Swiss National Bank lowered its position in DexCom, Inc. (NASDAQ:DXCM - Free Report) by 2.7% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,101,600 shares of the medical device company's stock after selling 30,400 shares during the period. Swiss National Bank owned about 0.28% of DexCom worth $75,228,000 at the end of the most recent reporting period.

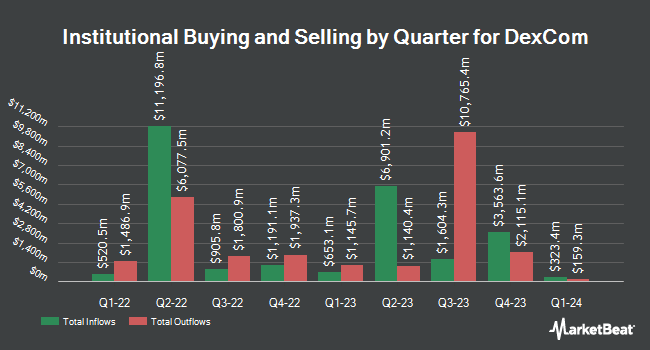

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Jennison Associates LLC increased its holdings in DexCom by 37.7% during the first quarter. Jennison Associates LLC now owns 10,523,246 shares of the medical device company's stock worth $718,632,000 after buying an additional 2,879,489 shares during the last quarter. Massachusetts Financial Services Co. MA increased its holdings in DexCom by 171.0% during the first quarter. Massachusetts Financial Services Co. MA now owns 3,194,829 shares of the medical device company's stock worth $218,175,000 after buying an additional 2,015,971 shares during the last quarter. Federated Hermes Inc. increased its holdings in DexCom by 2,371.4% during the first quarter. Federated Hermes Inc. now owns 1,994,732 shares of the medical device company's stock worth $136,220,000 after buying an additional 1,914,019 shares during the last quarter. Vanguard Group Inc. increased its holdings in DexCom by 2.0% during the first quarter. Vanguard Group Inc. now owns 47,455,899 shares of the medical device company's stock worth $3,240,763,000 after buying an additional 925,882 shares during the last quarter. Finally, Woodline Partners LP purchased a new stake in DexCom during the fourth quarter worth about $63,338,000. Hedge funds and other institutional investors own 97.75% of the company's stock.

DexCom Price Performance

Shares of DXCM stock traded down $0.21 on Wednesday, reaching $79.96. The company's stock had a trading volume of 4,073,156 shares, compared to its average volume of 3,919,810. The stock's fifty day simple moving average is $83.40 and its 200-day simple moving average is $80.19. DexCom, Inc. has a 1 year low of $57.52 and a 1 year high of $93.25. The company has a current ratio of 1.52, a quick ratio of 1.35 and a debt-to-equity ratio of 0.48. The company has a market capitalization of $31.36 billion, a price-to-earnings ratio of 55.53, a price-to-earnings-growth ratio of 1.63 and a beta of 1.43.

DexCom (NASDAQ:DXCM - Get Free Report) last posted its earnings results on Wednesday, July 30th. The medical device company reported $0.48 earnings per share for the quarter, beating analysts' consensus estimates of $0.45 by $0.03. DexCom had a net margin of 13.29% and a return on equity of 30.41%. The firm had revenue of $1.16 billion during the quarter, compared to analyst estimates of $1.13 billion. During the same period last year, the firm posted $0.43 earnings per share. DexCom's revenue for the quarter was up 15.2% compared to the same quarter last year. Analysts forecast that DexCom, Inc. will post 2.03 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on DXCM shares. UBS Group lifted their target price on shares of DexCom from $105.00 to $106.00 and gave the stock a "buy" rating in a research note on Thursday, July 31st. Truist Financial started coverage on shares of DexCom in a research note on Monday, June 16th. They issued a "buy" rating and a $102.00 target price for the company. The Goldman Sachs Group started coverage on shares of DexCom in a research note on Friday, May 30th. They issued a "buy" rating and a $104.00 target price for the company. Robert W. Baird reduced their target price on shares of DexCom from $115.00 to $105.00 and set an "outperform" rating for the company in a research note on Friday, May 2nd. Finally, Barclays lifted their target price on shares of DexCom from $93.00 to $98.00 and gave the stock an "equal weight" rating in a research note on Wednesday, July 30th. Four equities research analysts have rated the stock with a hold rating, sixteen have assigned a buy rating and three have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $99.89.

Get Our Latest Report on DXCM

Insider Activity

In other DexCom news, EVP Sadie Stern sold 6,184 shares of DexCom stock in a transaction on Tuesday, May 27th. The shares were sold at an average price of $85.11, for a total transaction of $526,320.24. Following the completion of the transaction, the executive vice president directly owned 109,621 shares of the company's stock, valued at $9,329,843.31. The trade was a 5.34% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Mark G. Foletta sold 2,750 shares of DexCom stock in a transaction on Monday, June 16th. The stock was sold at an average price of $83.13, for a total transaction of $228,607.50. Following the transaction, the director directly owned 56,621 shares of the company's stock, valued at $4,706,903.73. The trade was a 4.63% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 28,656 shares of company stock valued at $2,412,191 over the last ninety days. 0.32% of the stock is owned by corporate insiders.

DexCom Company Profile

(

Free Report)

DexCom, Inc, a medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally. The company provides its systems for use by people with diabetes, as well as for use by healthcare providers. Its products include Dexcom G6 and Dexcom G7, integrated CGM systems for diabetes management; Dexcom Share, a remote monitoring system; Dexcom Real-Time API, which enables authorized third-party software developers to integrate real-time CGM data into their digital health apps and devices; and Dexcom ONE, that is designed to replace finger stick blood glucose testing for diabetes treatment decisions.

Recommended Stories

Before you consider DexCom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DexCom wasn't on the list.

While DexCom currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report