Connecticut Wealth Management LLC lifted its position in shares of Salesforce, Inc. (NYSE:CRM - Free Report) by 83.4% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 3,615 shares of the CRM provider's stock after purchasing an additional 1,644 shares during the period. Connecticut Wealth Management LLC's holdings in Salesforce were worth $1,209,000 at the end of the most recent quarter.

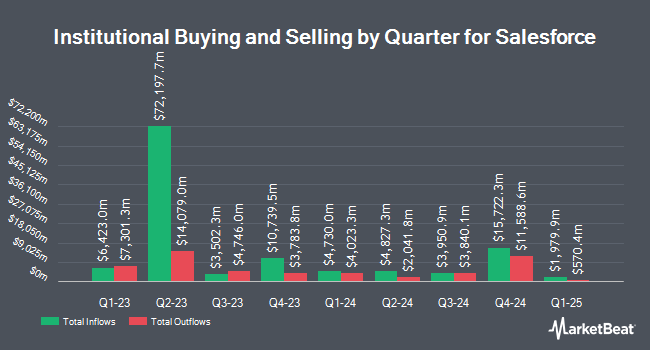

A number of other institutional investors and hedge funds also recently modified their holdings of the company. Bernard Wealth Management Corp. bought a new position in Salesforce during the fourth quarter worth about $25,000. Accredited Wealth Management LLC bought a new stake in Salesforce in the fourth quarter valued at approximately $27,000. Arlington Trust Co LLC lifted its position in shares of Salesforce by 85.1% in the fourth quarter. Arlington Trust Co LLC now owns 87 shares of the CRM provider's stock valued at $29,000 after buying an additional 40 shares during the last quarter. Compass Financial Services Inc bought a new position in shares of Salesforce during the 4th quarter worth approximately $30,000. Finally, Asset Planning Inc acquired a new position in shares of Salesforce during the 4th quarter worth approximately $31,000. 80.43% of the stock is owned by institutional investors.

Salesforce Trading Down 2.0%

Shares of CRM stock opened at $282.35 on Thursday. Salesforce, Inc. has a fifty-two week low of $212.00 and a fifty-two week high of $369.00. The stock's fifty day moving average price is $268.53 and its two-hundred day moving average price is $306.85. The company has a debt-to-equity ratio of 0.14, a quick ratio of 1.11 and a current ratio of 1.11. The company has a market cap of $271.45 billion, a PE ratio of 46.44, a P/E/G ratio of 2.58 and a beta of 1.42.

Salesforce Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, April 24th. Shareholders of record on Thursday, April 10th were paid a dividend of $0.42 per share. This is an increase from Salesforce's previous quarterly dividend of $0.40. The ex-dividend date of this dividend was Thursday, April 10th. This represents a $1.68 annualized dividend and a yield of 0.60%. Salesforce's payout ratio is presently 26.10%.

Analyst Upgrades and Downgrades

Several brokerages have issued reports on CRM. Canaccord Genuity Group cut their price target on Salesforce from $415.00 to $400.00 and set a "buy" rating for the company in a report on Thursday, February 27th. Robert W. Baird dropped their price objective on shares of Salesforce from $430.00 to $400.00 and set an "outperform" rating on the stock in a research report on Thursday, February 27th. UBS Group reduced their target price on shares of Salesforce from $340.00 to $320.00 and set a "neutral" rating for the company in a report on Wednesday. DA Davidson reissued an "underperform" rating and issued a $200.00 price target on shares of Salesforce in a report on Monday, April 21st. Finally, Cantor Fitzgerald started coverage on shares of Salesforce in a research report on Wednesday, April 23rd. They set an "overweight" rating and a $210.00 price objective for the company. One analyst has rated the stock with a sell rating, five have issued a hold rating, thirty-two have issued a buy rating and five have given a strong buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $351.59.

View Our Latest Analysis on CRM

Insider Transactions at Salesforce

In other Salesforce news, insider Srinivas Tallapragada sold 6,697 shares of the firm's stock in a transaction that occurred on Wednesday, May 14th. The shares were sold at an average price of $295.00, for a total value of $1,975,615.00. Following the sale, the insider now owns 41,422 shares in the company, valued at $12,219,490. This trade represents a 13.92% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. Also, insider Miguel Milano sold 458 shares of the firm's stock in a transaction on Monday, February 24th. The shares were sold at an average price of $307.97, for a total value of $141,050.26. Following the sale, the insider now directly owns 5,864 shares in the company, valued at approximately $1,805,936.08. This trade represents a 7.24% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 46,306 shares of company stock valued at $12,841,368. 3.20% of the stock is currently owned by insiders.

About Salesforce

(

Free Report)

Salesforce, Inc provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide. The company's service includes sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and artificial intelligence, and deliver quotes, contracts, and invoices; and service that enables companies to deliver trusted and highly personalized customer support at scale.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Salesforce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Salesforce wasn't on the list.

While Salesforce currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.