Connor Clark & Lunn Investment Management Ltd. acquired a new position in shares of Elastic N.V. (NYSE:ESTC - Free Report) in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm acquired 55,088 shares of the company's stock, valued at approximately $4,908,000. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.05% of Elastic at the end of the most recent reporting period.

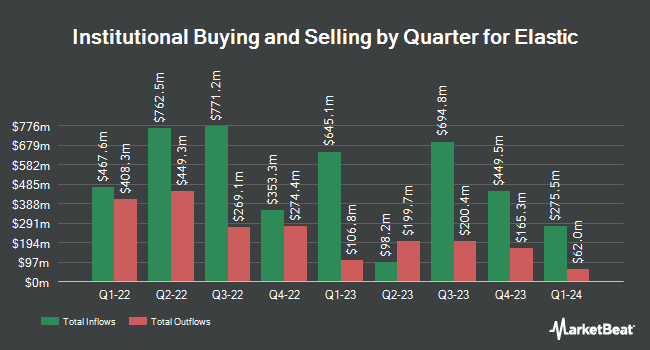

A number of other hedge funds have also modified their holdings of ESTC. Signaturefd LLC grew its stake in shares of Elastic by 53.7% during the 1st quarter. Signaturefd LLC now owns 335 shares of the company's stock valued at $30,000 after buying an additional 117 shares during the period. Parallel Advisors LLC lifted its holdings in shares of Elastic by 4.5% during the 1st quarter. Parallel Advisors LLC now owns 3,396 shares of the company's stock valued at $303,000 after acquiring an additional 145 shares in the last quarter. Y.D. More Investments Ltd lifted its holdings in shares of Elastic by 0.5% during the 1st quarter. Y.D. More Investments Ltd now owns 29,742 shares of the company's stock valued at $2,756,000 after acquiring an additional 145 shares in the last quarter. WCM Investment Management LLC lifted its holdings in Elastic by 0.7% in the 1st quarter. WCM Investment Management LLC now owns 23,811 shares of the company's stock worth $2,183,000 after buying an additional 169 shares in the last quarter. Finally, Guggenheim Capital LLC lifted its holdings in Elastic by 3.3% in the 4th quarter. Guggenheim Capital LLC now owns 7,278 shares of the company's stock worth $721,000 after buying an additional 230 shares in the last quarter. 97.03% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at Elastic

In related news, CRO Mark Eugene Dodds sold 2,500 shares of the stock in a transaction that occurred on Tuesday, June 24th. The shares were sold at an average price of $83.50, for a total transaction of $208,750.00. Following the completion of the sale, the executive directly owned 172,321 shares of the company's stock, valued at $14,388,803.50. This represents a 1.43% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Carolyn Herzog sold 5,702 shares of the stock in a transaction that occurred on Monday, June 9th. The shares were sold at an average price of $86.91, for a total transaction of $495,560.82. Following the sale, the insider directly owned 93,985 shares of the company's stock, valued at approximately $8,168,236.35. This represents a 5.72% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 50,913 shares of company stock valued at $4,416,324. Corporate insiders own 15.90% of the company's stock.

Wall Street Analyst Weigh In

ESTC has been the topic of a number of recent analyst reports. Oppenheimer cut their price objective on shares of Elastic from $120.00 to $100.00 and set an "outperform" rating on the stock in a report on Monday, July 21st. Canaccord Genuity Group cut their target price on shares of Elastic from $135.00 to $110.00 and set a "buy" rating on the stock in a research note on Monday, June 2nd. Wedbush cut their target price on shares of Elastic from $135.00 to $110.00 and set an "outperform" rating on the stock in a research note on Friday, May 30th. TD Securities dropped their price objective on shares of Elastic from $125.00 to $105.00 and set a "hold" rating on the stock in a research note on Wednesday, May 21st. Finally, Cantor Fitzgerald dropped their price objective on shares of Elastic from $109.00 to $92.00 and set a "neutral" rating on the stock in a research note on Friday, May 30th. Eight research analysts have rated the stock with a hold rating, twenty-one have given a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, Elastic presently has a consensus rating of "Moderate Buy" and a consensus price target of $110.60.

Get Our Latest Report on ESTC

Elastic Price Performance

Shares of Elastic stock traded up $0.99 on Friday, hitting $77.41. The company had a trading volume of 2,099,507 shares, compared to its average volume of 1,393,696. The business has a 50-day simple moving average of $83.26 and a 200-day simple moving average of $90.22. The company has a debt-to-equity ratio of 0.61, a current ratio of 1.92 and a quick ratio of 1.92. The company has a market cap of $8.17 billion, a PE ratio of -73.72 and a beta of 1.07. Elastic N.V. has a 52 week low of $69.00 and a 52 week high of $118.84.

Elastic (NYSE:ESTC - Get Free Report) last posted its quarterly earnings data on Thursday, May 29th. The company reported $0.47 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.37 by $0.10. The business had revenue of $388.43 million during the quarter, compared to analysts' expectations of $380.61 million. Elastic had a negative net margin of 7.29% and a negative return on equity of 4.46%. The business's revenue was up 15.9% on a year-over-year basis. During the same period last year, the firm posted $0.21 earnings per share. Research analysts expect that Elastic N.V. will post -0.77 EPS for the current fiscal year.

Elastic Company Profile

(

Free Report)

Elastic N.V., a data analytics company, delivers solutions designed to run in public or private clouds in multi-cloud environments. It primarily offers Elastic Stack, a set of software products that ingest and store data from various sources and formats, as well as performs search, analysis, and visualization on that data.

Further Reading

Before you consider Elastic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elastic wasn't on the list.

While Elastic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.