Dynamic Technology Lab Private Ltd increased its position in Constellium SE (NYSE:CSTM - Free Report) by 133.7% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 46,868 shares of the industrial products company's stock after buying an additional 26,817 shares during the quarter. Dynamic Technology Lab Private Ltd's holdings in Constellium were worth $473,000 as of its most recent filing with the Securities & Exchange Commission.

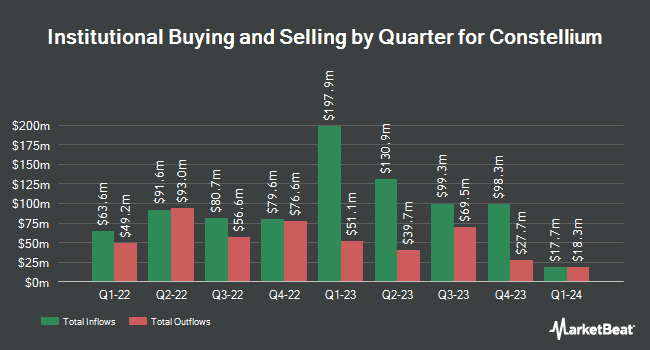

Several other large investors have also added to or reduced their stakes in the stock. Westwood Holdings Group Inc. boosted its holdings in Constellium by 12.2% in the first quarter. Westwood Holdings Group Inc. now owns 6,518,601 shares of the industrial products company's stock valued at $65,773,000 after acquiring an additional 708,412 shares in the last quarter. Janus Henderson Group PLC lifted its stake in Constellium by 4.8% during the 4th quarter. Janus Henderson Group PLC now owns 6,445,290 shares of the industrial products company's stock valued at $66,193,000 after acquiring an additional 292,335 shares during the period. Millennium Management LLC lifted its stake in Constellium by 65.8% during the 1st quarter. Millennium Management LLC now owns 4,115,439 shares of the industrial products company's stock valued at $41,525,000 after acquiring an additional 1,633,561 shares during the period. Encompass Capital Advisors LLC increased its position in shares of Constellium by 82.6% during the 1st quarter. Encompass Capital Advisors LLC now owns 3,357,544 shares of the industrial products company's stock valued at $33,878,000 after purchasing an additional 1,519,220 shares during the last quarter. Finally, Nuveen LLC purchased a new stake in shares of Constellium during the 1st quarter valued at about $19,630,000. Institutional investors own 92.59% of the company's stock.

Constellium Stock Performance

Constellium stock traded down $0.20 during midday trading on Tuesday, hitting $14.96. The stock had a trading volume of 657,402 shares, compared to its average volume of 1,109,263. The firm's fifty day moving average is $14.12 and its two-hundred day moving average is $12.34. The company has a market capitalization of $2.09 billion, a PE ratio of 78.74 and a beta of 1.70. Constellium SE has a 52-week low of $7.32 and a 52-week high of $17.27. The company has a current ratio of 1.23, a quick ratio of 0.53 and a debt-to-equity ratio of 2.47.

Constellium (NYSE:CSTM - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The industrial products company reported $0.25 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.28 by ($0.03). The company had revenue of $2.10 billion for the quarter, compared to analysts' expectations of $2.08 billion. Constellium had a net margin of 0.37% and a return on equity of 3.43%. On average, research analysts forecast that Constellium SE will post 1.1 EPS for the current year.

About Constellium

(

Free Report)

Constellium SE, together with its subsidiaries, engages in the design, manufacture, and sale of rolled and extruded aluminum products for the packaging, aerospace, automotive, defense, and other transportation and industry end-markets. The company operates through three segments: Packaging & Automotive Rolled Products, Aerospace & Transportation, and Automotive Structures & Industry.

See Also

Before you consider Constellium, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Constellium wasn't on the list.

While Constellium currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.