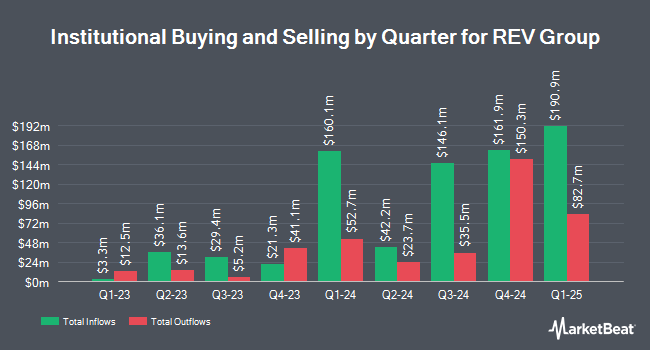

Corient IA LLC bought a new stake in REV Group, Inc. (NYSE:REVG - Free Report) during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 10,000 shares of the company's stock, valued at approximately $316,000.

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Wells Fargo & Company MN increased its stake in shares of REV Group by 375.1% in the fourth quarter. Wells Fargo & Company MN now owns 97,732 shares of the company's stock valued at $3,115,000 after buying an additional 77,163 shares during the period. Envestnet Asset Management Inc. increased its stake in shares of REV Group by 96.4% in the fourth quarter. Envestnet Asset Management Inc. now owns 17,805 shares of the company's stock valued at $567,000 after buying an additional 8,741 shares during the period. Cerity Partners LLC acquired a new position in shares of REV Group in the fourth quarter valued at approximately $205,000. Bank of Montreal Can increased its stake in shares of REV Group by 9.1% in the fourth quarter. Bank of Montreal Can now owns 8,182 shares of the company's stock valued at $261,000 after buying an additional 682 shares during the period. Finally, Barclays PLC increased its stake in shares of REV Group by 10.6% in the fourth quarter. Barclays PLC now owns 99,130 shares of the company's stock valued at $3,158,000 after buying an additional 9,511 shares during the period.

REV Group Trading Up 3.5%

Shares of REV Group stock traded up $1.7430 on Friday, reaching $52.2430. 1,006,453 shares of the company's stock were exchanged, compared to its average volume of 598,305. The company has a market capitalization of $2.55 billion, a P/E ratio of 27.79 and a beta of 1.18. REV Group, Inc. has a 52 week low of $21.54 and a 52 week high of $53.74. The firm's 50-day moving average is $48.47 and its two-hundred day moving average is $38.91. The company has a debt-to-equity ratio of 0.36, a quick ratio of 0.53 and a current ratio of 1.66.

REV Group (NYSE:REVG - Get Free Report) last posted its quarterly earnings results on Wednesday, June 4th. The company reported $0.70 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.57 by $0.13. The firm had revenue of $629.10 million for the quarter, compared to analysts' expectations of $603.51 million. REV Group had a return on equity of 23.99% and a net margin of 4.16%.The company's revenue for the quarter was up 2.0% compared to the same quarter last year. During the same period in the prior year, the business earned $0.39 EPS. REV Group has set its FY 2025 guidance at EPS. Sell-side analysts predict that REV Group, Inc. will post 2.12 EPS for the current fiscal year.

REV Group Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, July 11th. Stockholders of record on Friday, June 27th were given a dividend of $0.06 per share. This represents a $0.24 dividend on an annualized basis and a dividend yield of 0.5%. The ex-dividend date of this dividend was Friday, June 27th. REV Group's dividend payout ratio is presently 12.77%.

Insider Buying and Selling at REV Group

In other news, CEO Jr. Mark A. Skonieczny sold 92,601 shares of the company's stock in a transaction that occurred on Friday, June 6th. The stock was sold at an average price of $43.83, for a total transaction of $4,058,701.83. Following the transaction, the chief executive officer directly owned 516,446 shares of the company's stock, valued at $22,635,828.18. This represents a 15.20% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 1.70% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

Several analysts recently commented on REVG shares. Morgan Stanley upgraded REV Group from an "underweight" rating to an "equal weight" rating and upped their target price for the company from $33.00 to $46.00 in a report on Wednesday, June 18th. DA Davidson upped their target price on REV Group from $51.00 to $55.00 and gave the company a "buy" rating in a report on Tuesday, July 22nd. Wall Street Zen upgraded REV Group from a "buy" rating to a "strong-buy" rating in a report on Friday, June 6th. Finally, The Goldman Sachs Group upped their target price on REV Group from $26.00 to $30.00 and gave the company a "sell" rating in a report on Tuesday, May 27th. Two investment analysts have rated the stock with a Buy rating, one has given a Hold rating and one has issued a Sell rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $42.25.

Check Out Our Latest Report on REVG

REV Group Company Profile

(

Free Report)

REV Group, Inc, together with its subsidiaries, designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in the United States, Canada, and internationally. It operates through three segments: Fire & Emergency, Commercial, and Recreation. The Fire & Emergency segment provides fire apparatus equipment under the Emergency One, Kovatch Mobile Equipment, Ferrara, Spartan Emergency Response, Smeal, Spartan Fire Chassis, and Ladder Tower brand names; and ambulances under the American Emergency Vehicles, Horton Emergency Vehicles, Leader Emergency Vehicles, Road Rescue, and Wheeled Coach brand names.

Featured Articles

Before you consider REV Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and REV Group wasn't on the list.

While REV Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.