Credit Agricole S A raised its holdings in shares of Howmet Aerospace Inc. (NYSE:HWM - Free Report) by 16.4% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 179,731 shares of the company's stock after acquiring an additional 25,268 shares during the quarter. Credit Agricole S A's holdings in Howmet Aerospace were worth $23,317,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

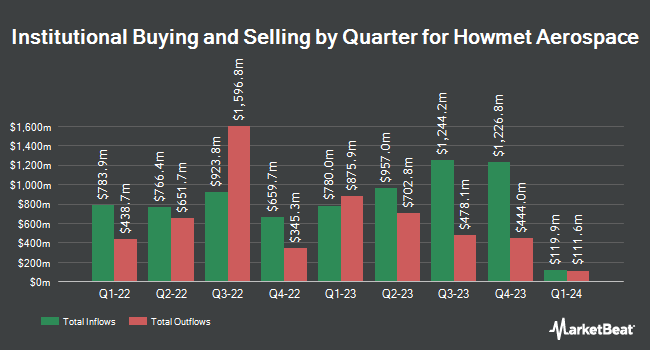

A number of other hedge funds and other institutional investors have also bought and sold shares of HWM. Brighton Jones LLC raised its holdings in Howmet Aerospace by 5.4% during the 4th quarter. Brighton Jones LLC now owns 2,548 shares of the company's stock valued at $279,000 after acquiring an additional 130 shares during the period. Townsquare Capital LLC grew its position in shares of Howmet Aerospace by 6.7% during the 4th quarter. Townsquare Capital LLC now owns 3,108 shares of the company's stock valued at $340,000 after purchasing an additional 195 shares in the last quarter. GeoWealth Management LLC grew its position in shares of Howmet Aerospace by 13.1% during the 4th quarter. GeoWealth Management LLC now owns 1,171 shares of the company's stock valued at $128,000 after purchasing an additional 136 shares in the last quarter. MML Investors Services LLC grew its position in shares of Howmet Aerospace by 22.9% during the 4th quarter. MML Investors Services LLC now owns 46,073 shares of the company's stock valued at $5,039,000 after purchasing an additional 8,576 shares in the last quarter. Finally, Tower Research Capital LLC TRC grew its position in shares of Howmet Aerospace by 183.2% during the 4th quarter. Tower Research Capital LLC TRC now owns 27,640 shares of the company's stock valued at $3,023,000 after purchasing an additional 17,879 shares in the last quarter. Institutional investors own 90.46% of the company's stock.

Analyst Ratings Changes

A number of research analysts have recently commented on HWM shares. JPMorgan Chase & Co. boosted their price target on shares of Howmet Aerospace from $150.00 to $190.00 and gave the company an "overweight" rating in a research report on Monday, August 4th. BTIG Research set a $205.00 price target on shares of Howmet Aerospace and gave the company a "buy" rating in a research report on Monday, August 4th. Wells Fargo & Company boosted their price target on shares of Howmet Aerospace from $118.00 to $145.00 and gave the company an "equal weight" rating in a research report on Friday, May 2nd. Vertical Research reiterated a "buy" rating on shares of Howmet Aerospace in a research report on Thursday, July 31st. Finally, Royal Bank Of Canada reiterated an "outperform" rating on shares of Howmet Aerospace in a research report on Monday, June 30th. Fourteen research analysts have rated the stock with a Buy rating and four have issued a Hold rating to the company. According to MarketBeat, Howmet Aerospace has an average rating of "Moderate Buy" and a consensus target price of $172.13.

Read Our Latest Stock Report on Howmet Aerospace

Howmet Aerospace Trading Down 1.4%

NYSE HWM traded down $2.4540 during trading on Friday, hitting $170.7960. 2,995,686 shares of the company's stock traded hands, compared to its average volume of 2,800,806. The stock has a fifty day moving average of $179.96 and a two-hundred day moving average of $154.41. The company has a debt-to-equity ratio of 0.65, a current ratio of 2.31 and a quick ratio of 1.08. Howmet Aerospace Inc. has a 12-month low of $90.71 and a 12-month high of $193.26. The firm has a market cap of $68.85 billion, a P/E ratio of 49.94, a PEG ratio of 2.24 and a beta of 1.48.

Howmet Aerospace (NYSE:HWM - Get Free Report) last posted its quarterly earnings results on Thursday, July 31st. The company reported $0.91 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.87 by $0.04. Howmet Aerospace had a net margin of 18.09% and a return on equity of 28.17%. The business had revenue of $2.05 billion during the quarter, compared to analyst estimates of $1.99 billion. During the same period in the prior year, the business posted $0.67 earnings per share. The company's revenue was up 9.2% on a year-over-year basis. Howmet Aerospace has set its Q3 2025 guidance at 0.890-0.910 EPS. FY 2025 guidance at 3.560-3.640 EPS. As a group, sell-side analysts expect that Howmet Aerospace Inc. will post 3.27 EPS for the current year.

Howmet Aerospace Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, August 25th. Stockholders of record on Friday, August 8th will be paid a dividend of $0.12 per share. This represents a $0.48 annualized dividend and a dividend yield of 0.3%. This is a positive change from Howmet Aerospace's previous quarterly dividend of $0.10. The ex-dividend date of this dividend is Friday, August 8th. Howmet Aerospace's payout ratio is currently 14.04%.

Howmet Aerospace Profile

(

Free Report)

Howmet Aerospace Inc provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally. It operates through four segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels.

See Also

Before you consider Howmet Aerospace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Howmet Aerospace wasn't on the list.

While Howmet Aerospace currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.