Crew Capital Management Ltd. reduced its position in shares of AutoZone, Inc. (NYSE:AZO - Free Report) by 38.2% in the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 243 shares of the company's stock after selling 150 shares during the quarter. Crew Capital Management Ltd.'s holdings in AutoZone were worth $902,000 as of its most recent filing with the Securities and Exchange Commission.

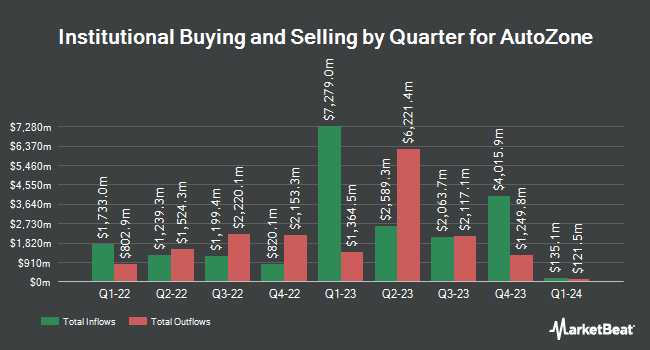

Other institutional investors also recently modified their holdings of the company. Blue Trust Inc. grew its position in shares of AutoZone by 3.5% during the 1st quarter. Blue Trust Inc. now owns 89 shares of the company's stock worth $339,000 after buying an additional 3 shares during the period. Hudson Valley Investment Advisors Inc. ADV grew its position in shares of AutoZone by 10.1% during the 1st quarter. Hudson Valley Investment Advisors Inc. ADV now owns 2,954 shares of the company's stock worth $11,267,000 after buying an additional 271 shares during the period. Kirr Marbach & Co. LLC IN grew its position in shares of AutoZone by 0.9% during the 1st quarter. Kirr Marbach & Co. LLC IN now owns 7,761 shares of the company's stock worth $29,591,000 after buying an additional 68 shares during the period. Banco Santander S.A. grew its position in shares of AutoZone by 98.3% during the 1st quarter. Banco Santander S.A. now owns 829 shares of the company's stock worth $3,161,000 after buying an additional 411 shares during the period. Finally, Alpine Bank Wealth Management acquired a new position in shares of AutoZone during the 1st quarter worth about $545,000. 92.74% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In other news, VP Richard Craig Smith sold 3,000 shares of the company's stock in a transaction that occurred on Thursday, July 24th. The stock was sold at an average price of $3,875.90, for a total transaction of $11,627,700.00. Following the sale, the vice president owned 2,925 shares in the company, valued at $11,337,007.50. This represents a 50.63% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this link. 2.10% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

Several equities analysts have recently issued reports on the company. BMO Capital Markets restated an "outperform" rating and set a $4,100.00 target price (up from $3,850.00) on shares of AutoZone in a research report on Wednesday, May 28th. UBS Group boosted their target price on AutoZone from $4,260.00 to $4,925.00 and gave the stock a "buy" rating in a research report on Thursday, September 11th. Wells Fargo & Company boosted their target price on AutoZone from $4,200.00 to $4,800.00 and gave the stock an "overweight" rating in a research report on Monday, September 15th. Truist Financial boosted their price objective on AutoZone from $4,038.00 to $4,504.00 and gave the company a "buy" rating in a research report on Wednesday, September 17th. Finally, Roth Capital boosted their price objective on AutoZone from $4,135.00 to $4,800.00 and gave the company a "buy" rating in a research report on Friday. Three analysts have rated the stock with a Strong Buy rating, twenty have issued a Buy rating and two have assigned a Hold rating to the company. According to MarketBeat, the stock has a consensus rating of "Buy" and a consensus price target of $4,449.18.

View Our Latest Report on AZO

AutoZone Stock Down 0.6%

Shares of AutoZone stock opened at $4,115.07 on Tuesday. AutoZone, Inc. has a 12-month low of $2,898.57 and a 12-month high of $4,388.11. The stock has a market cap of $69.05 billion, a P/E ratio of 27.85, a P/E/G ratio of 2.29 and a beta of 0.41. The business's 50 day moving average is $4,041.27 and its 200-day moving average is $3,805.01.

AutoZone Company Profile

(

Free Report)

AutoZone, Inc retails and distributes automotive replacement parts and accessories in the United States, Mexico, and Brazil. The company provides various products for cars, sport utility vehicles, vans, and light trucks, including new and remanufactured automotive hard parts, maintenance items, accessories, and non-automotive products.

Featured Stories

Want to see what other hedge funds are holding AZO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for AutoZone, Inc. (NYSE:AZO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AutoZone, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AutoZone wasn't on the list.

While AutoZone currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.