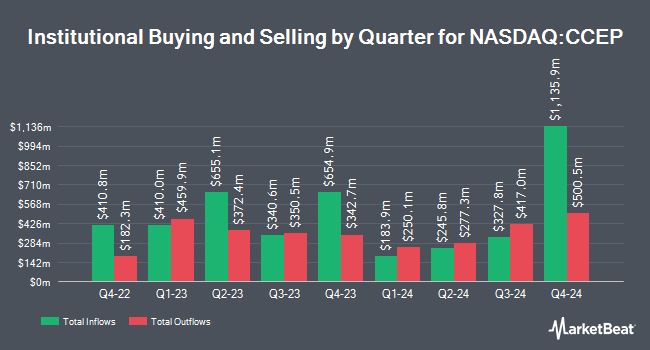

Credit Agricole S A grew its position in Coca-Cola Europacific Partners (NASDAQ:CCEP - Free Report) by 296.8% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 225,410 shares of the company's stock after acquiring an additional 168,606 shares during the quarter. Credit Agricole S A's holdings in Coca-Cola Europacific Partners were worth $19,617,000 at the end of the most recent reporting period.

A number of other institutional investors have also modified their holdings of CCEP. Vanguard Group Inc. grew its position in Coca-Cola Europacific Partners by 462.7% during the 1st quarter. Vanguard Group Inc. now owns 9,883,600 shares of the company's stock worth $862,167,000 after purchasing an additional 8,126,996 shares during the last quarter. Nuveen LLC acquired a new position in Coca-Cola Europacific Partners in the 1st quarter valued at about $162,036,000. Sumitomo Mitsui Trust Group Inc. raised its stake in Coca-Cola Europacific Partners by 253.8% during the 1st quarter. Sumitomo Mitsui Trust Group Inc. now owns 1,948,024 shares of the company's stock valued at $169,537,000 after acquiring an additional 1,397,394 shares during the last quarter. Goldman Sachs Group Inc. raised its stake in Coca-Cola Europacific Partners by 24.3% during the 1st quarter. Goldman Sachs Group Inc. now owns 6,205,337 shares of the company's stock valued at $540,050,000 after acquiring an additional 1,214,493 shares during the last quarter. Finally, Jane Street Group LLC lifted its position in Coca-Cola Europacific Partners by 842.4% during the 4th quarter. Jane Street Group LLC now owns 714,988 shares of the company's stock worth $54,918,000 after acquiring an additional 639,119 shares during the period. 31.35% of the stock is owned by institutional investors and hedge funds.

Coca-Cola Europacific Partners Price Performance

NASDAQ CCEP traded down $0.85 during mid-day trading on Friday, hitting $90.34. The stock had a trading volume of 1,827,265 shares, compared to its average volume of 1,919,257. The company has a 50 day simple moving average of $94.63 and a 200 day simple moving average of $89.73. The company has a market cap of $41.64 billion, a price-to-earnings ratio of 18.59, a P/E/G ratio of 2.62 and a beta of 0.75. Coca-Cola Europacific Partners has a 52-week low of $73.40 and a 52-week high of $100.67. The company has a quick ratio of 0.65, a current ratio of 0.83 and a debt-to-equity ratio of 1.15.

Wall Street Analyst Weigh In

Several equities research analysts have recently commented on CCEP shares. Deutsche Bank Aktiengesellschaft restated a "buy" rating on shares of Coca-Cola Europacific Partners in a research note on Friday, August 8th. UBS Group raised their target price on shares of Coca-Cola Europacific Partners from $100.00 to $105.00 and gave the stock a "buy" rating in a research note on Wednesday, July 2nd. Wall Street Zen cut shares of Coca-Cola Europacific Partners from a "buy" rating to a "hold" rating in a report on Saturday, July 5th. Barclays cut their target price on Coca-Cola Europacific Partners from $104.00 to $103.00 and set an "overweight" rating for the company in a research note on Friday, August 8th. Finally, Morgan Stanley downgraded Coca-Cola Europacific Partners from an "overweight" rating to an "equal weight" rating in a research note on Thursday, August 7th. One analyst has rated the stock with a Strong Buy rating, four have assigned a Buy rating, four have assigned a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $90.43.

Check Out Our Latest Stock Analysis on Coca-Cola Europacific Partners

About Coca-Cola Europacific Partners

(

Free Report)

Coca-Cola Europacific Partners PLC, together with its subsidiaries, produces, distributes, and sells a range of non-alcoholic ready to drink beverages. It offers flavours, mixers, and energy drinks; soft drinks, waters, enhanced water, and isotonic drinks; and ready-to-drink tea and coffee, juices, and other drinks.

Further Reading

Before you consider Coca-Cola Europacific Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola Europacific Partners wasn't on the list.

While Coca-Cola Europacific Partners currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.