CW Advisors LLC boosted its holdings in shares of Avery Dennison Corporation (NYSE:AVY - Free Report) by 32.6% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 18,556 shares of the industrial products company's stock after buying an additional 4,565 shares during the period. CW Advisors LLC's holdings in Avery Dennison were worth $3,302,000 as of its most recent filing with the Securities and Exchange Commission.

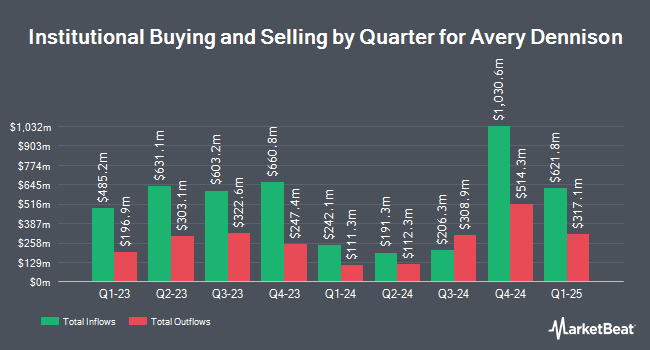

Several other large investors have also recently bought and sold shares of AVY. GAMMA Investing LLC raised its position in Avery Dennison by 19,370.0% during the first quarter. GAMMA Investing LLC now owns 428,730 shares of the industrial products company's stock valued at $76,301,000 after buying an additional 426,528 shares during the period. DAVENPORT & Co LLC raised its position in Avery Dennison by 905.0% during the first quarter. DAVENPORT & Co LLC now owns 324,095 shares of the industrial products company's stock valued at $57,503,000 after buying an additional 291,848 shares during the period. Vanguard Group Inc. raised its position in Avery Dennison by 2.9% during the first quarter. Vanguard Group Inc. now owns 9,959,263 shares of the industrial products company's stock valued at $1,772,450,000 after buying an additional 277,554 shares during the period. Nuveen LLC acquired a new position in Avery Dennison during the first quarter valued at $46,322,000. Finally, Ameriprise Financial Inc. raised its position in Avery Dennison by 12.9% during the fourth quarter. Ameriprise Financial Inc. now owns 2,185,732 shares of the industrial products company's stock valued at $409,014,000 after buying an additional 250,359 shares during the period. 94.17% of the stock is owned by institutional investors and hedge funds.

Avery Dennison Stock Performance

Avery Dennison stock traded up $0.37 during trading hours on Friday, hitting $171.45. The stock had a trading volume of 111,965 shares, compared to its average volume of 735,148. The company has a 50-day moving average of $176.29 and a two-hundred day moving average of $176.80. The company has a quick ratio of 0.70, a current ratio of 1.04 and a debt-to-equity ratio of 1.19. The company has a market cap of $13.37 billion, a PE ratio of 19.23, a price-to-earnings-growth ratio of 2.67 and a beta of 0.88. Avery Dennison Corporation has a fifty-two week low of $157.00 and a fifty-two week high of $224.38.

Avery Dennison (NYSE:AVY - Get Free Report) last posted its quarterly earnings results on Tuesday, July 22nd. The industrial products company reported $2.42 EPS for the quarter, beating the consensus estimate of $2.38 by $0.04. The firm had revenue of $2.22 billion during the quarter, compared to analysts' expectations of $2.23 billion. Avery Dennison had a return on equity of 33.14% and a net margin of 8.14%.The company's revenue for the quarter was down .7% on a year-over-year basis. During the same quarter in the prior year, the firm posted $2.42 EPS. Avery Dennison has set its Q3 2025 guidance at 2.240-2.40 EPS. On average, equities research analysts anticipate that Avery Dennison Corporation will post 9.96 EPS for the current fiscal year.

Avery Dennison Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, September 17th. Stockholders of record on Wednesday, September 3rd will be issued a $0.94 dividend. The ex-dividend date of this dividend is Wednesday, September 3rd. This represents a $3.76 dividend on an annualized basis and a dividend yield of 2.2%. Avery Dennison's dividend payout ratio is presently 42.20%.

Analysts Set New Price Targets

Several research analysts recently weighed in on the company. Citigroup upped their price target on Avery Dennison from $177.00 to $185.00 and gave the company a "neutral" rating in a research report on Friday, July 11th. Raymond James Financial upped their target price on Avery Dennison from $194.00 to $200.00 and gave the stock an "outperform" rating in a research report on Tuesday, July 15th. JPMorgan Chase & Co. upped their target price on Avery Dennison from $172.00 to $182.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 23rd. Wall Street Zen upgraded Avery Dennison from a "sell" rating to a "hold" rating in a research note on Thursday, May 22nd. Finally, Argus downgraded Avery Dennison from a "strong-buy" rating to a "hold" rating in a research note on Monday, May 12th. Six research analysts have rated the stock with a Buy rating and five have issued a Hold rating to the stock. According to data from MarketBeat, Avery Dennison currently has a consensus rating of "Moderate Buy" and a consensus target price of $197.60.

Check Out Our Latest Analysis on Avery Dennison

Avery Dennison Profile

(

Free Report)

Avery Dennison Corporation operates as a materials science and digital identification solutions company in the United States, Europe, the Middle East, North Africa, Asia, Latin, America, and internationally. It provides pressure-sensitive materials comprising papers, plastic films, metal foils, and fabrics; performance tapes products, including tapes for wire harnessing, as well as cable wrapping for automotive, electrical, and general industrial applications; mechanical fasteners, which are precision-extruded and injection-molded plastic devices used in various automotive, general industrial, and retail applications; and other pressure-sensitive adhesive-based materials and converted products under the Fasson, JAC, Yongle, and Avery Dennison brands.

Featured Articles

Before you consider Avery Dennison, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avery Dennison wasn't on the list.

While Avery Dennison currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.