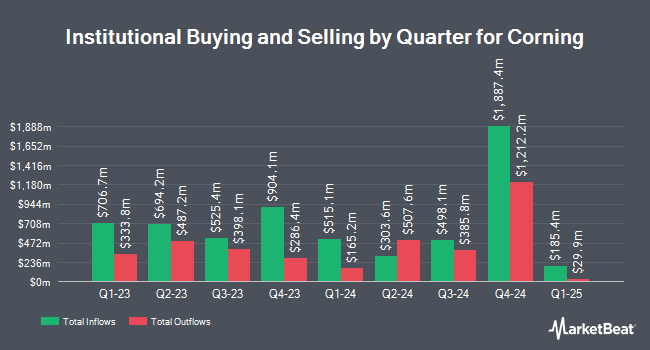

Cyrus J. Lawrence LLC boosted its stake in shares of Corning Incorporated (NYSE:GLW - Free Report) by 890.0% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 9,900 shares of the electronics maker's stock after buying an additional 8,900 shares during the quarter. Cyrus J. Lawrence LLC's holdings in Corning were worth $453,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the stock. Vident Advisory LLC lifted its holdings in Corning by 295.5% during the 1st quarter. Vident Advisory LLC now owns 64,780 shares of the electronics maker's stock valued at $2,966,000 after buying an additional 48,400 shares in the last quarter. Magnetar Financial LLC lifted its holdings in Corning by 255.8% during the 1st quarter. Magnetar Financial LLC now owns 16,949 shares of the electronics maker's stock valued at $776,000 after buying an additional 12,185 shares in the last quarter. Canada Pension Plan Investment Board lifted its holdings in Corning by 33.4% during the 1st quarter. Canada Pension Plan Investment Board now owns 395,743 shares of the electronics maker's stock valued at $18,117,000 after buying an additional 99,066 shares in the last quarter. State of Wyoming raised its holdings in shares of Corning by 41.0% in the 1st quarter. State of Wyoming now owns 11,581 shares of the electronics maker's stock valued at $530,000 after purchasing an additional 3,368 shares in the last quarter. Finally, Trexquant Investment LP raised its holdings in shares of Corning by 2.8% in the 1st quarter. Trexquant Investment LP now owns 623,667 shares of the electronics maker's stock valued at $28,551,000 after purchasing an additional 17,232 shares in the last quarter. Institutional investors own 69.80% of the company's stock.

Corning Stock Down 2.8%

NYSE:GLW opened at $67.03 on Friday. The company has a market cap of $57.42 billion, a PE ratio of 71.31, a P/E/G ratio of 1.50 and a beta of 1.08. Corning Incorporated has a twelve month low of $37.31 and a twelve month high of $69.29. The company has a current ratio of 1.50, a quick ratio of 0.93 and a debt-to-equity ratio of 0.58. The company's 50 day moving average is $58.86 and its two-hundred day moving average is $51.10.

Corning (NYSE:GLW - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The electronics maker reported $0.60 EPS for the quarter, beating the consensus estimate of $0.57 by $0.03. Corning had a net margin of 5.77% and a return on equity of 17.27%. The business had revenue of $3.86 billion during the quarter, compared to analysts' expectations of $3.84 billion. During the same period in the previous year, the business posted $0.47 EPS. Corning has set its Q3 2025 guidance at 0.630-0.670 EPS. Analysts anticipate that Corning Incorporated will post 2.33 EPS for the current year.

Corning Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, September 29th. Shareholders of record on Friday, August 29th will be given a dividend of $0.28 per share. The ex-dividend date is Friday, August 29th. This represents a $1.12 dividend on an annualized basis and a yield of 1.7%. Corning's dividend payout ratio is currently 119.15%.

Analyst Upgrades and Downgrades

Several research firms have recently commented on GLW. Wall Street Zen upgraded shares of Corning from a "buy" rating to a "strong-buy" rating in a report on Saturday, August 2nd. Argus restated a "buy" rating and issued a $68.00 price target on shares of Corning in a report on Wednesday, July 30th. Susquehanna restated a "positive" rating and issued a $75.00 price target (up previously from $60.00) on shares of Corning in a report on Wednesday, July 30th. Barclays boosted their price target on shares of Corning from $52.00 to $65.00 and gave the company an "equal weight" rating in a report on Wednesday, July 30th. Finally, Mizuho boosted their price target on shares of Corning from $63.00 to $74.00 and gave the company an "outperform" rating in a report on Friday, August 8th. One research analyst has rated the stock with a Strong Buy rating, ten have issued a Buy rating and three have given a Hold rating to the company. According to MarketBeat, Corning has a consensus rating of "Moderate Buy" and an average price target of $65.17.

Read Our Latest Analysis on Corning

Insider Activity at Corning

In other Corning news, COO Avery H. Nelson III sold 36,240 shares of the company's stock in a transaction on Wednesday, July 30th. The shares were sold at an average price of $62.26, for a total transaction of $2,256,302.40. Following the completion of the transaction, the chief operating officer directly owned 64,838 shares in the company, valued at approximately $4,036,813.88. This represents a 35.85% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, SVP Michael Paul O'day sold 14,879 shares of the company's stock in a transaction on Wednesday, July 30th. The stock was sold at an average price of $62.36, for a total transaction of $927,854.44. Following the transaction, the senior vice president owned 35,743 shares of the company's stock, valued at $2,228,933.48. This represents a 29.39% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 163,950 shares of company stock valued at $10,449,192 in the last three months. Company insiders own 0.40% of the company's stock.

Corning Company Profile

(

Free Report)

Corning Incorporated engages in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally. The company's Display Technologies segment offers glass substrates for flat panel displays, including liquid crystal displays and organic light-emitting diodes that are used in televisions, notebook computers, desktop monitors, tablets, and handheld devices.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corning wasn't on the list.

While Corning currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report