Connor Clark & Lunn Investment Management Ltd. boosted its position in JFrog Ltd. (NASDAQ:FROG - Free Report) by 14.7% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 605,721 shares of the company's stock after purchasing an additional 77,461 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.53% of JFrog worth $19,383,000 as of its most recent SEC filing.

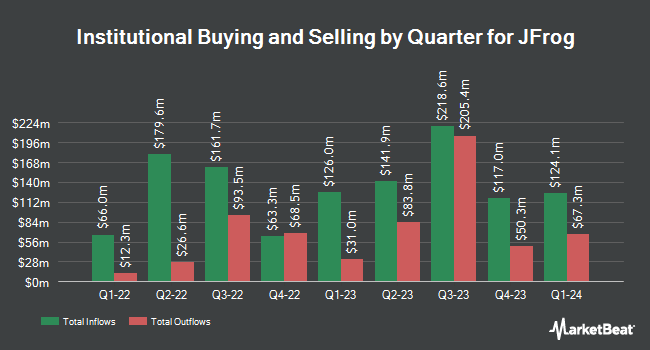

Other large investors also recently made changes to their positions in the company. Vanguard Group Inc. lifted its stake in JFrog by 0.4% during the first quarter. Vanguard Group Inc. now owns 8,871,984 shares of the company's stock valued at $283,903,000 after purchasing an additional 35,458 shares during the last quarter. TimesSquare Capital Management LLC grew its position in JFrog by 6.5% in the first quarter. TimesSquare Capital Management LLC now owns 3,622,911 shares of the company's stock worth $115,933,000 after buying an additional 222,635 shares during the last quarter. Champlain Investment Partners LLC increased its holdings in shares of JFrog by 48.4% in the fourth quarter. Champlain Investment Partners LLC now owns 2,446,819 shares of the company's stock valued at $71,961,000 after buying an additional 797,949 shares in the last quarter. Wasatch Advisors LP lifted its position in shares of JFrog by 3.3% during the 4th quarter. Wasatch Advisors LP now owns 2,211,088 shares of the company's stock valued at $65,028,000 after acquiring an additional 70,204 shares during the last quarter. Finally, Mackenzie Financial Corp boosted its stake in shares of JFrog by 93.8% during the 4th quarter. Mackenzie Financial Corp now owns 1,996,012 shares of the company's stock worth $58,703,000 after acquiring an additional 965,912 shares in the last quarter. Institutional investors own 85.02% of the company's stock.

JFrog Stock Up 0.7%

Shares of FROG traded up $0.29 during midday trading on Thursday, reaching $42.23. 449,524 shares of the stock were exchanged, compared to its average volume of 1,090,659. The company has a market cap of $4.93 billion, a price-to-earnings ratio of -54.76 and a beta of 1.06. JFrog Ltd. has a 12-month low of $25.93 and a 12-month high of $46.64. The firm has a 50 day simple moving average of $42.01 and a 200-day simple moving average of $38.01.

JFrog (NASDAQ:FROG - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The company reported $0.18 earnings per share for the quarter, beating the consensus estimate of $0.16 by $0.02. The firm had revenue of $127.20 million for the quarter, compared to analyst estimates of $122.80 million. JFrog had a negative net margin of 18.18% and a negative return on equity of 7.54%. The company's revenue for the quarter was up 23.5% on a year-over-year basis. During the same quarter last year, the firm earned $0.15 earnings per share. Research analysts expect that JFrog Ltd. will post -0.33 earnings per share for the current fiscal year.

Insider Buying and Selling at JFrog

In related news, Director Frederic Simon sold 35,000 shares of the company's stock in a transaction on Tuesday, July 8th. The shares were sold at an average price of $41.71, for a total value of $1,459,850.00. Following the completion of the sale, the director directly owned 4,239,903 shares in the company, valued at approximately $176,846,354.13. This represents a 0.82% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, CFO Eduard Grabscheid sold 13,043 shares of the firm's stock in a transaction dated Wednesday, June 4th. The shares were sold at an average price of $45.00, for a total value of $586,935.00. Following the transaction, the chief financial officer owned 159,887 shares in the company, valued at approximately $7,194,915. This trade represents a 7.54% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 308,338 shares of company stock worth $13,154,150 in the last ninety days. Company insiders own 14.10% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages have recently issued reports on FROG. Wall Street Zen raised JFrog from a "hold" rating to a "buy" rating in a research report on Sunday, June 29th. Scotiabank cut their price objective on JFrog from $40.00 to $36.00 and set a "sector perform" rating on the stock in a report on Thursday, April 24th. Morgan Stanley upped their price objective on shares of JFrog from $39.00 to $42.00 and gave the company an "overweight" rating in a research note on Friday, May 9th. Robert W. Baird set a $47.00 target price on shares of JFrog and gave the stock an "outperform" rating in a research report on Monday, August 4th. Finally, Stifel Nicolaus upped their price target on shares of JFrog from $45.00 to $53.00 and gave the company a "buy" rating in a research report on Friday, August 8th. Two research analysts have rated the stock with a hold rating, fifteen have given a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, JFrog currently has an average rating of "Moderate Buy" and a consensus target price of $46.87.

View Our Latest Research Report on FROG

JFrog Profile

(

Free Report)

JFrog Ltd. provides end-to-end hybrid software supply chain platform in the United States, Israel, India, and internationally. The company offers JFrog Artifactory, a package repository that allows teams and organizations to store, update, and manage their software packages; JFrog Curation that functions as a guardian outside the software development pipeline, controlling the admission of packages into an organization, primarily from open source or public repositories; JFrog Xray, which scans JFrog Artifactory to secure all software packages; JFrog Advanced Security, an optional add-on for select JFrog subscriptions; and JFrog Distribution that provides software package distribution.

Read More

Before you consider JFrog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JFrog wasn't on the list.

While JFrog currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report