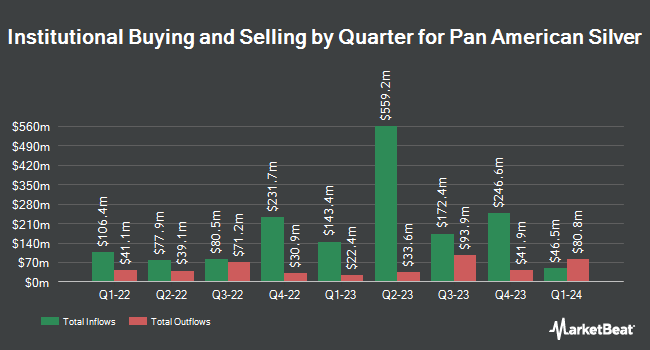

Counterpoint Mutual Funds LLC bought a new position in Pan American Silver Corp. (NYSE:PAAS - Free Report) TSE: PAAS during the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm bought 25,915 shares of the basic materials company's stock, valued at approximately $736,000.

A number of other large investors have also recently bought and sold shares of the business. Graybill Wealth Management LTD. acquired a new stake in shares of Pan American Silver in the first quarter valued at approximately $33,000. Farther Finance Advisors LLC increased its stake in shares of Pan American Silver by 39.8% in the first quarter. Farther Finance Advisors LLC now owns 2,720 shares of the basic materials company's stock valued at $70,000 after purchasing an additional 775 shares during the period. Whittier Trust Co. of Nevada Inc. increased its stake in shares of Pan American Silver by 507.3% in the first quarter. Whittier Trust Co. of Nevada Inc. now owns 4,500 shares of the basic materials company's stock valued at $116,000 after purchasing an additional 3,759 shares during the period. Banque Transatlantique SA bought a new stake in Pan American Silver during the first quarter worth approximately $139,000. Finally, Rossby Financial LCC bought a new stake in Pan American Silver during the first quarter worth approximately $151,000. Institutional investors own 55.43% of the company's stock.

Pan American Silver Trading Up 2.3%

Pan American Silver stock opened at $37.30 on Tuesday. Pan American Silver Corp. has a 12 month low of $19.80 and a 12 month high of $38.16. The company has a quick ratio of 2.11, a current ratio of 3.05 and a debt-to-equity ratio of 0.15. The stock has a market cap of $15.74 billion, a P/E ratio of 25.72, a P/E/G ratio of 0.59 and a beta of 0.64. The company's fifty day simple moving average is $32.06 and its 200-day simple moving average is $28.23.

Pan American Silver (NYSE:PAAS - Get Free Report) TSE: PAAS last released its quarterly earnings data on Wednesday, August 6th. The basic materials company reported $0.43 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.40 by $0.03. Pan American Silver had a return on equity of 11.49% and a net margin of 16.80%.The firm had revenue of $811.90 million during the quarter, compared to analysts' expectations of $782.12 million. During the same quarter last year, the firm earned $0.11 earnings per share. The business's revenue for the quarter was up 18.3% on a year-over-year basis. As a group, sell-side analysts forecast that Pan American Silver Corp. will post 1.26 EPS for the current fiscal year.

Pan American Silver Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, August 29th. Investors of record on Monday, August 18th were issued a $0.12 dividend. This is an increase from Pan American Silver's previous quarterly dividend of $0.10. This represents a $0.48 dividend on an annualized basis and a yield of 1.3%. The ex-dividend date was Monday, August 18th. Pan American Silver's dividend payout ratio is currently 33.10%.

Wall Street Analyst Weigh In

Several equities research analysts recently commented on PAAS shares. Scotiabank dropped their target price on Pan American Silver from $36.50 to $36.00 and set an "outperform" rating on the stock in a report on Friday, September 5th. Zacks Research cut Pan American Silver from a "strong-buy" rating to a "hold" rating in a report on Tuesday, August 19th. CIBC reissued an "outperform" rating on shares of Pan American Silver in a report on Tuesday, July 15th. National Bank Financial raised Pan American Silver to a "strong-buy" rating in a report on Thursday, September 4th. Finally, National Bankshares reissued an "outperform" rating on shares of Pan American Silver in a report on Friday, September 5th. One equities research analyst has rated the stock with a Strong Buy rating, four have given a Buy rating and four have assigned a Hold rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $32.20.

Check Out Our Latest Report on PAAS

About Pan American Silver

(

Free Report)

Pan American Silver Corp. engages in the exploration, mine development, extraction, processing, refining, and reclamation of silver, gold, zinc, lead, and copper mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. The company was formerly known as Pan American Minerals Corp. and changed its name to Pan American Silver Corp.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pan American Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pan American Silver wasn't on the list.

While Pan American Silver currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.