Connor Clark & Lunn Investment Management Ltd. lifted its position in shares of Airbnb, Inc. (NASDAQ:ABNB - Free Report) by 205.0% in the first quarter, according to its most recent disclosure with the SEC. The institutional investor owned 661,684 shares of the company's stock after buying an additional 444,720 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned about 0.10% of Airbnb worth $79,045,000 as of its most recent SEC filing.

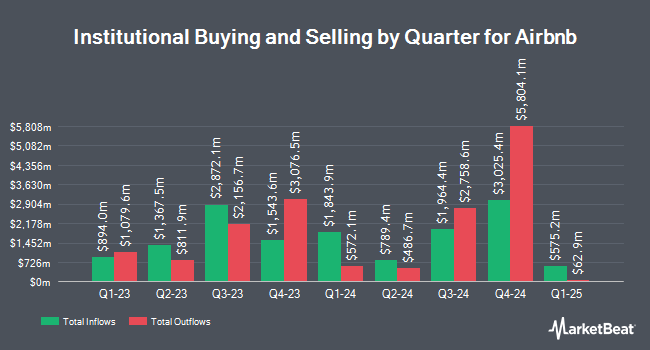

Other hedge funds and other institutional investors also recently modified their holdings of the company. Vanguard Group Inc. grew its holdings in Airbnb by 1.6% during the 1st quarter. Vanguard Group Inc. now owns 37,462,629 shares of the company's stock worth $4,475,286,000 after acquiring an additional 604,120 shares during the period. Northern Trust Corp boosted its stake in Airbnb by 8.4% during the 4th quarter. Northern Trust Corp now owns 4,296,835 shares of the company's stock valued at $564,647,000 after purchasing an additional 331,607 shares during the last quarter. Principal Financial Group Inc. boosted its stake in Airbnb by 74.4% during the 1st quarter. Principal Financial Group Inc. now owns 3,255,682 shares of the company's stock valued at $388,924,000 after purchasing an additional 1,389,251 shares during the last quarter. Two Sigma Advisers LP lifted its position in shares of Airbnb by 512.0% during the 4th quarter. Two Sigma Advisers LP now owns 3,080,300 shares of the company's stock worth $404,782,000 after buying an additional 2,577,000 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. lifted its position in shares of Airbnb by 3.7% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 2,894,569 shares of the company's stock worth $345,785,000 after buying an additional 103,925 shares in the last quarter. Institutional investors and hedge funds own 80.76% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts recently commented on ABNB shares. Morgan Stanley lowered their price target on shares of Airbnb from $130.00 to $120.00 and set an "underweight" rating on the stock in a report on Thursday, August 7th. Susquehanna cut their target price on shares of Airbnb from $200.00 to $150.00 and set a "positive" rating for the company in a research report on Monday, May 5th. Royal Bank Of Canada lifted their price objective on Airbnb from $140.00 to $145.00 and gave the stock a "sector perform" rating in a report on Thursday, August 7th. Wedbush lowered their price objective on shares of Airbnb from $135.00 to $130.00 and set a "neutral" rating for the company in a research note on Thursday, August 7th. Finally, Truist Financial reaffirmed a "sell" rating and set a $106.00 price objective (down from $112.00) on shares of Airbnb in a research note on Friday, May 30th. Five investment analysts have rated the stock with a sell rating, seventeen have assigned a hold rating, thirteen have given a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $142.72.

View Our Latest Stock Report on ABNB

Insider Activity at Airbnb

In related news, CAO David C. Bernstein sold 5,000 shares of the firm's stock in a transaction that occurred on Thursday, July 24th. The shares were sold at an average price of $142.00, for a total value of $710,000.00. Following the sale, the chief accounting officer owned 42,619 shares in the company, valued at approximately $6,051,898. This trade represents a 10.50% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, Director Joseph Gebbia sold 236,000 shares of the firm's stock in a transaction that occurred on Monday, August 4th. The stock was sold at an average price of $129.71, for a total transaction of $30,611,560.00. Following the completion of the sale, the director owned 236,015 shares in the company, valued at $30,613,505.65. This represents a 50.00% decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 1,671,023 shares of company stock worth $223,195,427. Company insiders own 27.83% of the company's stock.

Airbnb Stock Performance

Shares of NASDAQ:ABNB traded up $3.31 during trading on Tuesday, reaching $121.61. 6,278,882 shares of the stock traded hands, compared to its average volume of 5,334,211. The stock has a 50-day moving average of $134.73 and a two-hundred day moving average of $130.89. Airbnb, Inc. has a 52-week low of $99.88 and a 52-week high of $163.93. The stock has a market cap of $76.18 billion, a P/E ratio of 29.45, a price-to-earnings-growth ratio of 2.19 and a beta of 1.13.

Airbnb (NASDAQ:ABNB - Get Free Report) last posted its quarterly earnings results on Wednesday, August 6th. The company reported $1.03 EPS for the quarter, beating analysts' consensus estimates of $0.92 by $0.11. Airbnb had a net margin of 22.67% and a return on equity of 32.19%. The firm had revenue of $3.10 billion for the quarter, compared to analysts' expectations of $3.02 billion. During the same quarter in the prior year, the company posted $0.86 earnings per share. The business's revenue for the quarter was up 12.7% on a year-over-year basis. Sell-side analysts expect that Airbnb, Inc. will post 4.31 earnings per share for the current year.

Airbnb Profile

(

Free Report)

Airbnb, Inc, together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms, primary homes, and vacation homes.

Further Reading

Before you consider Airbnb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Airbnb wasn't on the list.

While Airbnb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report