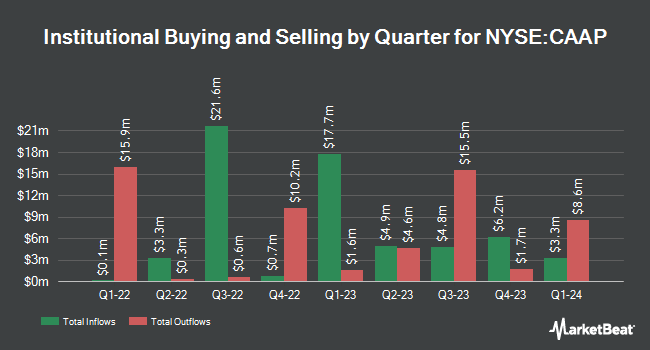

Fourth Sail Capital LP boosted its stake in shares of Corporacion America Airports S.A. (NYSE:CAAP - Free Report) by 9.0% in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,584,784 shares of the company's stock after purchasing an additional 130,702 shares during the quarter. Corporacion America Airports makes up approximately 6.8% of Fourth Sail Capital LP's holdings, making the stock its 2nd largest position. Fourth Sail Capital LP owned approximately 0.97% of Corporacion America Airports worth $29,002,000 at the end of the most recent reporting period.

A number of other institutional investors also recently added to or reduced their stakes in the business. Royal Bank of Canada boosted its position in Corporacion America Airports by 48.3% during the 4th quarter. Royal Bank of Canada now owns 887,485 shares of the company's stock worth $16,561,000 after acquiring an additional 288,948 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its position in Corporacion America Airports by 111.2% during the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 851,325 shares of the company's stock worth $15,886,000 after acquiring an additional 448,298 shares during the period. Millennium Management LLC boosted its position in Corporacion America Airports by 899.4% during the 4th quarter. Millennium Management LLC now owns 220,076 shares of the company's stock worth $4,107,000 after acquiring an additional 198,056 shares during the period. LMG Wealth Partners LLC boosted its position in Corporacion America Airports by 4.0% during the 1st quarter. LMG Wealth Partners LLC now owns 95,184 shares of the company's stock worth $1,742,000 after acquiring an additional 3,693 shares during the period. Finally, Empirical Finance LLC bought a new stake in shares of Corporacion America Airports in the 1st quarter worth $1,631,000. Institutional investors and hedge funds own 12.95% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have recently commented on the company. Bank of America assumed coverage on Corporacion America Airports in a research note on Thursday, May 22nd. They issued a "buy" rating and a $24.70 price objective on the stock. JPMorgan Chase & Co. boosted their price objective on Corporacion America Airports from $22.50 to $24.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 2nd. Finally, Itau BBA Securities assumed coverage on Corporacion America Airports in a research note on Monday, April 28th. They issued an "outperform" rating and a $20.40 price objective on the stock.

Read Our Latest Research Report on CAAP

Corporacion America Airports Price Performance

Shares of CAAP traded down $0.02 during midday trading on Friday, reaching $20.98. The stock had a trading volume of 56,787 shares, compared to its average volume of 101,210. The firm's 50 day moving average price is $20.08 and its 200-day moving average price is $19.43. The company has a market capitalization of $3.43 billion, a P/E ratio of 24.40, a P/E/G ratio of 0.70 and a beta of 1.37. The company has a debt-to-equity ratio of 0.66, a current ratio of 1.39 and a quick ratio of 1.37. Corporacion America Airports S.A. has a 52 week low of $14.00 and a 52 week high of $22.13.

Corporacion America Airports (NYSE:CAAP - Get Free Report) last announced its earnings results on Thursday, May 22nd. The company reported $0.25 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.51 by ($0.26). The company had revenue of $446.20 million for the quarter, compared to analyst estimates of $418.00 million. Corporacion America Airports had a return on equity of 9.33% and a net margin of 7.84%. On average, analysts forecast that Corporacion America Airports S.A. will post 0.95 earnings per share for the current fiscal year.

About Corporacion America Airports

(

Free Report)

Corporación América Airports SA, through its subsidiaries, acquires, develops, and operates airport concessions. It operates 52 airports in Latin America, Europe, and Eurasia. The company was formerly known as A.C.I. Airports International S.à r.l. and changed its name to Corporación América Airports SA in September 2017.

Further Reading

Before you consider Corporacion America Airports, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corporacion America Airports wasn't on the list.

While Corporacion America Airports currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.