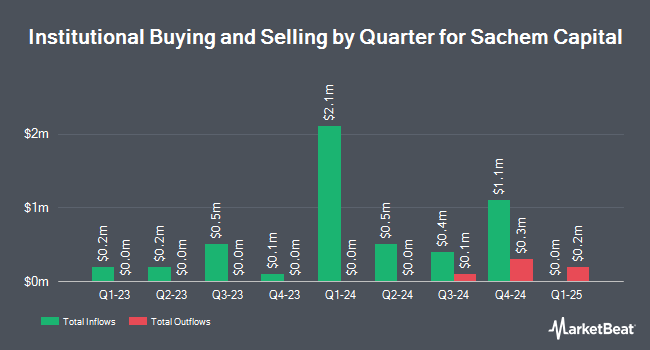

Cox Capital Mgt LLC boosted its position in shares of Sachem Capital Corp. (NYSEAMERICAN:SACH - Free Report) by 93.2% during the 2nd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 1,122,368 shares of the company's stock after buying an additional 541,301 shares during the quarter. Cox Capital Mgt LLC owned approximately 2.37% of Sachem Capital worth $1,347,000 at the end of the most recent reporting period.

A number of other large investors have also modified their holdings of SACH. US Financial Advisors LLC grew its position in shares of Sachem Capital by 4.1% during the 1st quarter. US Financial Advisors LLC now owns 451,570 shares of the company's stock valued at $524,000 after acquiring an additional 17,677 shares during the period. Vident Advisory LLC purchased a new position in Sachem Capital during the fourth quarter worth approximately $119,000. Finally, Jane Street Group LLC grew its holdings in Sachem Capital by 193.8% in the first quarter. Jane Street Group LLC now owns 47,393 shares of the company's stock valued at $55,000 after purchasing an additional 31,260 shares during the period. Institutional investors and hedge funds own 18.07% of the company's stock.

Analyst Ratings Changes

SACH has been the subject of several research analyst reports. JMP Securities reaffirmed a "market perform" rating on shares of Sachem Capital in a research note on Wednesday, July 9th. Oppenheimer reduced their price objective on shares of Sachem Capital from $2.50 to $2.00 and set an "outperform" rating for the company in a research report on Friday, September 19th. Finally, Citigroup reaffirmed a "market perform" rating on shares of Sachem Capital in a report on Wednesday, July 9th. One research analyst has rated the stock with a Buy rating and four have issued a Hold rating to the company. According to data from MarketBeat.com, Sachem Capital presently has a consensus rating of "Hold" and a consensus target price of $1.75.

View Our Latest Stock Analysis on Sachem Capital

Sachem Capital Price Performance

SACH stock opened at $1.07 on Friday. The business's 50-day moving average is $1.19 and its two-hundred day moving average is $1.12. The company has a debt-to-equity ratio of 0.09, a current ratio of 1.54 and a quick ratio of 1.54. The firm has a market capitalization of $50.65 million, a P/E ratio of -1.19, a P/E/G ratio of 0.59 and a beta of 1.10. Sachem Capital Corp. has a 1 year low of $0.80 and a 1 year high of $2.64.

Sachem Capital Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Monday, September 15th will be issued a dividend of $0.05 per share. This represents a $0.20 annualized dividend and a yield of 18.7%. The ex-dividend date is Monday, September 15th. Sachem Capital's payout ratio is -105.26%.

About Sachem Capital

(

Free Report)

Sachem Capital Corp. operates as a real estate finance company in the United States. The company engages in the originating, underwriting, funding, servicing, and managing a portfolio of short-term loans secured by first mortgage liens on real property. It offers short term loans to real estate investors or developers to fund its acquisition, renovation, rehabilitation, development, and/or improvement of residential or commercial properties.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sachem Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sachem Capital wasn't on the list.

While Sachem Capital currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.