Cynosure Group LLC purchased a new stake in International Business Machines Corporation (NYSE:IBM - Free Report) during the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm purchased 49,993 shares of the technology company's stock, valued at approximately $12,431,000. International Business Machines comprises 1.7% of Cynosure Group LLC's portfolio, making the stock its 14th largest holding.

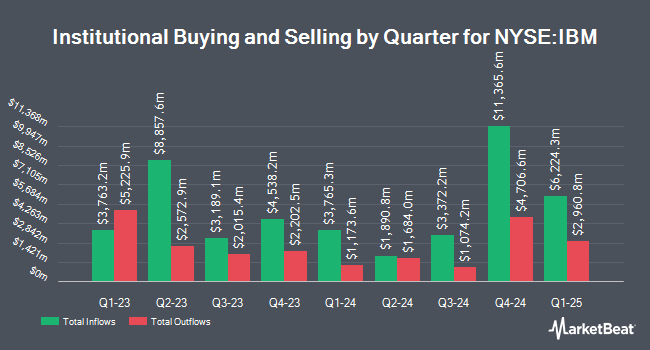

Other hedge funds have also added to or reduced their stakes in the company. Christopher J. Hasenberg Inc bought a new position in International Business Machines during the first quarter worth about $27,000. SSA Swiss Advisors AG bought a new position in International Business Machines during the first quarter worth about $28,000. Harel Insurance Investments & Financial Services Ltd. bought a new position in International Business Machines during the first quarter worth about $45,000. Park Square Financial Group LLC acquired a new stake in shares of International Business Machines during the fourth quarter worth about $43,000. Finally, Park Place Capital Corp raised its position in shares of International Business Machines by 42.6% during the first quarter. Park Place Capital Corp now owns 194 shares of the technology company's stock worth $48,000 after purchasing an additional 58 shares during the period. Institutional investors own 58.96% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms have recently commented on IBM. Jefferies Financial Group reaffirmed a "hold" rating on shares of International Business Machines in a research report on Wednesday, April 23rd. Citigroup reaffirmed an "outperform" rating on shares of International Business Machines in a research report on Saturday, May 10th. BMO Capital Markets raised their price target on International Business Machines from $260.00 to $300.00 and gave the stock a "market perform" rating in a research report on Friday, July 18th. Stifel Nicolaus raised their price target on International Business Machines from $290.00 to $310.00 and gave the stock a "buy" rating in a research report on Wednesday, July 16th. Finally, The Goldman Sachs Group boosted their price target on International Business Machines from $270.00 to $310.00 and gave the company a "buy" rating in a report on Wednesday, July 2nd. One analyst has rated the stock with a sell rating, eight have given a hold rating, nine have given a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat, International Business Machines presently has an average rating of "Moderate Buy" and an average target price of $268.75.

View Our Latest Research Report on IBM

International Business Machines Stock Performance

Shares of IBM traded down $8.28 during midday trading on Friday, reaching $241.88. 6,821,307 shares of the stock were exchanged, compared to its average volume of 5,876,410. The company has a quick ratio of 0.87, a current ratio of 0.91 and a debt-to-equity ratio of 2.00. The company has a market cap of $224.80 billion, a P/E ratio of 39.27, a PEG ratio of 3.74 and a beta of 0.69. The stock's 50 day simple moving average is $276.14 and its 200 day simple moving average is $258.25. International Business Machines Corporation has a twelve month low of $189.00 and a twelve month high of $296.16.

International Business Machines (NYSE:IBM - Get Free Report) last announced its quarterly earnings data on Wednesday, July 23rd. The technology company reported $2.80 earnings per share for the quarter, topping the consensus estimate of $2.65 by $0.15. International Business Machines had a return on equity of 37.62% and a net margin of 9.11%. The business had revenue of $16.98 billion during the quarter, compared to the consensus estimate of $16.58 billion. During the same period in the prior year, the company earned $2.43 EPS. International Business Machines's revenue for the quarter was up 7.7% on a year-over-year basis. On average, sell-side analysts expect that International Business Machines Corporation will post 10.78 earnings per share for the current year.

About International Business Machines

(

Free Report)

International Business Machines Corporation, together with its subsidiaries, provides integrated solutions and services worldwide. The company operates through Software, Consulting, Infrastructure, and Financing segments. The Software segment offers a hybrid cloud and AI platforms that allows clients to realize their digital and AI transformations across the applications, data, and environments in which they operate.

See Also

Before you consider International Business Machines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Business Machines wasn't on the list.

While International Business Machines currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.