D. E. Shaw & Co. Inc. trimmed its position in Solid Power, Inc. (NASDAQ:SLDP - Free Report) by 44.8% during the fourth quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 471,755 shares of the company's stock after selling 383,031 shares during the quarter. D. E. Shaw & Co. Inc. owned approximately 0.26% of Solid Power worth $892,000 as of its most recent SEC filing.

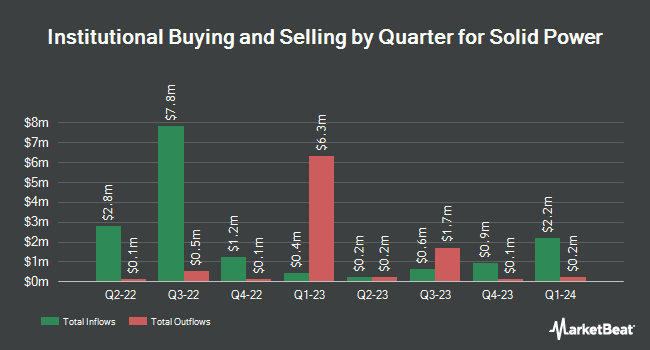

Several other hedge funds have also bought and sold shares of the company. Charles Schwab Investment Management Inc. raised its stake in Solid Power by 0.8% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,163,561 shares of the company's stock valued at $2,199,000 after buying an additional 9,097 shares during the period. Cibc World Markets Corp acquired a new position in shares of Solid Power during the 4th quarter worth approximately $27,000. Price T Rowe Associates Inc. MD raised its stake in Solid Power by 31.0% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 67,987 shares of the company's stock valued at $129,000 after acquiring an additional 16,105 shares during the period. Belvedere Trading LLC acquired a new stake in Solid Power during the 4th quarter valued at $33,000. Finally, BNP Paribas Financial Markets acquired a new stake in Solid Power during the 4th quarter valued at $34,000. 33.66% of the stock is currently owned by institutional investors and hedge funds.

Solid Power Price Performance

SLDP stock traded down $0.13 during midday trading on Thursday, reaching $1.68. 5,202,994 shares of the company were exchanged, compared to its average volume of 2,575,272. Solid Power, Inc. has a one year low of $0.68 and a one year high of $2.70. The firm has a market capitalization of $301.33 million, a price-to-earnings ratio of -3.43 and a beta of 1.42. The business has a 50-day moving average price of $1.19 and a two-hundred day moving average price of $1.30.

Solid Power (NASDAQ:SLDP - Get Free Report) last announced its earnings results on Tuesday, May 6th. The company reported ($0.08) EPS for the quarter, topping the consensus estimate of ($0.14) by $0.06. The business had revenue of $6.02 million during the quarter, compared to the consensus estimate of $5.00 million. Solid Power had a negative net margin of 471.22% and a negative return on equity of 18.08%.

Insider Transactions at Solid Power

In other Solid Power news, CTO Joshua Buettner-Garrett sold 187,500 shares of Solid Power stock in a transaction dated Thursday, March 6th. The shares were sold at an average price of $1.13, for a total value of $211,875.00. Following the completion of the sale, the chief technology officer now owns 865,304 shares in the company, valued at $977,793.52. The trade was a 17.81% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Steven H. Goldberg sold 82,365 shares of the firm's stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of $1.62, for a total transaction of $133,431.30. Following the transaction, the director now directly owns 118,808 shares in the company, valued at $192,468.96. This represents a 40.94% decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 4.90% of the company's stock.

Solid Power Company Profile

(

Free Report)

Solid Power, Inc develops solid state battery technologies for the electric vehicles (EV) and other markets in the United States. The company sells its sulfide-based solid electrolyte; and licenses its solid-state cell designs and manufacturing processes. It also produces and sells 0.2, 2, 20 ampere-hour (Ah), and EV cells.

See Also

Before you consider Solid Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Solid Power wasn't on the list.

While Solid Power currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.