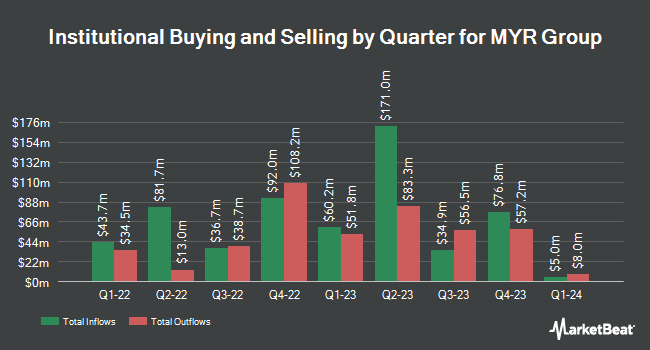

Deutsche Bank AG cut its position in MYR Group, Inc. (NASDAQ:MYRG - Free Report) by 16.0% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 24,258 shares of the utilities provider's stock after selling 4,626 shares during the period. Deutsche Bank AG owned 0.16% of MYR Group worth $2,743,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Versant Capital Management Inc boosted its position in MYR Group by 85.4% in the first quarter. Versant Capital Management Inc now owns 456 shares of the utilities provider's stock valued at $52,000 after buying an additional 210 shares in the last quarter. ANTIPODES PARTNERS Ltd lifted its position in shares of MYR Group by 16.3% during the first quarter. ANTIPODES PARTNERS Ltd now owns 719 shares of the utilities provider's stock worth $81,000 after purchasing an additional 101 shares in the last quarter. CWM LLC lifted its position in shares of MYR Group by 176.9% during the first quarter. CWM LLC now owns 1,293 shares of the utilities provider's stock worth $146,000 after purchasing an additional 826 shares in the last quarter. DekaBank Deutsche Girozentrale lifted its position in shares of MYR Group by 43.3% during the first quarter. DekaBank Deutsche Girozentrale now owns 1,622 shares of the utilities provider's stock worth $186,000 after purchasing an additional 490 shares in the last quarter. Finally, Tower Research Capital LLC TRC lifted its position in shares of MYR Group by 234.3% during the fourth quarter. Tower Research Capital LLC TRC now owns 1,337 shares of the utilities provider's stock worth $199,000 after purchasing an additional 937 shares in the last quarter. 88.90% of the stock is currently owned by institutional investors and hedge funds.

MYR Group Price Performance

MYRG stock traded down $0.38 during mid-day trading on Monday, hitting $185.20. The stock had a trading volume of 134,941 shares, compared to its average volume of 214,733. The company has a current ratio of 1.33, a quick ratio of 1.33 and a debt-to-equity ratio of 0.14. MYR Group, Inc. has a 52 week low of $86.60 and a 52 week high of $220.01. The firm has a market capitalization of $2.87 billion, a P/E ratio of 38.66 and a beta of 1.17. The firm has a fifty day simple moving average of $185.01 and a 200 day simple moving average of $151.96.

MYR Group (NASDAQ:MYRG - Get Free Report) last released its quarterly earnings data on Wednesday, July 30th. The utilities provider reported $1.70 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.56 by $0.14. MYR Group had a net margin of 2.21% and a return on equity of 13.16%. The business had revenue of $900.33 million during the quarter, compared to analysts' expectations of $828.20 million. During the same period in the prior year, the company earned ($0.91) EPS. The firm's quarterly revenue was up 8.6% compared to the same quarter last year. As a group, research analysts forecast that MYR Group, Inc. will post 1.16 EPS for the current year.

Wall Street Analyst Weigh In

A number of equities analysts have recently issued reports on the stock. The Goldman Sachs Group upped their target price on shares of MYR Group from $168.00 to $205.00 and gave the stock a "neutral" rating in a research report on Thursday, August 7th. Jefferies Financial Group started coverage on shares of MYR Group in a research note on Friday, August 15th. They set a "hold" rating and a $202.00 price target for the company. Stifel Nicolaus set a $210.00 target price on shares of MYR Group in a research note on Monday, August 4th. Robert W. Baird upped their target price on shares of MYR Group from $159.00 to $170.00 and gave the company an "outperform" rating in a research note on Thursday, May 1st. Finally, Wall Street Zen raised shares of MYR Group from a "buy" rating to a "strong-buy" rating in a research report on Saturday, May 24th. Three research analysts have rated the stock with a Buy rating and three have issued a Hold rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $191.83.

Check Out Our Latest Stock Analysis on MYR Group

About MYR Group

(

Free Report)

MYR Group Inc, through its subsidiaries, provides electrical construction services in the United States and Canada. It operates in two segments, Transmission and Distribution, and Commercial and Industrial. The Transmission and Distribution segment offers a range of services on electric transmission and distribution networks, and substation facilities, including design, engineering, procurement, construction, upgrade, maintenance, and repair services with primary focus on construction, maintenance, and repair to customers in the electric utility industry; and services, including construction and maintenance of high voltage transmission lines, substations, and lower voltage underground and overhead distribution systems, clean energy projects, and electric vehicle charging infrastructure services, as well as emergency restoration services in response to hurricane, wildfire, ice, or other related damages.

Recommended Stories

Before you consider MYR Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MYR Group wasn't on the list.

While MYR Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.