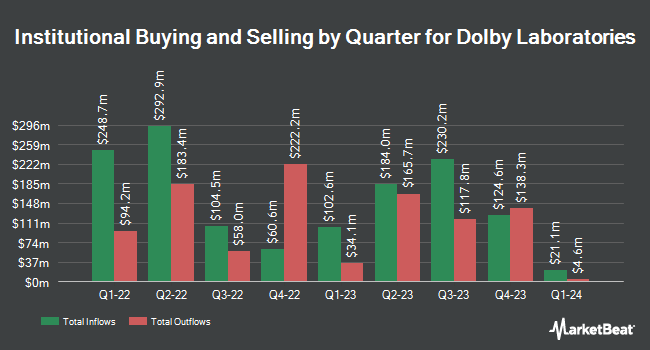

Cwm LLC raised its holdings in Dolby Laboratories (NYSE:DLB - Free Report) by 57.8% in the second quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 21,752 shares of the electronics maker's stock after purchasing an additional 7,967 shares during the period. Cwm LLC's holdings in Dolby Laboratories were worth $1,615,000 at the end of the most recent quarter.

Other institutional investors have also recently bought and sold shares of the company. Alpine Bank Wealth Management bought a new stake in Dolby Laboratories in the 1st quarter valued at about $25,000. MAI Capital Management boosted its holdings in Dolby Laboratories by 87.1% in the 1st quarter. MAI Capital Management now owns 348 shares of the electronics maker's stock valued at $28,000 after purchasing an additional 162 shares during the period. Cheviot Value Management LLC bought a new stake in Dolby Laboratories in the 1st quarter valued at about $27,000. Caitong International Asset Management Co. Ltd bought a new stake in Dolby Laboratories in the 1st quarter valued at about $29,000. Finally, Ameritas Advisory Services LLC bought a new stake in Dolby Laboratories in the 2nd quarter valued at about $48,000. Institutional investors own 58.56% of the company's stock.

Dolby Laboratories Price Performance

DLB stock opened at $68.79 on Monday. The company has a 50 day simple moving average of $71.85 and a 200 day simple moving average of $73.63. The stock has a market cap of $6.59 billion, a price-to-earnings ratio of 25.20 and a beta of 0.92. Dolby Laboratories has a 1 year low of $67.54 and a 1 year high of $89.66.

Dolby Laboratories (NYSE:DLB - Get Free Report) last released its quarterly earnings data on Thursday, July 31st. The electronics maker reported $0.78 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.72 by $0.06. The business had revenue of $315.55 million during the quarter, compared to analysts' expectations of $305.23 million. Dolby Laboratories had a net margin of 19.62% and a return on equity of 11.52%. The firm's quarterly revenue was up 9.2% compared to the same quarter last year. During the same period in the prior year, the company earned $0.71 EPS. Dolby Laboratories has set its FY 2025 guidance at 3.880-4.030 EPS. Q4 2025 guidance at 0.610-0.760 EPS. On average, equities research analysts anticipate that Dolby Laboratories will post 2.94 EPS for the current fiscal year.

Dolby Laboratories Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, August 20th. Investors of record on Tuesday, August 12th were given a dividend of $0.33 per share. This represents a $1.32 dividend on an annualized basis and a yield of 1.9%. The ex-dividend date was Tuesday, August 12th. Dolby Laboratories's dividend payout ratio is currently 48.35%.

Insider Buying and Selling

In other Dolby Laboratories news, SVP Shriram Revankar sold 7,000 shares of the company's stock in a transaction that occurred on Friday, August 22nd. The shares were sold at an average price of $74.92, for a total value of $524,440.00. Following the completion of the transaction, the senior vice president directly owned 70,435 shares in the company, valued at approximately $5,276,990.20. This represents a 9.04% decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CEO Kevin J. Yeaman sold 25,000 shares of the company's stock in a transaction that occurred on Tuesday, August 12th. The shares were sold at an average price of $72.31, for a total transaction of $1,807,750.00. Following the completion of the transaction, the chief executive officer owned 114,725 shares of the company's stock, valued at approximately $8,295,764.75. This trade represents a 17.89% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 82,000 shares of company stock valued at $5,845,440. 38.39% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of analysts have issued reports on DLB shares. Robert W. Baird assumed coverage on shares of Dolby Laboratories in a report on Friday, September 5th. They issued a "neutral" rating and a $74.00 price objective for the company. Baird R W raised shares of Dolby Laboratories to a "hold" rating in a research note on Friday, September 5th. Barrington Research reissued an "outperform" rating and issued a $100.00 price objective on shares of Dolby Laboratories in a research note on Friday, September 12th. Tigress Financial lifted their price objective on shares of Dolby Laboratories from $112.00 to $114.00 and gave the company a "buy" rating in a research note on Friday, August 15th. Finally, Weiss Ratings reissued a "hold (c)" rating on shares of Dolby Laboratories in a research note on Wednesday, October 8th. Three investment analysts have rated the stock with a Buy rating and three have given a Hold rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $95.75.

Check Out Our Latest Stock Report on Dolby Laboratories

Dolby Laboratories Company Profile

(

Free Report)

Dolby Laboratories, Inc creates audio and imaging technologies that transform entertainment at the cinema, DTV transmissions and devices, mobile devices, OTT video and music services, home entertainment devices, and automobiles. The company develops and licenses its audio technologies, such as AAC & HE-AAC, a digital audio codec solution used for a range of media applications; AVC, a digital video codec with high bandwidth efficiency used in various media devices; Dolby AC-4, a digital audio coding technology that delivers new audio experiences to a range of playback devices; and Dolby Atmos technology for cinema and various media devices.

Featured Stories

Want to see what other hedge funds are holding DLB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Dolby Laboratories (NYSE:DLB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Dolby Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dolby Laboratories wasn't on the list.

While Dolby Laboratories currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.