Empirical Financial Services LLC d.b.a. Empirical Wealth Management grew its position in Delta Air Lines, Inc. (NYSE:DAL - Free Report) by 204.8% during the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 29,931 shares of the transportation company's stock after purchasing an additional 20,110 shares during the quarter. Empirical Financial Services LLC d.b.a. Empirical Wealth Management's holdings in Delta Air Lines were worth $1,305,000 as of its most recent filing with the SEC.

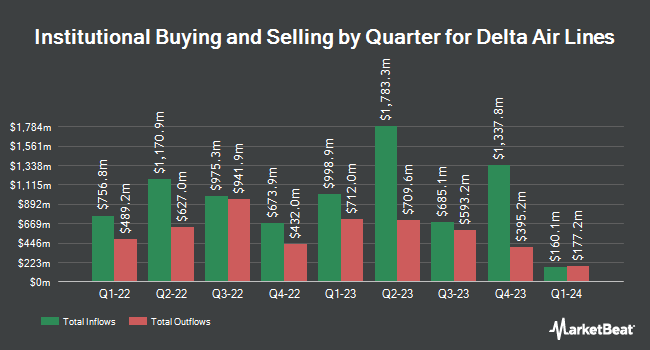

Other institutional investors also recently modified their holdings of the company. Continuum Advisory LLC raised its position in shares of Delta Air Lines by 44.2% in the 4th quarter. Continuum Advisory LLC now owns 584 shares of the transportation company's stock worth $35,000 after acquiring an additional 179 shares in the last quarter. Utah Retirement Systems grew its stake in shares of Delta Air Lines by 0.4% in the 4th quarter. Utah Retirement Systems now owns 52,725 shares of the transportation company's stock valued at $3,190,000 after buying an additional 200 shares during the period. Coppell Advisory Solutions LLC grew its stake in shares of Delta Air Lines by 13.0% in the 4th quarter. Coppell Advisory Solutions LLC now owns 1,791 shares of the transportation company's stock valued at $109,000 after buying an additional 206 shares during the period. Insigneo Advisory Services LLC grew its stake in shares of Delta Air Lines by 2.8% in the 4th quarter. Insigneo Advisory Services LLC now owns 7,671 shares of the transportation company's stock valued at $464,000 after buying an additional 212 shares during the period. Finally, Nissay Asset Management Corp Japan ADV grew its stake in shares of Delta Air Lines by 1.1% in the 4th quarter. Nissay Asset Management Corp Japan ADV now owns 21,148 shares of the transportation company's stock valued at $1,296,000 after buying an additional 222 shares during the period. 69.93% of the stock is owned by institutional investors.

Delta Air Lines Stock Performance

DAL stock traded up $1.41 during midday trading on Monday, reaching $52.56. 7,474,051 shares of the company's stock traded hands, compared to its average volume of 11,653,705. The company has a 50-day moving average price of $51.29 and a two-hundred day moving average price of $51.85. The company has a debt-to-equity ratio of 0.74, a quick ratio of 0.33 and a current ratio of 0.38. Delta Air Lines, Inc. has a 52 week low of $34.74 and a 52 week high of $69.98. The firm has a market capitalization of $34.32 billion, a PE ratio of 7.62, a price-to-earnings-growth ratio of 1.60 and a beta of 1.56.

Delta Air Lines (NYSE:DAL - Get Free Report) last released its quarterly earnings results on Thursday, July 10th. The transportation company reported $2.10 EPS for the quarter, beating analysts' consensus estimates of $2.01 by $0.09. The firm had revenue of $15,507,000 billion during the quarter, compared to analyst estimates of $16.16 billion. Delta Air Lines had a net margin of 7.24% and a return on equity of 24.86%. The business's revenue for the quarter was down .1% on a year-over-year basis. During the same period in the previous year, the business earned $2.36 EPS. As a group, equities analysts anticipate that Delta Air Lines, Inc. will post 7.63 EPS for the current year.

Delta Air Lines Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, August 21st. Stockholders of record on Thursday, July 31st will be given a dividend of $0.1875 per share. This is an increase from Delta Air Lines's previous quarterly dividend of $0.15. The ex-dividend date is Thursday, July 31st. This represents a $0.75 dividend on an annualized basis and a dividend yield of 1.4%. Delta Air Lines's dividend payout ratio (DPR) is presently 10.87%.

Insider Activity

In related news, EVP Peter W. Carter sold 17,550 shares of the company's stock in a transaction on Tuesday, July 15th. The shares were sold at an average price of $57.19, for a total value of $1,003,684.50. Following the completion of the transaction, the executive vice president directly owned 191,442 shares in the company, valued at approximately $10,948,567.98. The trade was a 8.40% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Steven M. Sear sold 18,000 shares of the company's stock in a transaction on Tuesday, July 15th. The stock was sold at an average price of $55.96, for a total transaction of $1,007,280.00. Following the completion of the transaction, the executive vice president owned 97,505 shares of the company's stock, valued at $5,456,379.80. This trade represents a 15.58% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 133,973 shares of company stock valued at $7,511,746 over the last 90 days. Company insiders own 0.96% of the company's stock.

Analyst Upgrades and Downgrades

DAL has been the subject of several research reports. Susquehanna Bancshares raised their target price on Delta Air Lines from $51.00 to $65.00 and gave the company a "positive" rating in a research note on Friday, July 11th. BNP Paribas Exane lifted their price target on Delta Air Lines from $58.00 to $70.00 and gave the company an "outperform" rating in a research note on Friday, July 11th. JPMorgan Chase & Co. lifted their price target on Delta Air Lines from $66.00 to $72.00 and gave the company an "overweight" rating in a research note on Friday, July 11th. Jefferies Financial Group increased their target price on shares of Delta Air Lines from $56.00 to $62.00 and gave the company a "hold" rating in a report on Monday, July 14th. Finally, UBS Group set a $72.00 target price on shares of Delta Air Lines in a report on Friday, July 11th. Three equities research analysts have rated the stock with a hold rating, fifteen have assigned a buy rating and two have given a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $66.21.

View Our Latest Research Report on Delta Air Lines

Delta Air Lines Profile

(

Free Report)

Delta Air Lines, Inc provides scheduled air transportation for passengers and cargo in the United States and internationally. The company operates through two segments, Airline and Refinery. Its domestic network centered on core hubs in Atlanta, Minneapolis-St. Paul, Detroit, and Salt Lake City, as well as coastal hub positions in Boston, Los Angeles, New York-LaGuardia, New York-JFK, and Seattle; and international network centered on hubs and market presence in Amsterdam, Bogota, Lima, Mexico City, London-Heathrow, Paris-Charles de Gaulle, Sao Paulo, Seoul-Incheon, and Tokyo.

Featured Stories

Before you consider Delta Air Lines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Delta Air Lines wasn't on the list.

While Delta Air Lines currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report