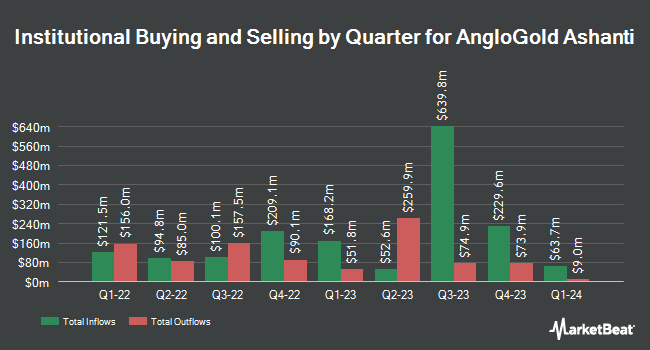

Coronation Fund Managers Ltd. purchased a new stake in shares of AngloGold Ashanti PLC (NYSE:AU - Free Report) in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 1,702,222 shares of the mining company's stock, valued at approximately $63,186,000. AngloGold Ashanti makes up about 3.4% of Coronation Fund Managers Ltd.'s portfolio, making the stock its 7th largest holding. Coronation Fund Managers Ltd. owned approximately 0.41% of AngloGold Ashanti as of its most recent filing with the Securities and Exchange Commission (SEC).

Other large investors have also added to or reduced their stakes in the company. Wellington Management Group LLP bought a new stake in AngloGold Ashanti in the 4th quarter worth approximately $392,000. Vanguard Capital Wealth Advisors bought a new stake in AngloGold Ashanti in the 1st quarter worth approximately $221,000. Cerity Partners LLC bought a new stake in AngloGold Ashanti in the 1st quarter worth approximately $312,000. Geode Capital Management LLC grew its position in AngloGold Ashanti by 59.2% in the 4th quarter. Geode Capital Management LLC now owns 520,772 shares of the mining company's stock worth $12,019,000 after purchasing an additional 193,664 shares during the period. Finally, Ritholtz Wealth Management bought a new stake in AngloGold Ashanti in the 1st quarter worth approximately $238,000. Institutional investors own 36.09% of the company's stock.

AngloGold Ashanti Stock Performance

Shares of AngloGold Ashanti stock traded up $0.44 on Tuesday, hitting $57.24. 1,774,845 shares of the company's stock were exchanged, compared to its average volume of 2,824,402. The company has a debt-to-equity ratio of 0.22, a quick ratio of 1.57 and a current ratio of 2.34. AngloGold Ashanti PLC has a 1 year low of $22.45 and a 1 year high of $59.19. The company has a 50-day simple moving average of $48.91 and a 200-day simple moving average of $41.01. The stock has a market capitalization of $24.03 billion, a PE ratio of 15.22 and a beta of 0.46.

AngloGold Ashanti (NYSE:AU - Get Free Report) last released its earnings results on Friday, August 1st. The mining company reported $1.25 earnings per share for the quarter, missing analysts' consensus estimates of $1.31 by ($0.06). AngloGold Ashanti had a net margin of 23.60% and a return on equity of 24.25%. The firm had revenue of $2.45 billion for the quarter, compared to analysts' expectations of $2.29 billion. As a group, equities analysts anticipate that AngloGold Ashanti PLC will post 3.83 EPS for the current year.

AngloGold Ashanti Increases Dividend

The company also recently announced a semi-annual dividend, which will be paid on Friday, September 5th. Investors of record on Friday, August 22nd will be paid a dividend of $0.80 per share. This is a positive change from AngloGold Ashanti's previous semi-annual dividend of $0.69. The ex-dividend date is Friday, August 22nd. This represents a dividend yield of 610.0%. AngloGold Ashanti's dividend payout ratio is presently 13.30%.

Analyst Ratings Changes

A number of research firms have commented on AU. Wall Street Zen downgraded shares of AngloGold Ashanti from a "buy" rating to a "hold" rating in a research report on Saturday. HSBC reaffirmed a "reduce" rating and issued a $35.00 target price on shares of AngloGold Ashanti in a research report on Thursday, April 17th. Scotiabank reiterated a "sector perform" rating and set a $55.00 price target on shares of AngloGold Ashanti in a research note on Monday. JPMorgan Chase & Co. lifted their price target on shares of AngloGold Ashanti from $58.00 to $63.00 and gave the stock an "overweight" rating in a research note on Tuesday, July 15th. Finally, Roth Capital reiterated a "buy" rating on shares of AngloGold Ashanti in a research note on Friday, August 1st. One research analyst has rated the stock with a sell rating, two have issued a hold rating and four have assigned a buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $49.60.

Get Our Latest Report on AU

AngloGold Ashanti Profile

(

Free Report)

AngloGold Ashanti plc operates as a gold mining company in Africa, Australia, and the Americas. The company primarily explores for gold, as well as produces silver and sulphuric acid as by-products. Its flagship property is a 100% owned Geita mine located in the Lake Victoria goldfields of the Mwanza region in north-western Tanzania.

Featured Stories

Before you consider AngloGold Ashanti, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AngloGold Ashanti wasn't on the list.

While AngloGold Ashanti currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.