Connor Clark & Lunn Investment Management Ltd. lifted its stake in shares of Tesla, Inc. (NASDAQ:TSLA - Free Report) by 5.2% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 167,101 shares of the electric vehicle producer's stock after acquiring an additional 8,325 shares during the quarter. Connor Clark & Lunn Investment Management Ltd.'s holdings in Tesla were worth $43,306,000 at the end of the most recent reporting period.

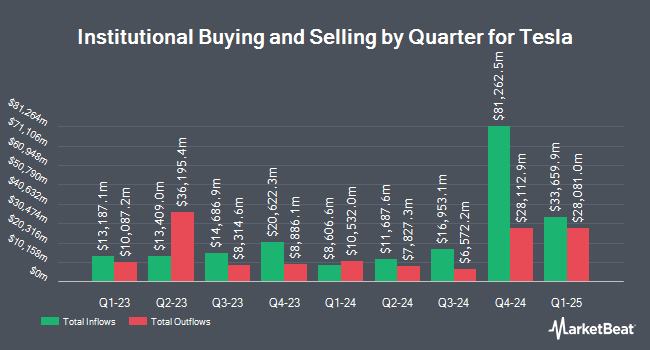

A number of other hedge funds also recently made changes to their positions in TSLA. Vanguard Group Inc. lifted its holdings in Tesla by 1.5% in the 1st quarter. Vanguard Group Inc. now owns 246,887,705 shares of the electric vehicle producer's stock worth $63,983,418,000 after purchasing an additional 3,694,524 shares in the last quarter. Northern Trust Corp lifted its holdings in Tesla by 21.6% in the 4th quarter. Northern Trust Corp now owns 28,579,615 shares of the electric vehicle producer's stock worth $11,541,592,000 after purchasing an additional 5,075,418 shares in the last quarter. Goldman Sachs Group Inc. lifted its holdings in Tesla by 322.1% in the 1st quarter. Goldman Sachs Group Inc. now owns 26,590,525 shares of the electric vehicle producer's stock worth $6,891,201,000 after purchasing an additional 20,291,139 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its holdings in Tesla by 0.7% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 24,536,519 shares of the electric vehicle producer's stock worth $9,908,828,000 after purchasing an additional 158,697 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. lifted its holdings in Tesla by 4.9% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 18,174,941 shares of the electric vehicle producer's stock worth $4,710,218,000 after purchasing an additional 849,091 shares in the last quarter. 66.20% of the stock is currently owned by institutional investors.

Tesla Price Performance

TSLA opened at $329.61 on Friday. Tesla, Inc. has a 12-month low of $194.67 and a 12-month high of $488.54. The company has a current ratio of 2.04, a quick ratio of 1.55 and a debt-to-equity ratio of 0.07. The business's fifty day simple moving average is $318.68 and its 200-day simple moving average is $308.19. The company has a market capitalization of $1.06 trillion, a price-to-earnings ratio of 190.53, a PEG ratio of 11.32 and a beta of 2.33.

Tesla (NASDAQ:TSLA - Get Free Report) last posted its quarterly earnings results on Wednesday, July 23rd. The electric vehicle producer reported $0.40 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.43 by ($0.03). Tesla had a return on equity of 7.98% and a net margin of 6.54%. The firm had revenue of $22.50 billion for the quarter, compared to the consensus estimate of $23.18 billion. During the same period in the previous year, the company posted $0.52 EPS. Tesla's quarterly revenue was down 11.8% compared to the same quarter last year. On average, equities research analysts anticipate that Tesla, Inc. will post 2.56 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of research firms recently commented on TSLA. Bank of America boosted their price target on Tesla from $305.00 to $341.00 and gave the stock a "neutral" rating in a report on Monday, July 21st. Barclays lowered their price target on Tesla from $325.00 to $275.00 and set an "equal weight" rating on the stock in a report on Monday, April 21st. JPMorgan Chase & Co. decreased their price objective on Tesla from $120.00 to $115.00 and set an "underweight" rating on the stock in a report on Wednesday, April 23rd. Needham & Company LLC reaffirmed a "hold" rating on shares of Tesla in a report on Thursday, July 24th. Finally, Morgan Stanley reaffirmed an "overweight" rating and set a $410.00 price objective on shares of Tesla in a report on Friday, June 6th. Ten equities research analysts have rated the stock with a sell rating, fifteen have issued a hold rating, seventeen have issued a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $303.31.

Check Out Our Latest Research Report on TSLA

Insider Transactions at Tesla

In other news, Director Ira Matthew Ehrenpreis sold 477,572 shares of the stock in a transaction on Tuesday, May 27th. The stock was sold at an average price of $357.30, for a total transaction of $170,636,475.60. Following the transaction, the director owned 855,394 shares of the company's stock, valued at approximately $305,632,276.20. This represents a 35.83% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Vaibhav Taneja sold 6,000 shares of the stock in a transaction on Monday, June 2nd. The stock was sold at an average price of $341.02, for a total value of $2,046,120.00. Following the transaction, the chief financial officer directly owned 1,950 shares in the company, valued at $664,989. The trade was a 75.47% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 602,724 shares of company stock worth $214,176,831 over the last quarter. 20.70% of the stock is owned by corporate insiders.

Tesla Company Profile

(

Free Report)

Tesla, Inc designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; and non-warranty after-sales vehicle, used vehicles, body shop and parts, supercharging, retail merchandise, and vehicle insurance services.

Further Reading

Want to see what other hedge funds are holding TSLA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Tesla, Inc. (NASDAQ:TSLA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tesla, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tesla wasn't on the list.

While Tesla currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report