Deutsche Bank AG increased its stake in shares of Archer Aviation Inc. (NYSE:ACHR - Free Report) by 23.9% during the 1st quarter, according to its most recent disclosure with the SEC. The institutional investor owned 258,261 shares of the company's stock after acquiring an additional 49,762 shares during the period. Deutsche Bank AG's holdings in Archer Aviation were worth $1,836,000 as of its most recent filing with the SEC.

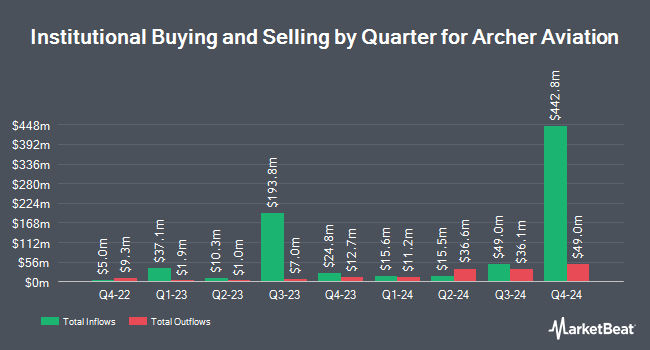

Other institutional investors and hedge funds have also bought and sold shares of the company. Sunbelt Securities Inc. bought a new stake in Archer Aviation during the fourth quarter worth about $27,000. Allworth Financial LP raised its holdings in Archer Aviation by 87.0% during the first quarter. Allworth Financial LP now owns 3,577 shares of the company's stock worth $25,000 after acquiring an additional 1,664 shares in the last quarter. Tidemark LLC raised its holdings in Archer Aviation by 100.0% during the first quarter. Tidemark LLC now owns 4,000 shares of the company's stock worth $28,000 after acquiring an additional 2,000 shares in the last quarter. Comerica Bank raised its holdings in Archer Aviation by 113.2% during the fourth quarter. Comerica Bank now owns 4,076 shares of the company's stock worth $40,000 after acquiring an additional 2,164 shares in the last quarter. Finally, ORG Partners LLC bought a new stake in Archer Aviation during the first quarter worth about $32,000. Institutional investors own 59.34% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on the company. Cantor Fitzgerald reiterated an "overweight" rating on shares of Archer Aviation in a report on Thursday, July 17th. JPMorgan Chase & Co. upped their target price on Archer Aviation from $9.00 to $10.00 and gave the stock a "neutral" rating in a report on Friday, August 1st. HC Wainwright reiterated a "buy" rating and set a $18.00 target price on shares of Archer Aviation in a report on Tuesday, August 12th. UBS Group reiterated a "buy" rating on shares of Archer Aviation in a report on Thursday, July 17th. Finally, Needham & Company LLC restated a "buy" rating and issued a $13.00 price objective on shares of Archer Aviation in a research note on Tuesday, August 12th. Seven analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company's stock. Based on data from MarketBeat, Archer Aviation presently has a consensus rating of "Moderate Buy" and an average price target of $13.43.

Read Our Latest Report on Archer Aviation

Archer Aviation Stock Performance

NYSE:ACHR traded up $0.2770 on Friday, hitting $9.6570. The company's stock had a trading volume of 25,053,983 shares, compared to its average volume of 29,753,948. The company has a current ratio of 22.30, a quick ratio of 22.30 and a debt-to-equity ratio of 0.05. The stock has a fifty day moving average of $10.42 and a two-hundred day moving average of $9.39. The firm has a market capitalization of $6.23 billion, a P/E ratio of -7.15 and a beta of 3.08. Archer Aviation Inc. has a one year low of $2.82 and a one year high of $13.92.

Archer Aviation (NYSE:ACHR - Get Free Report) last released its quarterly earnings data on Monday, August 11th. The company reported ($0.36) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.24) by ($0.12). Research analysts predict that Archer Aviation Inc. will post -1.32 earnings per share for the current year.

Insiders Place Their Bets

In other news, CFO Priya Gupta sold 10,224 shares of the stock in a transaction that occurred on Monday, August 18th. The stock was sold at an average price of $9.83, for a total transaction of $100,501.92. Following the transaction, the chief financial officer owned 147,153 shares in the company, valued at approximately $1,446,513.99. This trade represents a 6.50% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, insider Eric Lentell sold 48,936 shares of the stock in a transaction that occurred on Monday, August 18th. The stock was sold at an average price of $9.83, for a total value of $481,040.88. Following the transaction, the insider owned 47,518 shares in the company, valued at approximately $467,101.94. This trade represents a 50.74% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 283,964 shares of company stock worth $2,865,206 over the last ninety days. 7.65% of the stock is currently owned by corporate insiders.

Archer Aviation Profile

(

Free Report)

Archer Aviation Inc, together with its subsidiaries, engages in designs, develops, and operates electric vertical takeoff and landing aircraft for use in urban air mobility. The company was formerly known as Atlas Crest Investment Corp. and changed its name to Archer Aviation Inc The company is headquartered in San Jose, California.

Featured Stories

Before you consider Archer Aviation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Archer Aviation wasn't on the list.

While Archer Aviation currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.