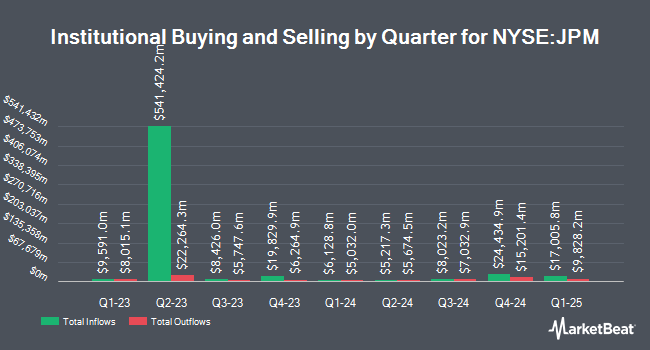

CW Advisors LLC lifted its position in JPMorgan Chase & Co. (NYSE:JPM - Free Report) by 25.6% in the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 242,757 shares of the financial services provider's stock after purchasing an additional 49,539 shares during the quarter. JPMorgan Chase & Co. makes up 0.7% of CW Advisors LLC's investment portfolio, making the stock its 23rd biggest holding. CW Advisors LLC's holdings in JPMorgan Chase & Co. were worth $59,610,000 at the end of the most recent quarter.

Other large investors have also recently made changes to their positions in the company. MJT & Associates Financial Advisory Group Inc. acquired a new stake in JPMorgan Chase & Co. during the 1st quarter worth approximately $28,000. University of Illinois Foundation acquired a new stake in JPMorgan Chase & Co. during the 1st quarter worth approximately $30,000. Curat Global LLC acquired a new stake in JPMorgan Chase & Co. during the 1st quarter worth approximately $33,000. Measured Risk Portfolios Inc. acquired a new stake in shares of JPMorgan Chase & Co. in the 4th quarter valued at approximately $44,000. Finally, Minot DeBlois Advisors LLC acquired a new stake in shares of JPMorgan Chase & Co. in the 4th quarter valued at approximately $54,000. 71.55% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several analysts have recently commented on JPM shares. Baird R W cut JPMorgan Chase & Co. from a "hold" rating to a "strong sell" rating in a report on Friday, June 27th. Phillip Securities downgraded JPMorgan Chase & Co. from a "moderate buy" rating to a "hold" rating in a research note on Wednesday, July 16th. Cowen reaffirmed a "buy" rating on shares of JPMorgan Chase & Co. in a research note on Wednesday, July 16th. Keefe, Bruyette & Woods raised their price target on JPMorgan Chase & Co. from $327.00 to $330.00 and gave the stock an "outperform" rating in a research report on Wednesday, July 16th. Finally, Wells Fargo & Company raised their price target on JPMorgan Chase & Co. from $320.00 to $325.00 and gave the stock an "overweight" rating in a research report on Wednesday, July 16th. One research analyst has rated the stock with a Strong Buy rating, thirteen have assigned a Buy rating, six have issued a Hold rating and three have given a Sell rating to the stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $288.68.

Get Our Latest Stock Report on JPM

Insiders Place Their Bets

In related news, COO Jennifer Piepszak sold 6,128 shares of the business's stock in a transaction dated Thursday, June 5th. The stock was sold at an average price of $262.47, for a total value of $1,608,416.16. Following the completion of the sale, the chief operating officer directly owned 62,455 shares of the company's stock, valued at $16,392,563.85. The trade was a 8.94% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 0.47% of the stock is currently owned by corporate insiders.

JPMorgan Chase & Co. Trading Down 0.4%

NYSE:JPM opened at $291.0580 on Friday. The company has a debt-to-equity ratio of 1.25, a quick ratio of 0.88 and a current ratio of 0.88. JPMorgan Chase & Co. has a one year low of $200.61 and a one year high of $301.29. The business's 50-day simple moving average is $288.29 and its 200 day simple moving average is $264.27. The stock has a market cap of $800.34 billion, a price-to-earnings ratio of 14.93, a price-to-earnings-growth ratio of 1.94 and a beta of 1.11.

JPMorgan Chase & Co. (NYSE:JPM - Get Free Report) last released its quarterly earnings results on Tuesday, July 15th. The financial services provider reported $4.96 EPS for the quarter, topping the consensus estimate of $4.48 by $0.48. The business had revenue of $44.91 billion for the quarter, compared to analysts' expectations of $43.76 billion. JPMorgan Chase & Co. had a return on equity of 16.93% and a net margin of 20.52%.The company's revenue was down 10.5% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $6.12 earnings per share. As a group, sell-side analysts predict that JPMorgan Chase & Co. will post 18.1 earnings per share for the current fiscal year.

About JPMorgan Chase & Co.

(

Free Report)

JPMorgan Chase & Co is a financial holding company, which engages in the provision of financial and investment banking services. It focuses on investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. It operates through the following segments: Consumer and Community Banking (CCB), Commercial and Investment Bank (CIB), Asset and Wealth Management (AWM), and Corporate.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider JPMorgan Chase & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JPMorgan Chase & Co. wasn't on the list.

While JPMorgan Chase & Co. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.