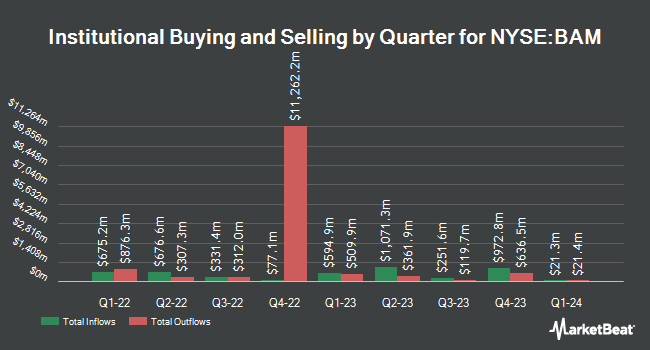

Connor Clark & Lunn Investment Management Ltd. reduced its stake in shares of Brookfield Asset Management Ltd. (NYSE:BAM - Free Report) TSE: BAM.A by 45.3% in the first quarter, according to its most recent filing with the SEC. The fund owned 2,187,561 shares of the financial services provider's stock after selling 1,809,596 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.13% of Brookfield Asset Management worth $105,911,000 as of its most recent SEC filing.

A number of other hedge funds also recently made changes to their positions in the stock. MUFG Securities EMEA plc bought a new stake in shares of Brookfield Asset Management in the 1st quarter worth approximately $27,859,000. Citigroup Inc. lifted its holdings in shares of Brookfield Asset Management by 162.2% in the 1st quarter. Citigroup Inc. now owns 271,489 shares of the financial services provider's stock worth $13,140,000 after acquiring an additional 167,931 shares during the last quarter. Deutsche Bank AG lifted its holdings in shares of Brookfield Asset Management by 11.3% in the 1st quarter. Deutsche Bank AG now owns 573,939 shares of the financial services provider's stock worth $27,807,000 after acquiring an additional 58,332 shares during the last quarter. Chicago Partners Investment Group LLC lifted its holdings in shares of Brookfield Asset Management by 12.8% in the 1st quarter. Chicago Partners Investment Group LLC now owns 61,664 shares of the financial services provider's stock worth $2,988,000 after acquiring an additional 7,017 shares during the last quarter. Finally, ASR Vermogensbeheer N.V. bought a new stake in Brookfield Asset Management during the 1st quarter valued at $319,000. 68.41% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently commented on BAM shares. National Bank Financial started coverage on shares of Brookfield Asset Management in a report on Tuesday, July 29th. They set an "outperform" rating and a $71.00 price target for the company. National Bankshares set a $71.00 price target on shares of Brookfield Asset Management and gave the company an "outperform" rating in a report on Tuesday, July 29th. Scotiabank upped their price target on shares of Brookfield Asset Management from $66.00 to $67.25 and gave the company an "outperform" rating in a report on Thursday, August 7th. Piper Sandler initiated coverage on shares of Brookfield Asset Management in a report on Monday, June 30th. They issued a "neutral" rating and a $60.00 price objective for the company. Finally, Wall Street Zen upgraded shares of Brookfield Asset Management from a "sell" rating to a "hold" rating in a report on Tuesday, April 15th. Two analysts have rated the stock with a sell rating, seven have assigned a hold rating, nine have issued a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $63.33.

Read Our Latest Research Report on BAM

Brookfield Asset Management Stock Down 0.4%

BAM stock traded down $0.25 during trading on Wednesday, hitting $62.41. 601,731 shares of the stock traded hands, compared to its average volume of 2,096,371. Brookfield Asset Management Ltd. has a 1 year low of $39.19 and a 1 year high of $64.10. The firm's 50 day moving average is $58.02 and its two-hundred day moving average is $55.09. The stock has a market cap of $102.21 billion, a price-to-earnings ratio of 41.81, a price-to-earnings-growth ratio of 2.22 and a beta of 1.44. The company has a debt-to-equity ratio of 0.14, a current ratio of 1.25 and a quick ratio of 1.31.

Brookfield Asset Management Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, September 29th. Investors of record on Friday, August 29th will be given a dividend of $0.4375 per share. This represents a $1.75 annualized dividend and a yield of 2.8%. The ex-dividend date of this dividend is Friday, August 29th. Brookfield Asset Management's dividend payout ratio is 117.45%.

Brookfield Asset Management Company Profile

(

Free Report)

Brookfield Asset Management Ltd. is a real estate investment firm specializing in alternative asset management services. Its renewable power and transition business includes the operates in the hydroelectric, wind, solar, distributed generation, and sustainable solution sector. The company's infrastructure business engages in the utilities, transport, midstream, and data infrastructure sectors.

Read More

Before you consider Brookfield Asset Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Asset Management wasn't on the list.

While Brookfield Asset Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.