Dimensional Fund Advisors LP raised its position in shares of Hilton Worldwide Holdings Inc. (NYSE:HLT - Free Report) by 3.7% during the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 727,654 shares of the company's stock after buying an additional 26,007 shares during the quarter. Dimensional Fund Advisors LP owned about 0.31% of Hilton Worldwide worth $165,555,000 at the end of the most recent quarter.

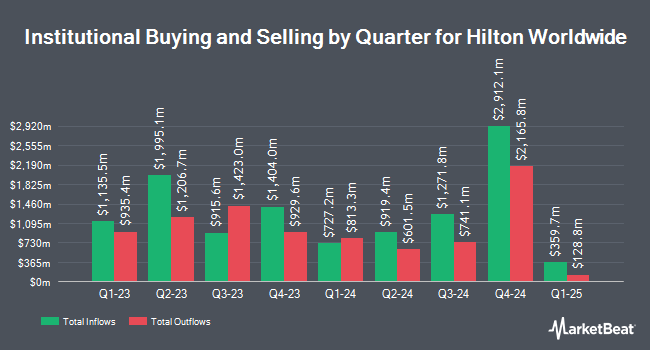

Several other institutional investors and hedge funds have also recently bought and sold shares of the company. MML Investors Services LLC raised its position in shares of Hilton Worldwide by 4.6% during the 4th quarter. MML Investors Services LLC now owns 33,491 shares of the company's stock worth $8,278,000 after purchasing an additional 1,463 shares during the period. Kayne Anderson Rudnick Investment Management LLC raised its position in shares of Hilton Worldwide by 21.7% during the 4th quarter. Kayne Anderson Rudnick Investment Management LLC now owns 11,667 shares of the company's stock worth $2,884,000 after purchasing an additional 2,082 shares during the period. Tower Research Capital LLC TRC raised its position in shares of Hilton Worldwide by 106.8% during the 4th quarter. Tower Research Capital LLC TRC now owns 13,119 shares of the company's stock worth $3,242,000 after purchasing an additional 6,775 shares during the period. TD Waterhouse Canada Inc. raised its position in shares of Hilton Worldwide by 30.1% during the 4th quarter. TD Waterhouse Canada Inc. now owns 6,653 shares of the company's stock worth $1,645,000 after purchasing an additional 1,541 shares during the period. Finally, State of Tennessee Department of Treasury raised its position in shares of Hilton Worldwide by 3.1% during the 4th quarter. State of Tennessee Department of Treasury now owns 81,217 shares of the company's stock worth $20,074,000 after purchasing an additional 2,444 shares during the period. Institutional investors and hedge funds own 95.90% of the company's stock.

Wall Street Analysts Forecast Growth

HLT has been the topic of a number of research reports. Dbs Bank upgraded Hilton Worldwide from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, May 14th. Raymond James Financial raised their target price on Hilton Worldwide from $275.00 to $300.00 and gave the company an "outperform" rating in a research report on Wednesday, July 30th. JPMorgan Chase & Co. started coverage on Hilton Worldwide in a research report on Monday, June 23rd. They issued an "overweight" rating and a $282.00 target price on the stock. Jefferies Financial Group upgraded Hilton Worldwide from a "hold" rating to a "buy" rating and raised their target price for the company from $228.00 to $296.00 in a research report on Monday, May 12th. Finally, Truist Financial raised their target price on Hilton Worldwide from $223.00 to $246.00 and gave the company a "hold" rating in a research report on Thursday, July 24th. One research analyst has rated the stock with a Strong Buy rating, eight have assigned a Buy rating and nine have given a Hold rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $264.40.

Check Out Our Latest Report on Hilton Worldwide

Hilton Worldwide Stock Up 3.0%

NYSE HLT traded up $8.1870 on Friday, reaching $277.3770. 1,578,622 shares of the stock traded hands, compared to its average volume of 1,564,406. The firm's fifty day simple moving average is $266.47 and its 200 day simple moving average is $249.36. The company has a market cap of $65.24 billion, a price-to-earnings ratio of 42.61, a P/E/G ratio of 2.73 and a beta of 1.26. Hilton Worldwide Holdings Inc. has a 12 month low of $196.04 and a 12 month high of $279.46.

Hilton Worldwide (NYSE:HLT - Get Free Report) last issued its quarterly earnings results on Wednesday, July 23rd. The company reported $2.20 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.04 by $0.16. The firm had revenue of $3.14 billion during the quarter, compared to analyst estimates of $3.09 billion. Hilton Worldwide had a negative return on equity of 46.13% and a net margin of 13.84%.The firm's quarterly revenue was up 6.3% on a year-over-year basis. During the same period last year, the company posted $1.91 EPS. Hilton Worldwide has set its Q3 2025 guidance at 1.980-2.040 EPS. FY 2025 guidance at 7.830-8.000 EPS. As a group, equities research analysts forecast that Hilton Worldwide Holdings Inc. will post 7.89 EPS for the current fiscal year.

Hilton Worldwide Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Friday, August 29th will be paid a dividend of $0.15 per share. The ex-dividend date of this dividend is Friday, August 29th. This represents a $0.60 annualized dividend and a dividend yield of 0.2%. Hilton Worldwide's dividend payout ratio (DPR) is currently 9.22%.

Insider Buying and Selling at Hilton Worldwide

In other news, insider Christopher W. Silcock sold 11,905 shares of the firm's stock in a transaction on Thursday, August 21st. The stock was sold at an average price of $269.40, for a total transaction of $3,207,207.00. Following the completion of the sale, the insider directly owned 79,451 shares of the company's stock, valued at $21,404,099.40. This trade represents a 13.03% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. 2.60% of the stock is currently owned by corporate insiders.

Hilton Worldwide Profile

(

Free Report)

Hilton Worldwide Holdings Inc, a hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts. It operates through two segments, Management and Franchise, and Ownership. The company engages in the hotel management and licensing of its brands. It operates luxury hotels under the Waldorf Astoria Hotels & Resorts, LXR Hotels & Resorts, and Conrad Hotels & Resorts brand; lifestyle hotels under the Canopy by Hilton, Curio Collection by Hilton, Tapestry Collection by Hilton, Tempo by Hilton, and Motto by Hilton brand; full service hotels under the Signia by Hilton, Hilton Hotels & Resorts, and DoubleTree by Hilton brand; service hotels under the Hilton Garden Inn, Hampton by Hilton, and Tru by Hilton brand; all-suite hotels under the Embassy Suites by Hilton, Homewood Suites by Hilton, and Home2 Suites by Hilton brand; and economy hotel under the Spark by Hilton brand, as well as Hilton Grand Vacations.

See Also

Before you consider Hilton Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hilton Worldwide wasn't on the list.

While Hilton Worldwide currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report