CreativeOne Wealth LLC increased its holdings in shares of Axon Enterprise, Inc (NASDAQ:AXON - Free Report) by 9.9% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 4,748 shares of the biotechnology company's stock after acquiring an additional 429 shares during the quarter. CreativeOne Wealth LLC's holdings in Axon Enterprise were worth $2,497,000 at the end of the most recent quarter.

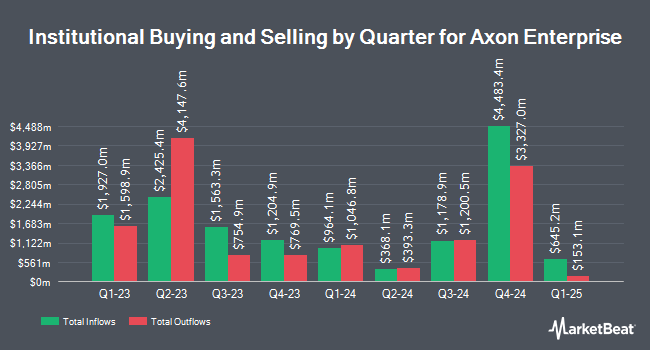

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Kentucky Retirement Systems Insurance Trust Fund acquired a new stake in shares of Axon Enterprise in the first quarter valued at approximately $1,110,000. Quotient Wealth Partners LLC acquired a new stake in shares of Axon Enterprise in the first quarter valued at approximately $438,000. CX Institutional acquired a new stake in shares of Axon Enterprise in the first quarter valued at approximately $115,000. GAMMA Investing LLC increased its stake in shares of Axon Enterprise by 11.8% in the first quarter. GAMMA Investing LLC now owns 1,454 shares of the biotechnology company's stock valued at $765,000 after purchasing an additional 154 shares during the period. Finally, DAVENPORT & Co LLC increased its stake in shares of Axon Enterprise by 5.1% in the first quarter. DAVENPORT & Co LLC now owns 940 shares of the biotechnology company's stock valued at $494,000 after purchasing an additional 46 shares during the period. Institutional investors and hedge funds own 79.08% of the company's stock.

Axon Enterprise Trading Down 0.8%

Axon Enterprise stock traded down $6.15 during midday trading on Tuesday, reaching $741.14. The stock had a trading volume of 302,829 shares, compared to its average volume of 695,551. The firm's fifty day simple moving average is $771.42 and its two-hundred day simple moving average is $677.75. Axon Enterprise, Inc has a twelve month low of $346.71 and a twelve month high of $885.91. The company has a debt-to-equity ratio of 0.63, a current ratio of 2.95 and a quick ratio of 2.71. The firm has a market cap of $58.18 billion, a price-to-earnings ratio of 183.00, a PEG ratio of 27.43 and a beta of 1.40.

Axon Enterprise (NASDAQ:AXON - Get Free Report) last posted its quarterly earnings data on Monday, August 4th. The biotechnology company reported $2.12 EPS for the quarter, topping analysts' consensus estimates of $1.54 by $0.58. Axon Enterprise had a net margin of 13.64% and a return on equity of 6.80%. The firm had revenue of $668.54 million during the quarter, compared to analyst estimates of $641.77 million. During the same quarter last year, the business posted $1.20 EPS. The company's revenue was up 32.6% on a year-over-year basis. Axon Enterprise has set its FY 2025 guidance at EPS. Equities analysts anticipate that Axon Enterprise, Inc will post 5.8 EPS for the current fiscal year.

Insider Buying and Selling at Axon Enterprise

In other news, insider Jeffrey C. Kunins sold 7,891 shares of the business's stock in a transaction on Thursday, August 14th. The shares were sold at an average price of $750.10, for a total transaction of $5,919,039.10. Following the transaction, the insider directly owned 144,538 shares in the company, valued at $108,417,953.80. The trade was a 5.18% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Hadi Partovi acquired 1,358 shares of Axon Enterprise stock in a transaction that occurred on Wednesday, August 13th. The stock was acquired at an average cost of $740.00 per share, with a total value of $1,004,920.00. Following the purchase, the director owned 237,938 shares in the company, valued at $176,074,120. The trade was a 0.57% increase in their position. The disclosure for this purchase can be found here. Insiders sold a total of 40,703 shares of company stock worth $31,366,051 over the last 90 days. 5.70% of the stock is currently owned by insiders.

Analysts Set New Price Targets

Several equities research analysts have commented on AXON shares. JMP Securities raised their price target on shares of Axon Enterprise from $725.00 to $825.00 and gave the company a "market outperform" rating in a research note on Tuesday, July 22nd. Wolfe Research initiated coverage on shares of Axon Enterprise in a research note on Monday, July 7th. They issued an "outperform" rating on the stock. Morgan Stanley set a $885.00 price objective on shares of Axon Enterprise and gave the company an "overweight" rating in a research note on Friday, July 11th. Craig Hallum upgraded shares of Axon Enterprise from a "hold" rating to a "buy" rating and set a $900.00 price objective on the stock in a research note on Tuesday, August 5th. Finally, Needham & Company LLC set a $870.00 price objective on shares of Axon Enterprise and gave the company a "buy" rating in a research note on Tuesday, August 5th. Thirteen research analysts have rated the stock with a Buy rating and two have issued a Hold rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $837.69.

Check Out Our Latest Research Report on Axon Enterprise

Axon Enterprise Profile

(

Free Report)

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

See Also

Before you consider Axon Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axon Enterprise wasn't on the list.

While Axon Enterprise currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.