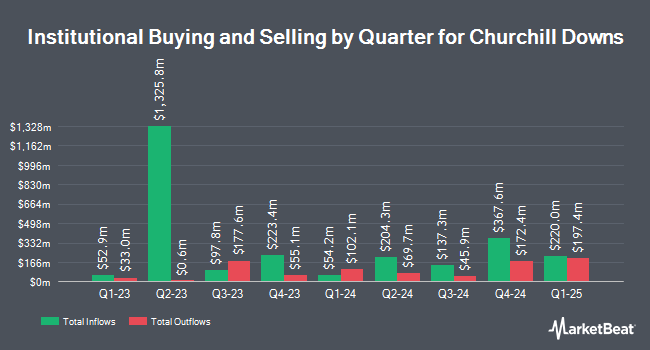

Corient IA LLC purchased a new position in Churchill Downs, Incorporated (NASDAQ:CHDN - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 3,000 shares of the company's stock, valued at approximately $333,000.

Several other institutional investors have also modified their holdings of the business. MassMutual Private Wealth & Trust FSB grew its stake in shares of Churchill Downs by 159.1% during the first quarter. MassMutual Private Wealth & Trust FSB now owns 412 shares of the company's stock worth $46,000 after purchasing an additional 253 shares in the last quarter. Central Pacific Bank Trust Division grew its stake in shares of Churchill Downs by 39.6% during the first quarter. Central Pacific Bank Trust Division now owns 455 shares of the company's stock worth $51,000 after purchasing an additional 129 shares in the last quarter. Private Trust Co. NA grew its stake in shares of Churchill Downs by 154.9% during the first quarter. Private Trust Co. NA now owns 543 shares of the company's stock worth $60,000 after purchasing an additional 330 shares in the last quarter. Caitong International Asset Management Co. Ltd grew its stake in shares of Churchill Downs by 181.4% during the first quarter. Caitong International Asset Management Co. Ltd now owns 560 shares of the company's stock worth $62,000 after purchasing an additional 361 shares in the last quarter. Finally, Ossiam grew its stake in shares of Churchill Downs by 2,292.7% during the fourth quarter. Ossiam now owns 1,962 shares of the company's stock worth $262,000 after purchasing an additional 1,880 shares in the last quarter. Institutional investors and hedge funds own 82.59% of the company's stock.

Churchill Downs Stock Performance

Shares of NASDAQ:CHDN traded up $1.58 on Friday, reaching $104.04. The company's stock had a trading volume of 556,045 shares, compared to its average volume of 523,376. The stock's 50-day moving average is $104.12 and its two-hundred day moving average is $104.67. Churchill Downs, Incorporated has a 52-week low of $85.58 and a 52-week high of $150.21. The company has a debt-to-equity ratio of 4.74, a current ratio of 0.60 and a quick ratio of 0.60. The stock has a market capitalization of $7.30 billion, a P/E ratio of 17.88, a PEG ratio of 1.92 and a beta of 0.95.

Churchill Downs (NASDAQ:CHDN - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The company reported $3.10 EPS for the quarter, beating analysts' consensus estimates of $3.03 by $0.07. Churchill Downs had a net margin of 15.22% and a return on equity of 41.46%. The business had revenue of $934.40 million during the quarter, compared to analysts' expectations of $924.36 million. During the same period in the prior year, the company earned $2.89 earnings per share. The business's revenue was up 4.9% compared to the same quarter last year. As a group, sell-side analysts forecast that Churchill Downs, Incorporated will post 6.92 EPS for the current year.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on CHDN shares. Barclays boosted their target price on shares of Churchill Downs from $127.00 to $131.00 and gave the stock an "overweight" rating in a research note on Friday, July 25th. Mizuho boosted their target price on shares of Churchill Downs from $134.00 to $136.00 and gave the stock an "outperform" rating in a research note on Tuesday, July 22nd. Macquarie boosted their target price on shares of Churchill Downs from $150.00 to $155.00 and gave the stock an "outperform" rating in a research note on Monday, July 28th. JPMorgan Chase & Co. initiated coverage on shares of Churchill Downs in a research note on Monday, June 23rd. They set an "overweight" rating and a $116.00 target price for the company. Finally, JMP Securities reduced their price target on shares of Churchill Downs from $144.00 to $138.00 and set a "market outperform" rating for the company in a research report on Tuesday, May 27th. Ten analysts have rated the stock with a Buy rating, According to data from MarketBeat, Churchill Downs currently has a consensus rating of "Buy" and an average price target of $136.50.

View Our Latest Report on CHDN

About Churchill Downs

(

Free Report)

Churchill Downs Incorporated operates as a racing, online wagering, and gaming entertainment company in the United States. It operates through three segments: Live and Historical Racing, TwinSpires, and Gaming. The company operates pari-mutuel gaming entertainment venues; TwinSpires, an online wagering platform for horse racing, sports, and iGaming; retail sports books; casino gaming; and Terre Haute Casino Resort.

Recommended Stories

Before you consider Churchill Downs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Churchill Downs wasn't on the list.

While Churchill Downs currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.