CenterBook Partners LP reduced its stake in shares of Consolidated Water Co. Ltd. (NASDAQ:CWCO - Free Report) by 67.6% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 30,464 shares of the utilities provider's stock after selling 63,634 shares during the period. CenterBook Partners LP owned about 0.19% of Consolidated Water worth $746,000 as of its most recent filing with the SEC.

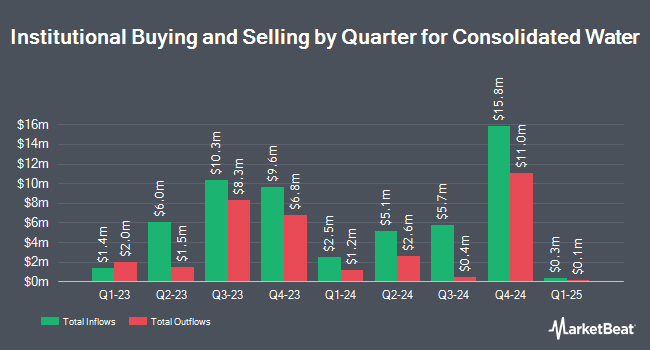

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Franklin Resources Inc. grew its holdings in shares of Consolidated Water by 1.6% in the fourth quarter. Franklin Resources Inc. now owns 30,327 shares of the utilities provider's stock valued at $785,000 after acquiring an additional 467 shares in the last quarter. Journey Strategic Wealth LLC grew its holdings in shares of Consolidated Water by 7.0% in the first quarter. Journey Strategic Wealth LLC now owns 9,776 shares of the utilities provider's stock valued at $239,000 after acquiring an additional 638 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its holdings in shares of Consolidated Water by 7.0% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 11,620 shares of the utilities provider's stock valued at $301,000 after acquiring an additional 764 shares in the last quarter. Russell Investments Group Ltd. grew its holdings in shares of Consolidated Water by 13.0% in the fourth quarter. Russell Investments Group Ltd. now owns 6,905 shares of the utilities provider's stock valued at $179,000 after acquiring an additional 794 shares in the last quarter. Finally, Federated Hermes Inc. grew its holdings in shares of Consolidated Water by 3.6% in the first quarter. Federated Hermes Inc. now owns 26,084 shares of the utilities provider's stock valued at $639,000 after acquiring an additional 904 shares in the last quarter. 55.16% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Separately, Wall Street Zen raised Consolidated Water from a "sell" rating to a "hold" rating in a report on Thursday, May 22nd.

Check Out Our Latest Report on Consolidated Water

Consolidated Water Stock Performance

NASDAQ CWCO traded up $0.39 on Friday, hitting $29.29. 55,774 shares of the stock traded hands, compared to its average volume of 97,268. The business's fifty day moving average is $29.34 and its two-hundred day moving average is $26.97. Consolidated Water Co. Ltd. has a 12 month low of $22.69 and a 12 month high of $31.30. The firm has a market capitalization of $466.30 million, a price-to-earnings ratio of 18.08 and a beta of 0.53.

Consolidated Water (NASDAQ:CWCO - Get Free Report) last announced its quarterly earnings data on Monday, May 12th. The utilities provider reported $0.31 earnings per share for the quarter, beating the consensus estimate of $0.22 by $0.09. Consolidated Water had a return on equity of 7.43% and a net margin of 20.75%. The business had revenue of $33.72 million during the quarter, compared to analyst estimates of $32.30 million. Analysts expect that Consolidated Water Co. Ltd. will post 1.27 EPS for the current fiscal year.

Consolidated Water Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, July 31st. Shareholders of record on Tuesday, July 1st were issued a dividend of $0.14 per share. This represents a $0.56 annualized dividend and a yield of 1.9%. This is a positive change from Consolidated Water's previous quarterly dividend of $0.11. The ex-dividend date of this dividend was Tuesday, July 1st. Consolidated Water's dividend payout ratio is currently 34.57%.

About Consolidated Water

(

Free Report)

Consolidated Water Co Ltd., together with its subsidiaries, designs, constructs, manages, and operates water production and water treatment plants primarily in the Cayman Islands, the Bahamas, and the United States. The company operates through four segments: Retail, Bulk, Services, and Manufacturing.

Further Reading

Before you consider Consolidated Water, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Consolidated Water wasn't on the list.

While Consolidated Water currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.