Mackenzie Financial Corp increased its holdings in CorVel Corp. (NASDAQ:CRVL - Free Report) by 50.2% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 11,449 shares of the business services provider's stock after acquiring an additional 3,825 shares during the quarter. Mackenzie Financial Corp's holdings in CorVel were worth $1,282,000 as of its most recent filing with the Securities & Exchange Commission.

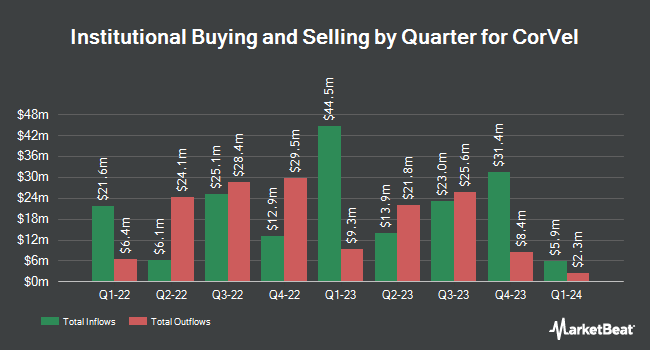

Several other large investors have also added to or reduced their stakes in CRVL. Kayne Anderson Rudnick Investment Management LLC boosted its stake in shares of CorVel by 193.7% during the 4th quarter. Kayne Anderson Rudnick Investment Management LLC now owns 5,714,351 shares of the business services provider's stock valued at $635,779,000 after purchasing an additional 3,768,440 shares in the last quarter. Renaissance Technologies LLC lifted its holdings in CorVel by 184.1% in the fourth quarter. Renaissance Technologies LLC now owns 1,858,830 shares of the business services provider's stock worth $206,813,000 after buying an additional 1,204,611 shares during the period. Dimensional Fund Advisors LP boosted its position in CorVel by 187.3% during the 4th quarter. Dimensional Fund Advisors LP now owns 1,545,619 shares of the business services provider's stock valued at $171,969,000 after acquiring an additional 1,007,651 shares in the last quarter. Neuberger Berman Group LLC boosted its position in CorVel by 204.6% during the 4th quarter. Neuberger Berman Group LLC now owns 845,531 shares of the business services provider's stock valued at $94,074,000 after acquiring an additional 567,984 shares in the last quarter. Finally, Geode Capital Management LLC grew its holdings in shares of CorVel by 205.1% during the 4th quarter. Geode Capital Management LLC now owns 774,653 shares of the business services provider's stock worth $86,204,000 after acquiring an additional 520,783 shares during the period. Institutional investors own 51.36% of the company's stock.

Insiders Place Their Bets

In other news, EVP Mark E. Bertels sold 900 shares of CorVel stock in a transaction that occurred on Tuesday, May 27th. The shares were sold at an average price of $113.34, for a total transaction of $102,006.00. Following the completion of the transaction, the executive vice president directly owned 2,586 shares in the company, valued at approximately $293,097.24. This trade represents a 25.82% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CFO Brandon O'brien sold 3,957 shares of the business's stock in a transaction that occurred on Monday, June 9th. The stock was sold at an average price of $108.46, for a total value of $429,176.22. Following the completion of the sale, the chief financial officer directly owned 11,804 shares in the company, valued at approximately $1,280,261.84. This represents a 25.11% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 13,079 shares of company stock valued at $1,446,023. Insiders own 44.56% of the company's stock.

CorVel Trading Down 0.0%

CRVL traded down $0.04 during trading on Friday, reaching $85.52. The stock had a trading volume of 38,925 shares, compared to its average volume of 132,769. The company has a market capitalization of $4.40 billion, a price-to-earnings ratio of 44.08 and a beta of 0.95. The stock's 50 day moving average is $99.44 and its two-hundred day moving average is $107.86. CorVel Corp. has a one year low of $85.13 and a one year high of $128.61.

CorVel (NASDAQ:CRVL - Get Free Report) last released its earnings results on Tuesday, August 5th. The business services provider reported $0.52 earnings per share for the quarter. CorVel had a net margin of 10.98% and a return on equity of 33.40%.

Analysts Set New Price Targets

Separately, Wall Street Zen upgraded CorVel from a "hold" rating to a "buy" rating in a research note on Friday, April 18th.

Check Out Our Latest Stock Report on CorVel

CorVel Company Profile

(

Free Report)

CorVel Corporation provides workers' compensation, auto, liability, and health solutions. It applies technology, including artificial intelligence, machine learning, and natural language processing to enhance the managing of episodes of care and the related health care costs. The company also offers network solutions services, including automated medical fee auditing, preferred provider management and reimbursement, retrospective utilization review, facility claim review, professional review, pharmacy, directed care, clearinghouse, independent medical examination, and inpatient medical bill review services, as well as Medicare solutions.

Featured Articles

Before you consider CorVel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CorVel wasn't on the list.

While CorVel currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.