Deutsche Bank AG reduced its stake in shares of OR Royalties Inc. (NYSE:OR - Free Report) by 79.2% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 16,517 shares of the basic materials company's stock after selling 63,064 shares during the quarter. Deutsche Bank AG's holdings in OR Royalties were worth $349,000 at the end of the most recent quarter.

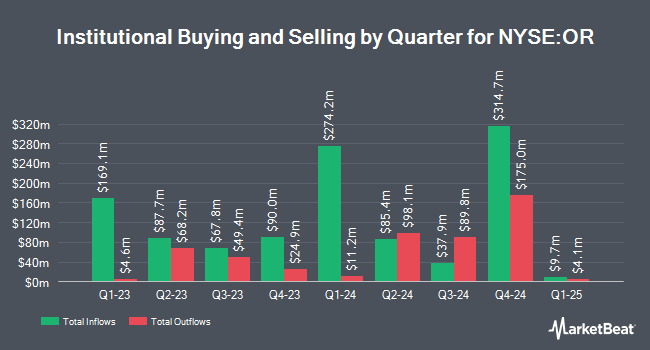

Other institutional investors also recently made changes to their positions in the company. Employees Retirement System of Texas acquired a new stake in OR Royalties during the 4th quarter worth about $131,000. Autumn Glory Partners LLC bought a new position in OR Royalties during the first quarter worth about $232,000. Cetera Investment Advisers acquired a new stake in shares of OR Royalties during the 1st quarter worth about $268,000. Mariner LLC increased its holdings in shares of OR Royalties by 36.1% during the fourth quarter. Mariner LLC now owns 15,816 shares of the basic materials company's stock worth $286,000 after buying an additional 4,197 shares in the last quarter. Finally, Synergy Asset Management LLC acquired a new stake in shares of OR Royalties during the first quarter worth approximately $301,000. 68.52% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several equities analysts have recently issued reports on the company. CIBC reaffirmed an "outperform" rating on shares of OR Royalties in a research note on Tuesday, July 15th. Scotiabank increased their price target on shares of OR Royalties from $26.00 to $28.00 and gave the company a "sector outperform" rating in a report on Monday, July 7th. National Bankshares reissued an "outperform" rating on shares of OR Royalties in a report on Tuesday, June 24th. Finally, Wall Street Zen upgraded OR Royalties from a "hold" rating to a "buy" rating in a research note on Friday, August 22nd. Six analysts have rated the stock with a Buy rating and two have issued a Hold rating to the stock. Based on data from MarketBeat, OR Royalties currently has a consensus rating of "Moderate Buy" and a consensus target price of $24.33.

Check Out Our Latest Analysis on OR

OR Royalties Stock Up 2.9%

Shares of OR stock traded up $0.91 during trading hours on Friday, reaching $32.14. 738,642 shares of the company's stock were exchanged, compared to its average volume of 792,047. The company has a current ratio of 4.73, a quick ratio of 4.73 and a debt-to-equity ratio of 0.03. The stock's 50 day moving average is $28.36 and its 200-day moving average is $24.44. OR Royalties Inc. has a fifty-two week low of $16.50 and a fifty-two week high of $32.20. The company has a market cap of $6.05 billion, a price-to-earnings ratio of 86.87 and a beta of 0.71.

OR Royalties (NYSE:OR - Get Free Report) last released its earnings results on Tuesday, August 5th. The basic materials company reported $0.13 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.17 by ($0.04). The firm had revenue of $60.36 million during the quarter, compared to analyst estimates of $83.25 million. OR Royalties had a net margin of 35.25% and a return on equity of 8.56%. Analysts predict that OR Royalties Inc. will post 0.62 earnings per share for the current fiscal year.

OR Royalties Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, October 15th. Investors of record on Tuesday, September 30th will be paid a $0.055 dividend. The ex-dividend date of this dividend is Tuesday, September 30th. This represents a $0.22 dividend on an annualized basis and a yield of 0.7%. OR Royalties's dividend payout ratio (DPR) is currently 56.76%.

OR Royalties Profile

(

Free Report)

Osisko Gold Royalties Ltd acquires and manages precious metal and other royalties, streams, and other interests in Canada and internationally. It also owns options on offtake; royalty/stream financings; and exclusive rights to participate in future royalty/stream financings on various projects. The company's primary asset is a 3-5% net smelter return royalty on the Canadian Malartic complex located in Canada.

Featured Articles

Before you consider OR Royalties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OR Royalties wasn't on the list.

While OR Royalties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.