Cantor Fitzgerald Investment Advisors L.P. decreased its stake in shares of Costco Wholesale Corporation (NASDAQ:COST - Free Report) by 26.0% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,138 shares of the retailer's stock after selling 752 shares during the quarter. Cantor Fitzgerald Investment Advisors L.P.'s holdings in Costco Wholesale were worth $2,022,000 at the end of the most recent reporting period.

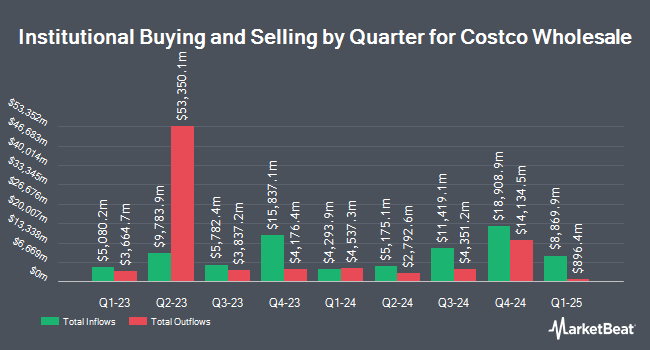

Other hedge funds have also bought and sold shares of the company. Proathlete Wealth Management LLC acquired a new stake in shares of Costco Wholesale in the first quarter worth $121,000. Abundance Wealth Counselors increased its stake in shares of Costco Wholesale by 8.7% in the first quarter. Abundance Wealth Counselors now owns 1,828 shares of the retailer's stock worth $1,729,000 after acquiring an additional 147 shares during the period. Investment Research & Advisory Group Inc. increased its stake in shares of Costco Wholesale by 3.0% in the first quarter. Investment Research & Advisory Group Inc. now owns 4,590 shares of the retailer's stock worth $4,341,000 after acquiring an additional 134 shares during the period. Walter & Keenan Wealth Management LLC IN ADV increased its stake in shares of Costco Wholesale by 3.1% in the first quarter. Walter & Keenan Wealth Management LLC IN ADV now owns 2,489 shares of the retailer's stock worth $2,354,000 after acquiring an additional 74 shares during the period. Finally, Trifecta Capital Advisors LLC increased its stake in shares of Costco Wholesale by 0.4% in the first quarter. Trifecta Capital Advisors LLC now owns 15,607 shares of the retailer's stock worth $14,761,000 after acquiring an additional 68 shares during the period. Institutional investors and hedge funds own 68.48% of the company's stock.

Costco Wholesale Stock Performance

NASDAQ:COST opened at $980.29 on Friday. The company's 50-day moving average price is $1,002.94 and its 200-day moving average price is $981.10. The company has a current ratio of 1.02, a quick ratio of 0.52 and a debt-to-equity ratio of 0.21. The company has a market cap of $434.74 billion, a P/E ratio of 55.60, a P/E/G ratio of 5.76 and a beta of 1.00. Costco Wholesale Corporation has a twelve month low of $793.00 and a twelve month high of $1,078.24.

Costco Wholesale (NASDAQ:COST - Get Free Report) last posted its quarterly earnings results on Thursday, May 29th. The retailer reported $4.28 earnings per share for the quarter, topping the consensus estimate of $4.24 by $0.04. The firm had revenue of $63.21 billion for the quarter, compared to the consensus estimate of $62.93 billion. Costco Wholesale had a net margin of 2.92% and a return on equity of 30.48%. The company's revenue for the quarter was up 8.0% on a year-over-year basis. During the same period last year, the firm posted $3.78 earnings per share. On average, sell-side analysts forecast that Costco Wholesale Corporation will post 18.03 earnings per share for the current fiscal year.

Costco Wholesale Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, May 16th. Stockholders of record on Friday, May 2nd were paid a $1.30 dividend. This is an increase from Costco Wholesale's previous quarterly dividend of $1.16. This represents a $5.20 annualized dividend and a dividend yield of 0.53%. The ex-dividend date was Friday, May 2nd. Costco Wholesale's dividend payout ratio (DPR) is currently 29.50%.

Insider Transactions at Costco Wholesale

In other Costco Wholesale news, Director Susan L. Decker sold 547 shares of Costco Wholesale stock in a transaction dated Wednesday, June 18th. The shares were sold at an average price of $980.00, for a total transaction of $536,060.00. Following the transaction, the director now directly owns 11,531 shares of the company's stock, valued at $11,300,380. The trade was a 4.53% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Claudine Adamo sold 900 shares of Costco Wholesale stock in a transaction dated Monday, March 24th. The stock was sold at an average price of $922.56, for a total transaction of $830,304.00. Following the transaction, the executive vice president now directly owns 6,987 shares in the company, valued at $6,445,926.72. This trade represents a 11.41% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 11,547 shares of company stock valued at $11,361,265. Corporate insiders own 0.18% of the company's stock.

Analysts Set New Price Targets

A number of analysts have recently weighed in on COST shares. Cfra Research upgraded shares of Costco Wholesale from a "hold" rating to a "moderate buy" rating in a research note on Friday, April 4th. Barclays increased their price objective on shares of Costco Wholesale from $940.00 to $980.00 and gave the stock an "equal weight" rating in a research note on Monday, March 10th. Loop Capital cut their price objective on shares of Costco Wholesale from $1,115.00 to $1,110.00 and set a "buy" rating on the stock in a research note on Thursday, May 29th. Telsey Advisory Group restated an "outperform" rating and set a $1,100.00 price target on shares of Costco Wholesale in a research report on Tuesday, June 3rd. Finally, Cowen restated a "buy" rating on shares of Costco Wholesale in a research report on Friday, March 7th. Nine equities research analysts have rated the stock with a hold rating and twenty-one have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $1,034.79.

Check Out Our Latest Research Report on COST

Costco Wholesale Company Profile

(

Free Report)

Costco Wholesale Corporation, together with its subsidiaries, engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden. The company offers branded and private-label products in a range of merchandise categories.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Costco Wholesale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Costco Wholesale wasn't on the list.

While Costco Wholesale currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report