Dimensional Fund Advisors LP decreased its holdings in CorVel Corp. (NASDAQ:CRVL - Free Report) by 6.7% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 1,442,661 shares of the business services provider's stock after selling 102,958 shares during the quarter. Dimensional Fund Advisors LP owned about 2.81% of CorVel worth $161,531,000 as of its most recent filing with the SEC.

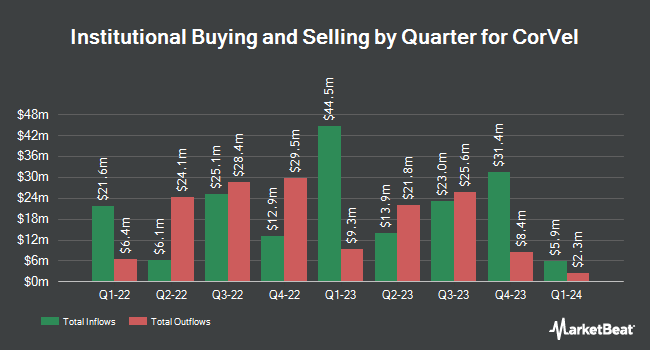

Other institutional investors also recently made changes to their positions in the company. Envestnet Asset Management Inc. lifted its stake in shares of CorVel by 201.6% in the fourth quarter. Envestnet Asset Management Inc. now owns 48,447 shares of the business services provider's stock valued at $5,390,000 after purchasing an additional 32,386 shares during the period. Barclays PLC lifted its stake in CorVel by 209.3% in the 4th quarter. Barclays PLC now owns 49,409 shares of the business services provider's stock valued at $5,497,000 after buying an additional 33,432 shares in the last quarter. Mariner LLC increased its position in CorVel by 214.3% during the 4th quarter. Mariner LLC now owns 2,637 shares of the business services provider's stock worth $293,000 after purchasing an additional 1,798 shares in the last quarter. Walleye Capital LLC acquired a new position in shares of CorVel in the fourth quarter valued at approximately $730,000. Finally, Marshall Wace LLP acquired a new stake in shares of CorVel during the fourth quarter worth $671,000. 51.36% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity

In other CorVel news, Director Alan Hoops sold 3,000 shares of CorVel stock in a transaction on Tuesday, May 27th. The stock was sold at an average price of $113.05, for a total transaction of $339,150.00. Following the sale, the director owned 16,688 shares of the company's stock, valued at $1,886,578.40. The trade was a 15.24% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director R Judd Jessup sold 935 shares of the company's stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of $113.50, for a total value of $106,122.50. Following the completion of the sale, the director owned 129,519 shares of the company's stock, valued at $14,700,406.50. This trade represents a 0.72% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 25,079 shares of company stock valued at $2,515,943 over the last three months. 44.56% of the stock is currently owned by company insiders.

CorVel Price Performance

CRVL stock traded down $2.19 on Monday, hitting $90.45. 140,575 shares of the company were exchanged, compared to its average volume of 155,520. The stock has a market capitalization of $4.64 billion, a price-to-earnings ratio of 46.62 and a beta of 0.95. The business's fifty day moving average is $94.79 and its two-hundred day moving average is $105.42. CorVel Corp. has a twelve month low of $85.13 and a twelve month high of $128.61.

CorVel (NASDAQ:CRVL - Get Free Report) last released its quarterly earnings data on Tuesday, August 5th. The business services provider reported $0.52 earnings per share (EPS) for the quarter. CorVel had a net margin of 10.98% and a return on equity of 32.31%.

About CorVel

(

Free Report)

CorVel Corporation provides workers' compensation, auto, liability, and health solutions. It applies technology, including artificial intelligence, machine learning, and natural language processing to enhance the managing of episodes of care and the related health care costs. The company also offers network solutions services, including automated medical fee auditing, preferred provider management and reimbursement, retrospective utilization review, facility claim review, professional review, pharmacy, directed care, clearinghouse, independent medical examination, and inpatient medical bill review services, as well as Medicare solutions.

Featured Stories

Before you consider CorVel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CorVel wasn't on the list.

While CorVel currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.