CW Advisors LLC reduced its stake in CSW Industrials, Inc. (NYSE:CSW - Free Report) by 8.1% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 31,711 shares of the basic materials company's stock after selling 2,802 shares during the period. CW Advisors LLC owned approximately 0.19% of CSW Industrials worth $9,245,000 as of its most recent filing with the Securities and Exchange Commission.

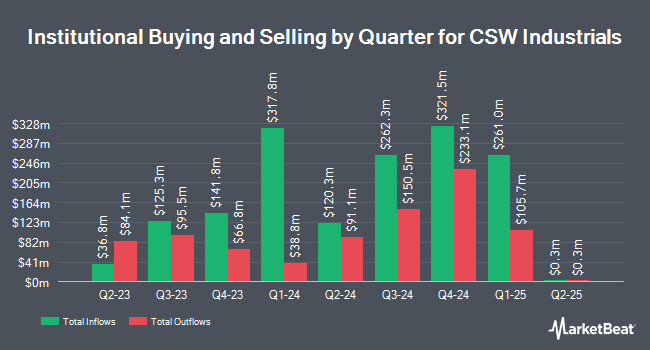

Other institutional investors have also made changes to their positions in the company. Conestoga Capital Advisors LLC lifted its stake in CSW Industrials by 5.1% during the first quarter. Conestoga Capital Advisors LLC now owns 603,277 shares of the basic materials company's stock worth $175,867,000 after purchasing an additional 29,285 shares during the last quarter. Northern Trust Corp lifted its stake in CSW Industrials by 0.3% during the first quarter. Northern Trust Corp now owns 218,208 shares of the basic materials company's stock worth $63,612,000 after purchasing an additional 553 shares during the last quarter. Price T Rowe Associates Inc. MD lifted its stake in CSW Industrials by 0.3% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 207,136 shares of the basic materials company's stock worth $73,079,000 after purchasing an additional 661 shares during the last quarter. Invesco Ltd. lifted its stake in CSW Industrials by 14.2% during the first quarter. Invesco Ltd. now owns 134,726 shares of the basic materials company's stock worth $39,275,000 after purchasing an additional 16,737 shares during the last quarter. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its stake in CSW Industrials by 5.6% during the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 117,472 shares of the basic materials company's stock worth $41,444,000 after purchasing an additional 6,213 shares during the last quarter. 82.79% of the stock is currently owned by institutional investors.

CSW Industrials Stock Up 6.0%

Shares of CSW opened at $272.82 on Friday. CSW Industrials, Inc. has a 52 week low of $241.99 and a 52 week high of $436.50. The stock has a market capitalization of $4.58 billion, a price-to-earnings ratio of 32.60 and a beta of 0.91. The company has a debt-to-equity ratio of 0.09, a quick ratio of 1.48 and a current ratio of 2.86. The stock has a fifty day moving average of $285.54 and a 200-day moving average of $297.70.

CSW Industrials (NYSE:CSW - Get Free Report) last announced its earnings results on Thursday, July 31st. The basic materials company reported $2.85 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.62 by $0.23. The business had revenue of $263.65 million during the quarter, compared to analyst estimates of $278.27 million. CSW Industrials had a return on equity of 13.78% and a net margin of 15.18%. As a group, sell-side analysts anticipate that CSW Industrials, Inc. will post 8.49 earnings per share for the current fiscal year.

CSW Industrials Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, August 8th. Investors of record on Friday, July 25th were given a dividend of $0.27 per share. This represents a $1.08 annualized dividend and a yield of 0.4%. CSW Industrials's dividend payout ratio is currently 12.90%.

Insider Buying and Selling at CSW Industrials

In other CSW Industrials news, EVP Don Sullivan sold 1,067 shares of the stock in a transaction dated Thursday, August 14th. The stock was sold at an average price of $283.14, for a total transaction of $302,110.38. Following the completion of the sale, the executive vice president directly owned 22,641 shares in the company, valued at approximately $6,410,572.74. This trade represents a 4.50% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CEO Joseph B. Armes sold 1,000 shares of the stock in a transaction dated Tuesday, July 15th. The stock was sold at an average price of $294.92, for a total value of $294,920.00. Following the sale, the chief executive officer owned 63,522 shares of the company's stock, valued at approximately $18,733,908.24. The trade was a 1.55% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 6,676 shares of company stock worth $1,942,668 over the last 90 days. Company insiders own 1.30% of the company's stock.

Wall Street Analysts Forecast Growth

CSW has been the subject of several recent analyst reports. Truist Financial set a $273.00 target price on CSW Industrials and gave the stock a "hold" rating in a research note on Tuesday, August 5th. Citigroup upped their target price on CSW Industrials from $313.00 to $321.00 and gave the stock a "neutral" rating in a research note on Friday, May 23rd. Finally, Wells Fargo & Company cut their target price on CSW Industrials from $305.00 to $285.00 and set an "equal weight" rating for the company in a research note on Friday, August 1st. Four investment analysts have rated the stock with a Hold rating, According to MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $319.75.

Get Our Latest Analysis on CSW

CSW Industrials Profile

(

Free Report)

CSW Industrials, Inc operates as a diversified industrial company in the United States and internationally. It operates through three segments: Contractor Solutions, Engineered Building Solutions, and Specialized Reliability Solutions. The Contractor Solutions segment provides condensate pads, pans, pumps, switches, and traps; cements, diffusers, grilles, registers, solvents, thread sealants, and vents; line set covers; refrigerant caps; wire pulling head tools; electrical protection, chemical maintenance, and installation supplies for HVAC; ductless mini-split systems installation support tools and accessories; and drain waste and vent system products for use in HVAC/R, plumbing, general industrial, architecturally specified building products.

Read More

Want to see what other hedge funds are holding CSW? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for CSW Industrials, Inc. (NYSE:CSW - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CSW Industrials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CSW Industrials wasn't on the list.

While CSW Industrials currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report