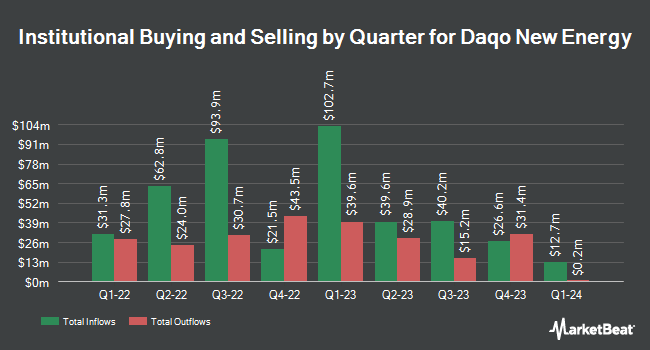

Russell Investments Group Ltd. lifted its holdings in shares of DAQO New Energy Corp. (NYSE:DQ - Free Report) by 39.2% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 411,345 shares of the semiconductor company's stock after acquiring an additional 115,831 shares during the quarter. Russell Investments Group Ltd. owned about 0.61% of DAQO New Energy worth $7,450,000 as of its most recent filing with the Securities and Exchange Commission.

Several other large investors have also recently added to or reduced their stakes in the stock. Northern Trust Corp raised its position in DAQO New Energy by 27.2% in the fourth quarter. Northern Trust Corp now owns 119,786 shares of the semiconductor company's stock valued at $2,329,000 after purchasing an additional 25,647 shares during the period. XTX Topco Ltd acquired a new stake in shares of DAQO New Energy in the first quarter valued at about $316,000. Barclays PLC raised its holdings in shares of DAQO New Energy by 587.8% during the 4th quarter. Barclays PLC now owns 80,750 shares of the semiconductor company's stock valued at $1,570,000 after buying an additional 69,010 shares during the period. Hsbc Holdings PLC raised its holdings in shares of DAQO New Energy by 381.6% during the 4th quarter. Hsbc Holdings PLC now owns 81,576 shares of the semiconductor company's stock valued at $1,586,000 after buying an additional 64,639 shares during the period. Finally, Susquehanna Fundamental Investments LLC acquired a new position in DAQO New Energy during the 4th quarter worth approximately $1,187,000. 47.22% of the stock is currently owned by institutional investors and hedge funds.

DAQO New Energy Price Performance

Shares of DQ stock traded up $1.06 on Monday, hitting $23.92. 1,489,344 shares of the stock traded hands, compared to its average volume of 933,513. The company has a market capitalization of $1.60 billion, a PE ratio of -3.67 and a beta of 0.48. DAQO New Energy Corp. has a 1-year low of $12.40 and a 1-year high of $30.85. The company's fifty day moving average is $19.89 and its 200 day moving average is $17.63.

Analyst Upgrades and Downgrades

Several brokerages have issued reports on DQ. Hsbc Global Res downgraded shares of DAQO New Energy from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, April 30th. HSBC lowered shares of DAQO New Energy from a "buy" rating to a "hold" rating and set a $14.00 price target for the company. in a report on Wednesday, April 30th. Glj Research raised shares of DAQO New Energy from a "sell" rating to a "buy" rating and set a $30.51 price target on the stock in a research note on Thursday, July 10th. Finally, Citigroup assumed coverage on shares of DAQO New Energy in a research report on Friday, July 18th. They issued a "buy" rating and a $27.00 price objective for the company. Two analysts have rated the stock with a Strong Buy rating, four have assigned a Buy rating and four have given a Hold rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $23.22.

View Our Latest Report on DQ

About DAQO New Energy

(

Free Report)

Daqo New Energy Corp., together with its subsidiaries, manufactures and sells polysilicon to photovoltaic product manufacturers in the People's Republic of China. Its products are used in ingots, wafers, cells, and modules for solar power solutions. The company was formerly known as Mega Stand International Limited and changed its name to Daqo New Energy Corp.

Featured Stories

Before you consider DAQO New Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DAQO New Energy wasn't on the list.

While DAQO New Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.