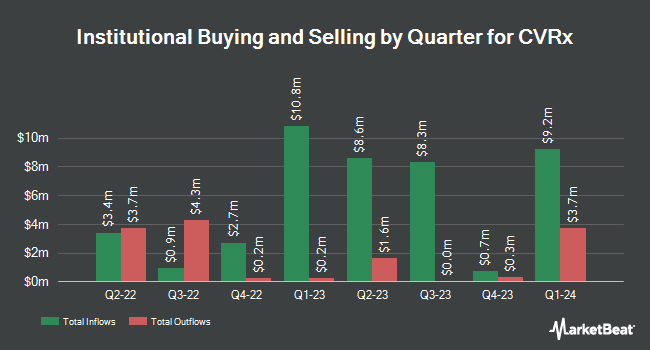

Parkman Healthcare Partners LLC lifted its stake in CVRx, Inc. (NASDAQ:CVRX - Free Report) by 33.5% in the first quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 1,229,522 shares of the company's stock after purchasing an additional 308,348 shares during the quarter. CVRx accounts for about 1.8% of Parkman Healthcare Partners LLC's investment portfolio, making the stock its 19th largest holding. Parkman Healthcare Partners LLC owned 4.72% of CVRx worth $15,037,000 as of its most recent filing with the Securities & Exchange Commission.

Several other institutional investors and hedge funds have also recently bought and sold shares of CVRX. Cubist Systematic Strategies LLC boosted its holdings in shares of CVRx by 48.1% in the first quarter. Cubist Systematic Strategies LLC now owns 59,105 shares of the company's stock worth $723,000 after buying an additional 19,183 shares during the period. AlphaQuest LLC lifted its position in shares of CVRx by 725.4% in the 1st quarter. AlphaQuest LLC now owns 6,108 shares of the company's stock valued at $75,000 after acquiring an additional 5,368 shares in the last quarter. Lord Abbett & CO. LLC acquired a new position in CVRx in the 1st quarter worth approximately $4,852,000. Russell Investments Group Ltd. grew its position in CVRx by 70.1% during the 1st quarter. Russell Investments Group Ltd. now owns 61,133 shares of the company's stock worth $748,000 after purchasing an additional 25,194 shares in the last quarter. Finally, Informed Momentum Co LLC acquired a new stake in CVRx during the 1st quarter valued at $683,000. Institutional investors and hedge funds own 75.27% of the company's stock.

CVRx Stock Up 4.6%

CVRX traded up $0.36 during trading on Thursday, reaching $8.24. 149,440 shares of the stock traded hands, compared to its average volume of 309,851. The stock's 50-day simple moving average is $7.58 and its two-hundred day simple moving average is $8.07. The company has a debt-to-equity ratio of 0.85, a current ratio of 11.99 and a quick ratio of 10.78. CVRx, Inc. has a fifty-two week low of $4.30 and a fifty-two week high of $18.55. The stock has a market cap of $215.49 million, a price-to-earnings ratio of -3.92 and a beta of 1.26.

CVRx (NASDAQ:CVRX - Get Free Report) last posted its quarterly earnings results on Monday, August 4th. The company reported ($0.57) earnings per share for the quarter, missing analysts' consensus estimates of ($0.52) by ($0.05). The firm had revenue of $13.59 million for the quarter, compared to analysts' expectations of $13.22 million. CVRx had a negative return on equity of 79.31% and a negative net margin of 95.61%. CVRx has set its FY 2025 guidance at EPS. Q3 2025 guidance at EPS. As a group, equities research analysts expect that CVRx, Inc. will post -1.91 EPS for the current year.

Analysts Set New Price Targets

Several brokerages have recently commented on CVRX. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $11.00 target price on shares of CVRx in a research report on Tuesday, August 5th. William Blair upgraded CVRx to a "strong-buy" rating in a research report on Monday, July 7th. One research analyst has rated the stock with a Strong Buy rating, five have assigned a Buy rating and one has assigned a Sell rating to the company's stock. Based on data from MarketBeat.com, CVRx presently has an average rating of "Moderate Buy" and a consensus target price of $14.00.

Read Our Latest Stock Report on CVRx

About CVRx

(

Free Report)

CVRx, Inc, a commercial-stage medical device company, focuses on developing, manufacturing, and commercializing neuromodulation solutions for patients with cardiovascular diseases. The company offers Barostim, a neuromodulation device indicated to improve symptoms for patients with heart failure with reduced ejection fraction or systolic heart failure.

Featured Stories

Before you consider CVRx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CVRx wasn't on the list.

While CVRx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.