Cookson Peirce & Co. Inc. bought a new stake in shares of Zscaler, Inc. (NASDAQ:ZS - Free Report) during the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm bought 4,073 shares of the company's stock, valued at approximately $1,279,000.

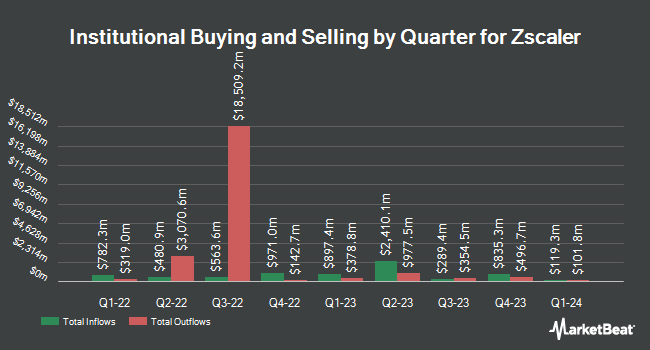

A number of other institutional investors have also modified their holdings of ZS. GAMMA Investing LLC boosted its holdings in shares of Zscaler by 43.1% in the 1st quarter. GAMMA Investing LLC now owns 641 shares of the company's stock valued at $127,000 after buying an additional 193 shares in the last quarter. Wealth Enhancement Advisory Services LLC boosted its holdings in shares of Zscaler by 10.5% in the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 25,072 shares of the company's stock valued at $4,975,000 after buying an additional 2,378 shares in the last quarter. Kentucky Retirement Systems bought a new stake in shares of Zscaler in the 1st quarter valued at about $1,262,000. Kentucky Retirement Systems Insurance Trust Fund bought a new stake in shares of Zscaler in the 1st quarter valued at about $538,000. Finally, Oppenheimer & Co. Inc. boosted its holdings in shares of Zscaler by 25.5% in the 1st quarter. Oppenheimer & Co. Inc. now owns 4,214 shares of the company's stock valued at $836,000 after buying an additional 856 shares in the last quarter. 46.45% of the stock is currently owned by institutional investors.

Zscaler Stock Performance

Shares of NASDAQ ZS opened at $307.92 on Thursday. The company has a current ratio of 2.01, a quick ratio of 2.01 and a debt-to-equity ratio of 0.95. Zscaler, Inc. has a 12 month low of $164.78 and a 12 month high of $319.89. The company has a 50 day simple moving average of $288.61 and a two-hundred day simple moving average of $272.79. The stock has a market cap of $48.74 billion, a price-to-earnings ratio of -1,140.44 and a beta of 1.06.

Zscaler (NASDAQ:ZS - Get Free Report) last announced its quarterly earnings data on Tuesday, September 2nd. The company reported $0.89 EPS for the quarter, beating the consensus estimate of $0.80 by $0.09. Zscaler had a negative net margin of 1.55% and a negative return on equity of 0.47%. The business had revenue of $719.23 million during the quarter, compared to analysts' expectations of $707.15 million. During the same period in the previous year, the business posted $0.88 EPS. The business's quarterly revenue was up 21.3% compared to the same quarter last year. Zscaler has set its FY 2026 guidance at 3.640-3.680 EPS. Q1 2026 guidance at 0.850-0.860 EPS. As a group, analysts predict that Zscaler, Inc. will post -0.1 earnings per share for the current year.

Insider Buying and Selling at Zscaler

In other Zscaler news, insider Robert Schlossman sold 7,006 shares of Zscaler stock in a transaction that occurred on Thursday, October 2nd. The shares were sold at an average price of $305.57, for a total transaction of $2,140,823.42. Following the completion of the sale, the insider directly owned 76,132 shares in the company, valued at approximately $23,263,655.24. The trade was a 8.43% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Also, insider Adam Geller sold 10,464 shares of Zscaler stock in a transaction that occurred on Wednesday, September 17th. The shares were sold at an average price of $284.25, for a total transaction of $2,974,392.00. Following the sale, the insider owned 43,478 shares of the company's stock, valued at approximately $12,358,621.50. The trade was a 19.40% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 39,884 shares of company stock valued at $11,406,825. 18.10% of the stock is currently owned by insiders.

Analysts Set New Price Targets

A number of analysts have recently weighed in on the stock. KeyCorp raised their price target on shares of Zscaler from $345.00 to $350.00 and gave the company an "overweight" rating in a report on Wednesday, September 3rd. Wall Street Zen cut shares of Zscaler from a "buy" rating to a "hold" rating in a report on Saturday, October 18th. Robert W. Baird raised their price target on shares of Zscaler from $330.00 to $345.00 and gave the company an "outperform" rating in a report on Wednesday, September 3rd. UBS Group lowered their target price on shares of Zscaler from $365.00 to $350.00 and set a "buy" rating for the company in a research note on Wednesday, September 3rd. Finally, BTIG Research reiterated a "buy" rating on shares of Zscaler in a research note on Thursday, July 10th. One equities research analyst has rated the stock with a Strong Buy rating, twenty-nine have assigned a Buy rating, eight have given a Hold rating and one has issued a Sell rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $307.86.

Read Our Latest Report on Zscaler

Zscaler Company Profile

(

Free Report)

Zscaler, Inc operates as a cloud security company worldwide. The company offers Zscaler Internet Access solution that provides users, workloads, IoT, and OT devices secure access to externally managed applications, including software-as-a-service (SaaS) applications and internet destinations; and Zscaler Private Access solution, which is designed to provide access to managed applications hosted internally in data centers, and private or public clouds.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Zscaler, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zscaler wasn't on the list.

While Zscaler currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.