Dimensional Fund Advisors LP increased its stake in shares of Teck Resources Ltd (NYSE:TECK - Free Report) TSE: TECK by 0.2% in the first quarter, according to its most recent 13F filing with the SEC. The firm owned 5,325,223 shares of the basic materials company's stock after purchasing an additional 9,246 shares during the period. Dimensional Fund Advisors LP owned approximately 1.08% of Teck Resources worth $194,025,000 at the end of the most recent reporting period.

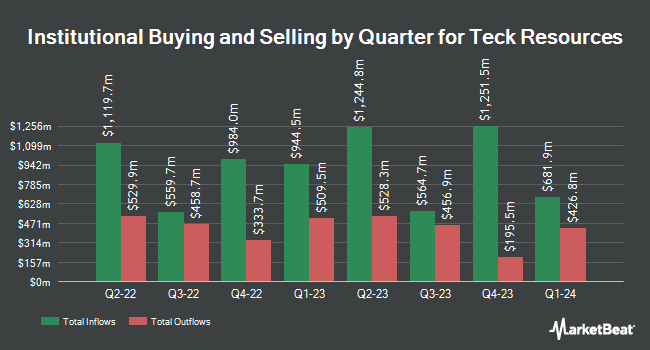

Other institutional investors also recently bought and sold shares of the company. Costello Asset Management INC purchased a new stake in Teck Resources during the 1st quarter worth approximately $33,000. Banque Cantonale Vaudoise purchased a new stake in Teck Resources in the first quarter valued at $36,000. Golden State Wealth Management LLC boosted its holdings in shares of Teck Resources by 7,560.0% in the first quarter. Golden State Wealth Management LLC now owns 1,149 shares of the basic materials company's stock valued at $42,000 after acquiring an additional 1,134 shares during the period. Ameriflex Group Inc. acquired a new stake in shares of Teck Resources during the fourth quarter worth about $50,000. Finally, Bruce G. Allen Investments LLC grew its position in Teck Resources by 104.8% in the 1st quarter. Bruce G. Allen Investments LLC now owns 1,636 shares of the basic materials company's stock valued at $60,000 after buying an additional 837 shares during the last quarter. 78.06% of the stock is owned by institutional investors and hedge funds.

Teck Resources Stock Up 5.8%

Shares of TECK traded up $1.84 during mid-day trading on Friday, hitting $33.60. 4,897,497 shares of the company's stock were exchanged, compared to its average volume of 3,749,394. The stock has a market cap of $16.23 billion, a price-to-earnings ratio of 88.42, a P/E/G ratio of 0.49 and a beta of 0.81. The firm has a fifty day moving average of $36.29 and a two-hundred day moving average of $37.29. Teck Resources Ltd has a twelve month low of $28.32 and a twelve month high of $54.13. The company has a quick ratio of 2.45, a current ratio of 3.47 and a debt-to-equity ratio of 0.15.

Teck Resources (NYSE:TECK - Get Free Report) TSE: TECK last announced its earnings results on Thursday, July 24th. The basic materials company reported $0.27 earnings per share for the quarter, beating the consensus estimate of $0.20 by $0.07. Teck Resources had a return on equity of 3.91% and a net margin of 2.51%.The firm had revenue of $1.49 billion during the quarter, compared to the consensus estimate of $2.25 billion. During the same quarter in the prior year, the company earned $0.79 EPS. The firm's revenue for the quarter was up 12.3% compared to the same quarter last year. On average, sell-side analysts forecast that Teck Resources Ltd will post 1.53 earnings per share for the current year.

Teck Resources Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, September 29th. Investors of record on Monday, September 15th will be issued a dividend of $0.0918 per share. The ex-dividend date of this dividend is Monday, September 15th. This represents a $0.37 annualized dividend and a yield of 1.1%. This is an increase from Teck Resources's previous quarterly dividend of $0.09. Teck Resources's payout ratio is 94.74%.

Analyst Ratings Changes

Several equities analysts recently issued reports on TECK shares. Royal Bank Of Canada reduced their price objective on Teck Resources from $82.00 to $67.00 and set an "outperform" rating for the company in a report on Friday, July 25th. Stifel Canada raised Teck Resources to a "hold" rating in a research note on Tuesday, July 8th. JPMorgan Chase & Co. reissued a "neutral" rating and issued a $41.00 price objective (down from $46.00) on shares of Teck Resources in a research report on Friday, July 25th. Benchmark dropped their price objective on Teck Resources from $55.00 to $48.00 and set a "buy" rating on the stock in a report on Monday, July 28th. Finally, Cibc World Mkts cut Teck Resources from a "strong-buy" rating to a "hold" rating in a research note on Friday, July 25th. One research analyst has rated the stock with a Strong Buy rating, seven have given a Buy rating and twelve have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $60.11.

Get Our Latest Stock Analysis on TECK

Teck Resources Profile

(

Free Report)

Teck Resources Limited engages in exploring for, acquiring, developing, and producing natural resources in Asia, Europe, and North America. The company operates through Steelmaking Coal, Copper, Zinc, and Energy segments. Its principal products include copper, zinc, steelmaking coal, and blended bitumen.

Further Reading

Before you consider Teck Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teck Resources wasn't on the list.

While Teck Resources currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.