Sands Capital Ventures LLC lifted its holdings in Datadog, Inc. (NASDAQ:DDOG - Free Report) by 20.6% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 117,930 shares of the company's stock after purchasing an additional 20,142 shares during the period. Datadog accounts for about 2.9% of Sands Capital Ventures LLC's investment portfolio, making the stock its 8th biggest holding. Sands Capital Ventures LLC's holdings in Datadog were worth $11,700,000 as of its most recent SEC filing.

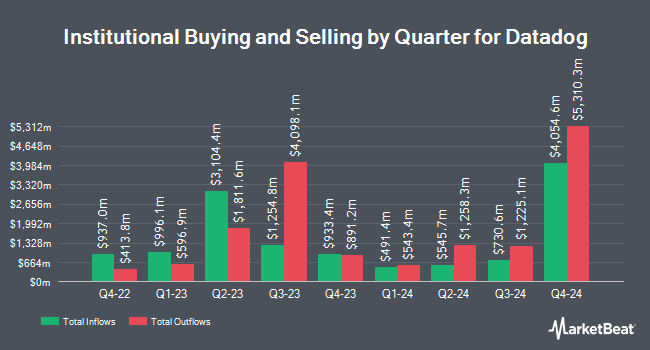

Several other institutional investors also recently bought and sold shares of the stock. DLD Asset Management LP bought a new position in Datadog during the first quarter valued at about $1,379,000. EntryPoint Capital LLC acquired a new stake in shares of Datadog in the first quarter valued at about $247,000. Credit Agricole S A grew its position in shares of Datadog by 23.6% in the first quarter. Credit Agricole S A now owns 306,974 shares of the company's stock valued at $30,455,000 after purchasing an additional 58,708 shares during the last quarter. MIG Capital LLC grew its position in shares of Datadog by 526.1% in the first quarter. MIG Capital LLC now owns 14,313 shares of the company's stock valued at $1,420,000 after purchasing an additional 12,027 shares during the last quarter. Finally, Oberndorf William E acquired a new stake in shares of Datadog in the first quarter valued at about $7,190,000. 78.29% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently issued reports on the company. Barclays set a $170.00 price target on Datadog and gave the company an "overweight" rating in a research report on Thursday, August 7th. BTIG Research set a $136.00 price target on Datadog and gave the company a "buy" rating in a research report on Tuesday, May 6th. Rosenblatt Securities lowered their price target on Datadog from $160.00 to $150.00 and set a "buy" rating on the stock in a research report on Monday, May 5th. Cantor Fitzgerald raised their price target on Datadog from $171.00 to $179.00 and gave the company an "overweight" rating in a research report on Thursday, August 7th. Finally, Bank of America raised their price target on Datadog from $150.00 to $175.00 and gave the company a "buy" rating in a research report on Monday, July 7th. Twenty-four analysts have rated the stock with a Buy rating, five have given a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $153.10.

View Our Latest Stock Report on Datadog

Insider Activity

In other news, CFO David M. Obstler sold 35,016 shares of Datadog stock in a transaction that occurred on Monday, June 2nd. The shares were sold at an average price of $117.40, for a total value of $4,110,878.40. Following the completion of the transaction, the chief financial officer owned 399,270 shares in the company, valued at approximately $46,874,298. The trade was a 8.06% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CTO Alexis Le-Quoc sold 127,105 shares of Datadog stock in a transaction that occurred on Wednesday, June 4th. The shares were sold at an average price of $119.96, for a total transaction of $15,247,515.80. Following the completion of the transaction, the chief technology officer owned 452,769 shares of the company's stock, valued at $54,314,169.24. This trade represents a 21.92% decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 846,051 shares of company stock worth $107,936,283. 8.70% of the stock is currently owned by insiders.

Datadog Price Performance

NASDAQ DDOG traded up $2.07 during trading on Friday, reaching $131.22. 3,826,266 shares of the company traded hands, compared to its average volume of 6,020,662. The company has a debt-to-equity ratio of 0.31, a quick ratio of 3.43 and a current ratio of 3.43. The stock's 50 day moving average price is $136.83 and its two-hundred day moving average price is $119.68. The company has a market cap of $45.76 billion, a price-to-earnings ratio of 374.92, a P/E/G ratio of 54.12 and a beta of 1.02. Datadog, Inc. has a 1-year low of $81.63 and a 1-year high of $170.08.

Datadog (NASDAQ:DDOG - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The company reported $0.46 earnings per share for the quarter, beating analysts' consensus estimates of $0.41 by $0.05. The company had revenue of $826.76 million for the quarter, compared to the consensus estimate of $791.72 million. Datadog had a return on equity of 5.04% and a net margin of 4.13%.The company's quarterly revenue was up 28.1% on a year-over-year basis. During the same period in the previous year, the business earned $0.43 earnings per share. Datadog has set its Q3 2025 guidance at 0.440-0.460 EPS. FY 2025 guidance at 1.800-1.830 EPS. As a group, analysts anticipate that Datadog, Inc. will post 0.34 EPS for the current year.

About Datadog

(

Free Report)

Datadog, Inc operates an observability and security platform for cloud applications in North America and internationally. The company's products comprise infrastructure and application performance monitoring, log management, digital experience monitoring, continuous profiler, database monitoring, data streams and universal service monitoring, network monitoring, incident management, workflow automation, observability pipelines, cloud cost and cloud security management, application security management, cloud SIEM, sensitive data scanner, and CI visibility.

Featured Articles

Before you consider Datadog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Datadog wasn't on the list.

While Datadog currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report