Connor Clark & Lunn Investment Management Ltd. lowered its stake in shares of Tencent Music Entertainment Group Sponsored ADR (NYSE:TME - Free Report) by 98.0% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 18,259 shares of the company's stock after selling 899,643 shares during the period. Connor Clark & Lunn Investment Management Ltd.'s holdings in Tencent Music Entertainment Group were worth $263,000 as of its most recent filing with the Securities and Exchange Commission.

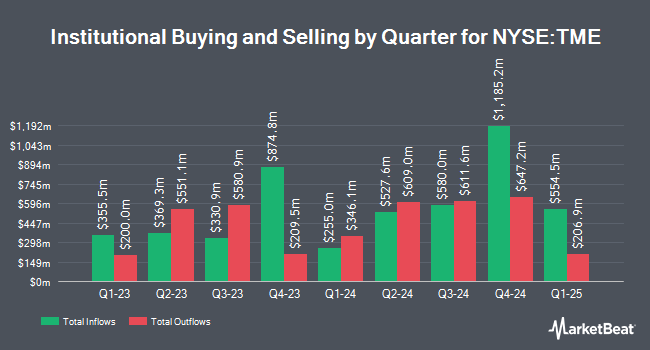

Several other institutional investors have also modified their holdings of the business. Vanguard Group Inc. lifted its holdings in shares of Tencent Music Entertainment Group by 1.4% during the 1st quarter. Vanguard Group Inc. now owns 29,993,486 shares of the company's stock valued at $432,206,000 after purchasing an additional 404,674 shares in the last quarter. Krane Funds Advisors LLC lifted its holdings in shares of Tencent Music Entertainment Group by 20.8% during the 1st quarter. Krane Funds Advisors LLC now owns 23,984,629 shares of the company's stock valued at $345,619,000 after purchasing an additional 4,128,678 shares in the last quarter. Mirae Asset Global Investments Co. Ltd. lifted its holdings in shares of Tencent Music Entertainment Group by 3,382.1% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 4,481,537 shares of the company's stock valued at $64,579,000 after purchasing an additional 4,352,834 shares in the last quarter. Deutsche Bank AG lifted its holdings in shares of Tencent Music Entertainment Group by 11.9% during the 1st quarter. Deutsche Bank AG now owns 4,434,839 shares of the company's stock valued at $63,906,000 after purchasing an additional 469,945 shares in the last quarter. Finally, Northern Trust Corp lifted its holdings in shares of Tencent Music Entertainment Group by 242.2% during the 4th quarter. Northern Trust Corp now owns 3,682,994 shares of the company's stock valued at $41,802,000 after purchasing an additional 2,606,781 shares in the last quarter. Institutional investors own 24.32% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently weighed in on the company. Barclays reiterated an "overweight" rating and set a $27.00 price objective (up previously from $16.00) on shares of Tencent Music Entertainment Group in a report on Tuesday, August 12th. Daiwa Capital Markets upgraded Tencent Music Entertainment Group from a "neutral" rating to an "outperform" rating in a report on Tuesday, August 12th. Wall Street Zen upgraded Tencent Music Entertainment Group from a "hold" rating to a "buy" rating in a report on Friday. Citigroup reiterated a "buy" rating and set a $29.00 price objective (up previously from $23.00) on shares of Tencent Music Entertainment Group in a report on Tuesday, August 12th. Finally, Benchmark lifted their target price on Tencent Music Entertainment Group from $19.00 to $28.00 and gave the company a "buy" rating in a research report on Wednesday, August 13th. One investment analyst has rated the stock with a Strong Buy rating and nine have given a Buy rating to the company. Based on data from MarketBeat.com, Tencent Music Entertainment Group presently has a consensus rating of "Buy" and an average price target of $24.47.

Get Our Latest Stock Report on TME

Tencent Music Entertainment Group Stock Up 1.6%

Shares of NYSE:TME traded up $0.42 during trading on Tuesday, hitting $26.14. 25,841,883 shares of the company were exchanged, compared to its average volume of 6,261,027. The stock has a market cap of $44.85 billion, a price-to-earnings ratio of 28.72 and a beta of 0.50. Tencent Music Entertainment Group Sponsored ADR has a fifty-two week low of $9.41 and a fifty-two week high of $26.54. The firm has a fifty day moving average price of $21.57 and a two-hundred day moving average price of $16.93. The company has a current ratio of 1.87, a quick ratio of 1.87 and a debt-to-equity ratio of 0.04.

Tencent Music Entertainment Group Company Profile

(

Free Report)

Tencent Music Entertainment Group operates online music entertainment platforms to provide music streaming, online karaoke, and live streaming services in the People's Republic of China. It offers QQ Music, Kugou Music, and Kuwo Music that enable users to discover music in personalized ways; long-form audio content, including audiobooks, podcasts and talk shows, as well as music-oriented video content comprising music videos, live performances, and short videos; and WeSing, which enables users to sing along from its library of karaoke songs and share their performances in audio or video formats with friends.

Featured Stories

Before you consider Tencent Music Entertainment Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tencent Music Entertainment Group wasn't on the list.

While Tencent Music Entertainment Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.