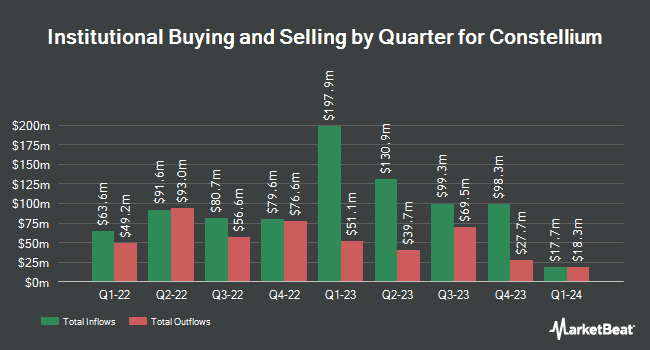

Millennium Management LLC boosted its position in Constellium SE (NYSE:CSTM - Free Report) by 33.5% in the fourth quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 2,481,878 shares of the industrial products company's stock after purchasing an additional 622,367 shares during the quarter. Millennium Management LLC owned approximately 1.69% of Constellium worth $25,489,000 at the end of the most recent reporting period.

Other large investors have also added to or reduced their stakes in the company. Victory Capital Management Inc. boosted its holdings in Constellium by 15.1% in the fourth quarter. Victory Capital Management Inc. now owns 947,430 shares of the industrial products company's stock valued at $9,730,000 after purchasing an additional 124,140 shares in the last quarter. State of Alaska Department of Revenue acquired a new position in Constellium in the fourth quarter valued at approximately $1,386,000. Barclays PLC boosted its holdings in Constellium by 476.1% in the third quarter. Barclays PLC now owns 336,569 shares of the industrial products company's stock valued at $5,473,000 after purchasing an additional 278,149 shares in the last quarter. Renaissance Technologies LLC acquired a new position in Constellium in the fourth quarter valued at approximately $775,000. Finally, SG Americas Securities LLC boosted its holdings in Constellium by 41.7% in the fourth quarter. SG Americas Securities LLC now owns 59,521 shares of the industrial products company's stock valued at $611,000 after purchasing an additional 17,515 shares in the last quarter. 92.59% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Separately, Deutsche Bank Aktiengesellschaft upgraded Constellium from a "hold" rating to a "buy" rating and set a $15.00 target price on the stock in a research report on Tuesday, February 25th.

Get Our Latest Report on Constellium

Constellium Stock Down 1.4%

NYSE CSTM traded down $0.16 on Friday, reaching $11.66. The stock had a trading volume of 1,507,668 shares, compared to its average volume of 1,448,744. The business has a 50 day moving average price of $10.17 and a 200 day moving average price of $10.64. The company has a current ratio of 1.28, a quick ratio of 0.52 and a debt-to-equity ratio of 1.93. Constellium SE has a 1 year low of $7.33 and a 1 year high of $22.00. The company has a market capitalization of $1.67 billion, a price-to-earnings ratio of 36.44 and a beta of 1.65.

Constellium (NYSE:CSTM - Get Free Report) last posted its quarterly earnings results on Wednesday, April 30th. The industrial products company reported $0.26 EPS for the quarter, beating the consensus estimate of $0.07 by $0.19. The firm had revenue of $1.98 billion during the quarter, compared to analysts' expectations of $1.88 billion. Constellium had a return on equity of 4.83% and a net margin of 0.67%. The company's revenue for the quarter was up 5.3% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.11 EPS. On average, analysts forecast that Constellium SE will post 1.1 EPS for the current fiscal year.

About Constellium

(

Free Report)

Constellium SE, together with its subsidiaries, engages in the design, manufacture, and sale of rolled and extruded aluminum products for the packaging, aerospace, automotive, defense, and other transportation and industry end-markets. The company operates through three segments: Packaging & Automotive Rolled Products, Aerospace & Transportation, and Automotive Structures & Industry.

Recommended Stories

Before you consider Constellium, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Constellium wasn't on the list.

While Constellium currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.