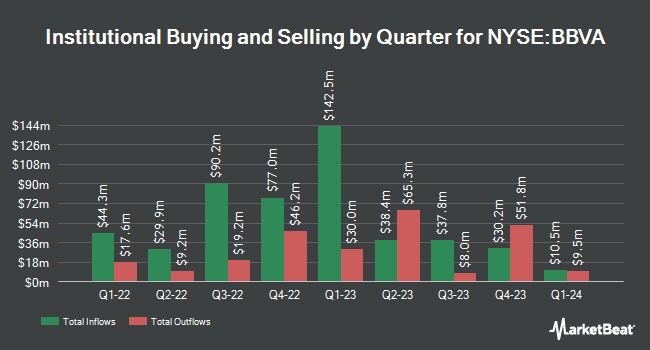

CSS LLC IL acquired a new position in Banco Bilbao Vizcaya Argentaria, S.A. (NYSE:BBVA - Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 35,160 shares of the bank's stock, valued at approximately $342,000.

Several other institutional investors have also recently bought and sold shares of BBVA. Symmetry Investments LP acquired a new position in Banco Bilbao Vizcaya Argentaria during the fourth quarter worth $27,647,000. Northern Trust Corp lifted its holdings in Banco Bilbao Vizcaya Argentaria by 48.6% during the 4th quarter. Northern Trust Corp now owns 7,418,877 shares of the bank's stock valued at $72,111,000 after purchasing an additional 2,424,880 shares during the last quarter. Millennium Management LLC boosted its position in Banco Bilbao Vizcaya Argentaria by 514.5% in the fourth quarter. Millennium Management LLC now owns 951,350 shares of the bank's stock valued at $9,247,000 after buying an additional 796,526 shares in the last quarter. Raymond James Financial Inc. bought a new stake in Banco Bilbao Vizcaya Argentaria during the fourth quarter worth about $7,333,000. Finally, Bank of America Corp DE raised its holdings in shares of Banco Bilbao Vizcaya Argentaria by 13.7% in the fourth quarter. Bank of America Corp DE now owns 5,108,410 shares of the bank's stock valued at $49,654,000 after buying an additional 613,563 shares during the last quarter. Institutional investors own 2.96% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have issued reports on the stock. Kepler Capital Markets upgraded shares of Banco Bilbao Vizcaya Argentaria from a "reduce" rating to a "hold" rating in a research report on Thursday, February 27th. Wall Street Zen upgraded Banco Bilbao Vizcaya Argentaria from a "hold" rating to a "buy" rating in a report on Saturday, May 17th. Finally, Hsbc Global Res upgraded shares of Banco Bilbao Vizcaya Argentaria from a "hold" rating to a "strong-buy" rating in a report on Friday, January 31st. One investment analyst has rated the stock with a sell rating, one has issued a hold rating, one has assigned a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, Banco Bilbao Vizcaya Argentaria presently has an average rating of "Moderate Buy".

View Our Latest Analysis on Banco Bilbao Vizcaya Argentaria

Banco Bilbao Vizcaya Argentaria Trading Down 2.9%

NYSE BBVA traded down $0.45 during trading hours on Wednesday, hitting $14.98. 709,840 shares of the company's stock were exchanged, compared to its average volume of 1,780,689. The stock has a 50-day simple moving average of $13.95 and a 200 day simple moving average of $12.14. The firm has a market cap of $87.42 billion, a price-to-earnings ratio of 8.27, a PEG ratio of 0.80 and a beta of 1.05. The company has a current ratio of 1.01, a quick ratio of 0.27 and a debt-to-equity ratio of 1.16. Banco Bilbao Vizcaya Argentaria, S.A. has a 1-year low of $9.23 and a 1-year high of $15.66.

Banco Bilbao Vizcaya Argentaria (NYSE:BBVA - Get Free Report) last issued its quarterly earnings data on Tuesday, April 29th. The bank reported $0.47 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.47. The business had revenue of $10.61 billion during the quarter, compared to the consensus estimate of $9.12 billion. Banco Bilbao Vizcaya Argentaria had a net margin of 28.10% and a return on equity of 17.49%. On average, equities analysts forecast that Banco Bilbao Vizcaya Argentaria, S.A. will post 1.59 EPS for the current fiscal year.

Banco Bilbao Vizcaya Argentaria Increases Dividend

The firm also recently declared a semi-annual dividend, which was paid on Friday, April 25th. Shareholders of record on Wednesday, April 9th were given a dividend of $0.4439 per share. This is a boost from Banco Bilbao Vizcaya Argentaria's previous semi-annual dividend of $0.11. This represents a yield of 4.3%. The ex-dividend date was Wednesday, April 9th. Banco Bilbao Vizcaya Argentaria's dividend payout ratio (DPR) is presently 39.15%.

Banco Bilbao Vizcaya Argentaria Company Profile

(

Free Report)

Banco Bilbao Vizcaya Argentaria, SA provides retail banking, wholesale banking, and asset management services in the United States, Spain, Mexico, Turkey, South America, and internationally. The company offers savings account, demand deposits, and time deposits; and loan products, such as residential mortgages, other households, credit card loans, loans to enterprises and public sector, as well as consumer finance.

Further Reading

Before you consider Banco Bilbao Vizcaya Argentaria, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banco Bilbao Vizcaya Argentaria wasn't on the list.

While Banco Bilbao Vizcaya Argentaria currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.