Cypress Capital LLC acquired a new position in shares of Salesforce Inc. (NYSE:CRM - Free Report) during the 1st quarter, according to its most recent 13F filing with the SEC. The firm acquired 1,156 shares of the CRM provider's stock, valued at approximately $310,000.

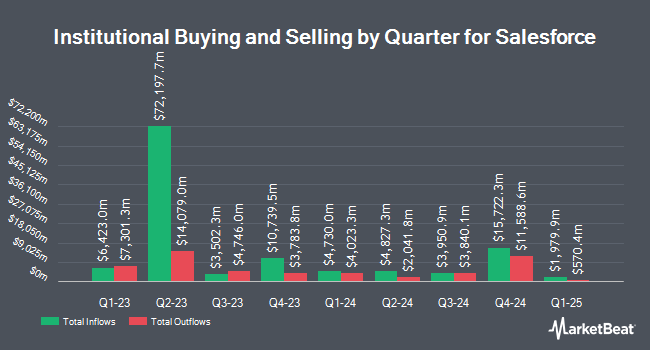

Other institutional investors and hedge funds have also bought and sold shares of the company. Brighton Jones LLC lifted its position in shares of Salesforce by 13.7% in the 4th quarter. Brighton Jones LLC now owns 25,668 shares of the CRM provider's stock worth $8,582,000 after purchasing an additional 3,102 shares during the period. Revolve Wealth Partners LLC raised its stake in Salesforce by 12.6% in the fourth quarter. Revolve Wealth Partners LLC now owns 1,827 shares of the CRM provider's stock worth $611,000 after buying an additional 205 shares in the last quarter. Kohmann Bosshard Financial Services LLC purchased a new stake in Salesforce during the fourth quarter worth $59,000. Modera Wealth Management LLC boosted its position in Salesforce by 6.4% during the 4th quarter. Modera Wealth Management LLC now owns 25,900 shares of the CRM provider's stock valued at $8,659,000 after acquiring an additional 1,559 shares in the last quarter. Finally, Plato Investment Management Ltd increased its holdings in shares of Salesforce by 2.9% in the 4th quarter. Plato Investment Management Ltd now owns 30,726 shares of the CRM provider's stock valued at $10,310,000 after acquiring an additional 862 shares during the period. 80.43% of the stock is owned by institutional investors.

Salesforce Stock Performance

CRM stock traded up $2.37 during midday trading on Friday, hitting $271.58. 5,031,804 shares of the stock traded hands, compared to its average volume of 6,543,873. Salesforce Inc. has a 1-year low of $230.00 and a 1-year high of $369.00. The company has a debt-to-equity ratio of 0.14, a current ratio of 1.07 and a quick ratio of 1.07. The stock's fifty day simple moving average is $272.21 and its 200-day simple moving average is $292.32. The firm has a market cap of $259.63 billion, a P/E ratio of 42.50, a PEG ratio of 2.44 and a beta of 1.36.

Salesforce (NYSE:CRM - Get Free Report) last posted its earnings results on Wednesday, May 28th. The CRM provider reported $2.58 EPS for the quarter, beating analysts' consensus estimates of $2.55 by $0.03. Salesforce had a return on equity of 12.94% and a net margin of 16.08%. The firm had revenue of $9.83 billion for the quarter, compared to analysts' expectations of $9.74 billion. During the same period last year, the firm earned $2.44 EPS. The company's quarterly revenue was up 7.6% on a year-over-year basis. On average, analysts expect that Salesforce Inc. will post 7.46 earnings per share for the current year.

Salesforce Cuts Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, July 10th. Stockholders of record on Wednesday, June 18th will be paid a dividend of $0.416 per share. This represents a $1.66 annualized dividend and a dividend yield of 0.61%. The ex-dividend date of this dividend is Wednesday, June 18th. Salesforce's payout ratio is 25.98%.

Insider Activity

In related news, insider Parker Harris sold 1,142 shares of the business's stock in a transaction on Monday, June 23rd. The shares were sold at an average price of $262.35, for a total value of $299,603.70. Following the completion of the sale, the insider owned 136,824 shares of the company's stock, valued at approximately $35,895,776.40. The trade was a 0.83% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider R David Schmaier sold 6,959 shares of the stock in a transaction on Wednesday, April 16th. The shares were sold at an average price of $253.31, for a total transaction of $1,762,784.29. Following the transaction, the insider directly owned 36,090 shares in the company, valued at approximately $9,141,957.90. The trade was a 16.17% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 28,534 shares of company stock worth $7,609,842. Insiders own 3.20% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts recently weighed in on CRM shares. Mizuho decreased their price objective on Salesforce from $425.00 to $380.00 and set an "outperform" rating for the company in a research note on Thursday, May 15th. Erste Group Bank lowered shares of Salesforce from a "buy" rating to a "hold" rating in a research report on Thursday, June 5th. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $325.00 price objective on shares of Salesforce in a research report on Thursday, June 26th. Citigroup decreased their target price on shares of Salesforce from $320.00 to $295.00 and set a "neutral" rating for the company in a research report on Friday, May 30th. Finally, Morgan Stanley reaffirmed an "overweight" rating and issued a $404.00 price target (up from $393.00) on shares of Salesforce in a report on Thursday, May 29th. Two investment analysts have rated the stock with a sell rating, eight have given a hold rating, twenty-eight have issued a buy rating and four have assigned a strong buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $349.08.

Read Our Latest Research Report on Salesforce

Salesforce Profile

(

Free Report)

Salesforce, Inc provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide. The company's service includes sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and artificial intelligence, and deliver quotes, contracts, and invoices; and service that enables companies to deliver trusted and highly personalized customer support at scale.

Featured Articles

Before you consider Salesforce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Salesforce wasn't on the list.

While Salesforce currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report