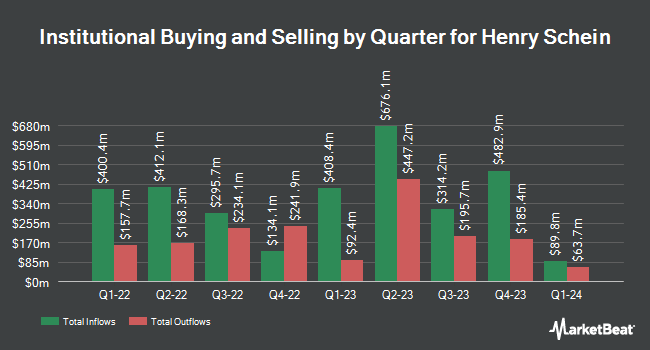

Dimensional Fund Advisors LP grew its stake in Henry Schein, Inc. (NASDAQ:HSIC - Free Report) by 4.8% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 2,240,933 shares of the company's stock after acquiring an additional 103,384 shares during the period. Dimensional Fund Advisors LP owned 1.84% of Henry Schein worth $153,480,000 as of its most recent filing with the Securities and Exchange Commission.

Other large investors also recently modified their holdings of the company. Farther Finance Advisors LLC increased its holdings in shares of Henry Schein by 237.3% in the first quarter. Farther Finance Advisors LLC now owns 2,698 shares of the company's stock valued at $186,000 after purchasing an additional 1,898 shares in the last quarter. State of Alaska Department of Revenue boosted its position in Henry Schein by 2.8% in the 1st quarter. State of Alaska Department of Revenue now owns 14,611 shares of the company's stock valued at $1,000,000 after buying an additional 395 shares during the last quarter. Oppenheimer Asset Management Inc. increased its stake in shares of Henry Schein by 5.2% in the 1st quarter. Oppenheimer Asset Management Inc. now owns 13,745 shares of the company's stock valued at $941,000 after buying an additional 678 shares during the period. GAMMA Investing LLC raised its position in shares of Henry Schein by 37.8% during the first quarter. GAMMA Investing LLC now owns 3,939 shares of the company's stock worth $270,000 after acquiring an additional 1,081 shares during the last quarter. Finally, Natixis Advisors LLC lifted its stake in shares of Henry Schein by 5.2% during the first quarter. Natixis Advisors LLC now owns 11,508 shares of the company's stock valued at $788,000 after acquiring an additional 572 shares during the period. 96.62% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of brokerages recently commented on HSIC. Leerink Partners set a $75.00 price objective on Henry Schein in a research report on Monday, July 14th. UBS Group lowered their price target on shares of Henry Schein from $75.00 to $70.00 and set a "neutral" rating for the company in a research report on Wednesday, August 6th. Evercore ISI dropped their price target on shares of Henry Schein from $78.00 to $70.00 and set an "in-line" rating for the company in a research note on Wednesday, August 6th. Wells Fargo & Company cut their price objective on shares of Henry Schein from $80.00 to $75.00 and set an "equal weight" rating on the stock in a report on Tuesday, May 6th. Finally, JPMorgan Chase & Co. lowered their target price on shares of Henry Schein from $80.00 to $76.00 and set an "overweight" rating for the company in a report on Thursday, August 7th. Four investment analysts have rated the stock with a Buy rating and eight have issued a Hold rating to the stock. Based on data from MarketBeat, Henry Schein presently has an average rating of "Hold" and an average price target of $75.58.

Get Our Latest Stock Report on Henry Schein

Henry Schein Stock Up 0.5%

Shares of NASDAQ HSIC opened at $68.64 on Thursday. Henry Schein, Inc. has a 52-week low of $60.56 and a 52-week high of $82.49. The company has a debt-to-equity ratio of 0.51, a quick ratio of 0.78 and a current ratio of 1.41. The stock has a market cap of $8.32 billion, a P/E ratio of 22.14, a P/E/G ratio of 2.25 and a beta of 0.81. The firm has a 50 day moving average price of $70.62 and a 200 day moving average price of $70.60.

Henry Schein (NASDAQ:HSIC - Get Free Report) last announced its quarterly earnings results on Tuesday, August 5th. The company reported $1.10 earnings per share for the quarter, missing analysts' consensus estimates of $1.19 by ($0.09). Henry Schein had a return on equity of 14.36% and a net margin of 3.05%.The firm had revenue of $3.24 billion for the quarter, compared to the consensus estimate of $3.22 billion. During the same period in the prior year, the business earned $1.23 earnings per share. The company's revenue for the quarter was up 3.3% compared to the same quarter last year. Henry Schein has set its FY 2025 guidance at 4.800-4.940 EPS. Analysts expect that Henry Schein, Inc. will post 4.74 EPS for the current year.

About Henry Schein

(

Free Report)

Henry Schein, Inc provides health care products and services to dental practitioners, laboratories, physician practices, and ambulatory surgery centers, government, institutional health care clinics, and other alternate care clinics worldwide. It operates through two segments, Health Care Distribution, and Technology and Value-Added Services.

Further Reading

Want to see what other hedge funds are holding HSIC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Henry Schein, Inc. (NASDAQ:HSIC - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Henry Schein, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Henry Schein wasn't on the list.

While Henry Schein currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.