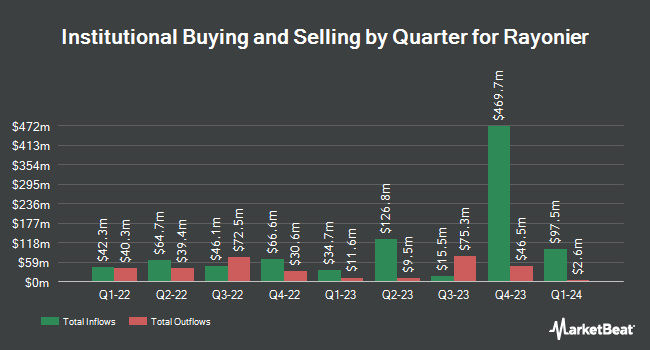

Other large investors have also recently bought and sold shares of the company. Deutsche Bank AG boosted its holdings in Rayonier by 730.8% during the fourth quarter. Deutsche Bank AG now owns 1,829,422 shares of the real estate investment trust's stock valued at $47,748,000 after acquiring an additional 1,609,232 shares during the period. AQR Capital Management LLC boosted its holdings in Rayonier by 1,287.3% during the first quarter. AQR Capital Management LLC now owns 1,506,119 shares of the real estate investment trust's stock valued at $41,991,000 after acquiring an additional 1,397,555 shares during the period. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp boosted its holdings in Rayonier by 30.0% during the first quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 4,203,552 shares of the real estate investment trust's stock valued at $117,195,000 after acquiring an additional 971,167 shares during the period. Nuveen LLC bought a new stake in Rayonier during the first quarter valued at about $26,187,000. Finally, Universal Beteiligungs und Servicegesellschaft mbH bought a new stake in Rayonier during the first quarter valued at about $23,582,000. 89.12% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

RYN has been the subject of a number of recent analyst reports. Wall Street Zen upgraded shares of Rayonier from a "sell" rating to a "hold" rating in a report on Saturday, August 9th. Citigroup upped their price target on shares of Rayonier from $26.00 to $27.00 and gave the company a "neutral" rating in a report on Thursday, August 21st. Finally, Royal Bank Of Canada upped their price target on shares of Rayonier from $26.00 to $27.00 and gave the company a "sector perform" rating in a report on Friday, August 8th. One research analyst has rated the stock with a Buy rating and three have given a Hold rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $28.00.

View Our Latest Stock Analysis on RYN

Rayonier Stock Performance

Shares of NYSE RYN traded down $0.37 during mid-day trading on Tuesday, hitting $26.25. The company had a trading volume of 344,743 shares, compared to its average volume of 1,093,955. The company has a debt-to-equity ratio of 0.37, a current ratio of 3.50 and a quick ratio of 3.38. The business's 50-day simple moving average is $24.84 and its 200-day simple moving average is $24.86. Rayonier Inc. has a 12 month low of $21.84 and a 12 month high of $32.88. The firm has a market cap of $4.05 billion, a P/E ratio of 5.30 and a beta of 1.01.

Rayonier (NYSE:RYN - Get Free Report) last released its earnings results on Wednesday, August 6th. The real estate investment trust reported $0.06 earnings per share for the quarter, beating the consensus estimate of $0.03 by $0.03. Rayonier had a net margin of 68.53% and a return on equity of 3.39%. The business had revenue of $106.50 million during the quarter, compared to analysts' expectations of $95.30 million. During the same quarter last year, the company earned $0.02 earnings per share. The firm's revenue was up 6.9% on a year-over-year basis. As a group, analysts predict that Rayonier Inc. will post 0.55 earnings per share for the current fiscal year.

Rayonier Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Tuesday, September 16th will be issued a dividend of $0.2725 per share. The ex-dividend date of this dividend is Tuesday, September 16th. This represents a $1.09 annualized dividend and a dividend yield of 4.2%. Rayonier's dividend payout ratio (DPR) is presently 22.02%.

Rayonier Company Profile

(

Free Report)

Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand. As of December 31, 2023, Rayonier owned or leased under long-term agreements approximately 2.7 million acres of timberlands located in the U.S.

Featured Stories

Before you consider Rayonier, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rayonier wasn't on the list.

While Rayonier currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.